The full-throttle (via fiscal measures) surgical strike on the bears and negative sentiment pushed benchmark indices to 10-year high in a single day on Friday, which ultimately helped the market recoup early losses and close second consecutive week that ended on September 20 higher, and has broken its six-week consolidation phase.

The BSE Sensex rallied 1.7 percent to close above 38,000 levels and the Nifty ended at 11,274.20 with 1.8 percent gains while broader markets also traded in line with benchmarks as the BSE Midcap index rising 3.3 percent and Smallcap gaining 1.5 percent.

After a biggest fiscal measures dose of Rs 1.45 lakh crore from government by lowering corporate tax to 25 percent from 35 percent (with cess and surcharge), minimum alternate tax to 15 percent from 18.5 percent etc, the sentiment turned positive and the same is expected to continue in coming months too but with intermittent correction, experts said, adding for the coming week, after a rally the market could see some consolidation amid September derivative contracts expiry and global cues.

"We may see a rotation in some sectors, but a lot of improvement is seen in the overall breadth. Witnessing such a move brings in much needed smart money which is going to stay for a longer-term and discounts the overall growth story. So at this point in time, we may see this move extended to 11,470-11,590," Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

"We have come out from this painful consolidation which was in effect from the last few weeks with a decisive close. Hence, any dip from here should be bought for a follow-up move," he said.

Romesh Tiwari, Head of Research at CapitalAim, also expects the Nifty to continue the upward march with fresh long formations expected along with shorts already running for cover for next week.

It would be interesting to see the effect on midcap and smallcap stocks as they have been at the receiving end of the overall bearish sentiments of investors, he said.

The sectoral trend was pretty mixed for the week as the Nifty Bank, Auto, FMCG and Metal indices rallied 2-4 percent whereas IT declined 1.5 percent and Pharma declined 0.6 percent.

Here are 10 key factors that will keep traders busy this week:

Effect of 4.0 Fiscal Measures to Continue

Analysts, investment advisors, brokerages, fund managers etc started doing calculations about corporate earnings after Finance Minister Nirmala Sitharaman unveiled 4.0 measures to revive economy that has been facing slowdown for last several quarters.

Most of them expect corporates to get huge amount of money by saving taxes that ultimately would be deployed back in the economy via capex, expansion, infrastructure development, job creations etc. As a result, earnings upgrade will be quite high after corporate report card of September quarter which the street could start pricing in well ahead of earnings season.

Hence the sector rotation buying could be seen in coming days as earnings growth may be around 10-20 percent, experts feel.

KR Choksey said the growth will be driven by higher profits and reinvestments, while the economy will witness growth as private sector capex revives. This will translate to higher tax collections in the long term, it added.

"June-September quarter numbers will see massive upgrades in the earnings with a minimum of 10-15 percent increase in profits due to the tax cut reform. Valuations of all companies have now therefore become far more reasonable and competitive with rest of the world when compared to other emerging markets, this will hopefully bring the much needed FPIs back to India," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote said.

US-China Trade War Worries

The visit to the US that was cut short by Chinese officials on Friday raised questions over both countries efforts to bring an amicable resolution to the trade war, which has been going on for more than a year now.

Recently, trade war tensions eased after the US had said the China would restart purchasing US agricultural products that had halted in retaliation against President Donald Trump's tariffs. Even US delayed its recent tariffs on $250 billion Chinese goods by 15 days to October 15 as a "gesture of goodwill" to China.

Now all eyes are seet on the meeting between Chinese and US delegates that is scheduled to be held on Thursday and Friday in coming week, which is ahead of higher-level meetings that will take place in October. Both sides started preparing for new rounds of talks to resolve trade war.

Rupee

The Indian rupee recovered 84 paise from 71.78 against the dollar, the highest level seen during the week after government's fiscal stimulus 4.0, dovish policy measures and hope of easing US-China trade war. The currency closed 2 paise lower at 70.94 for the week.

Experts also attributed the rupee recovery to fall in bond yields on hope of further rate cut by RBI and expect more appreciation in currency amid optimism over US-China trade war and measures by Indian government to boost economy.

"The rupee may recover till 70.40-70.00 levels against the US dollar in the short term following measures by the Government of India to stimulate the economy through tax cuts for corporates, optimism over US-China trade war, an interest rate cut by the US Fed and dovish policy measures by other central banks such as BOJ, ECB, BOE and PBOC," Abhishek Bansal, Chairman, Abans Group told Moneycontrol.

Crude

The international benchmark, Brent crude futures, rallied nearly 7 percent for the week— the biggest weekly gains since January, and closed at $64.28 a barrel but was off its weekly high.

Oil prices rallied nearly 20 percent earlier in the week to over $71 a barrel after drone attacks on two Saudi plants, but prices cooled off later on Saudi's assurance to restore oil production by month-end and supply assurance from the US.

The prices are expected to be rangebound till the restoration of Saudi's oil production and amid hopes of US-China trade resolution.

"Supply assurance from the US and improved supply from Aramco may put some pressure on oil prices at higher levels. An increase in US oil inventory and uncertainty over future rate cuts by the Fed may keep oil prices under pressure. Brent oil could find support around $63.80-60.50 levels, while key resistance remains near $69.70-72.40 levels," Bansal said.

FII Flow

foreign institutional investors (FIIs) bought only Rs 35.78 crore on the historical day (Friday) when the government announced big bang reforms. It was far less than Rs 3,000 crore worth of shares buying by domestic institutional investors (DIIs.)

In fact they were net sellers to the tune of Rs 3,375 crore during the week and sold Rs 8,191 crore worth of shares so far in September, while DIIs bought more than Rs 11,000 crore in equities, giving a strong support to the market.

Experts feel the sentiment at FII desk may improve soon, and they expect FII's flow to improve in coming months after the government's initiative to boost economy via sharp cut in corporate tax, several other measures etc.

"The move brings India in line with its Asian peers of China and Indonesia in terms of Corporate tax rates and is surely going to catch the eyes of many FPIs and FIIs, and we can see the inflows surging in the coming week," Amit Gupta Co-Founder and CEO TradingBells said.

Macro Data

Deposit and bank loan growth data for fortnight that ended on September 13 will be released on September 27.

Foreign exchange reserves for the week that ended on September 20 and current account deficit data for quarter that ended on June 2019 will also be announced on same day.

Current account deficit for March quarter had come in at $4.6 billion (0.7 percent of GDP), which had declined from $13 billion (1.8 percent of GDP) in the corresponding period last year.

Foreign exchange reserves for week that ended on September 14 had dropped by $649 million to $428.96 billion, due to a fall in the value of foreign currency assets and gold holdings. In the earlier week, its reserves had increased by $1 billion.

F&O Expiry

All September futures and options contracts will expire on September 26 and traders will roll over their positions to the next series. As a result, volatility is expected in the coming week.

Ahead of expiry week, maximum Put open interest was seen at 11,000 (which will act as crucial support for Nifty) followed by 10,800 and 10,600 strikes while maximum Call open interest was seen at 11,500 (which will act as a crucial resistance for index) followed by 11,300 and 11,400 strikes. Call Writing was seen at 11,600 followed by 11,500 and 11,400 strikes while Put Writing was seen at 11,000 followed by 11,200 and 11,100 strikes.

Above Option data indicated that there is a significant shift in trading range for the Nifty to 11,000 to 11,500 levels, from 10,600-11,000 earlier, followed by short covering on Friday.

"From the crucial support zone of 10,700-11,000, the Nifty has recovered sharply after government's fiscal measures. This move has taken out the average short price of 11,200 of FIIs. Above this level, we expect FIIs to start closing their short positions, which can push the Nifty higher towards 11,500," Amit Gupta of ICICI direct said.

"Short positions in index heavyweights have been covered partially after the announcement. The same is going to get further enhanced if the Nifty holds above 11,200," he added.

India VIX moved up by 9.07 percent from 14.12 to 15.40 levels.

Technical View

The unexpected 5 percent rally on Friday helped Nifty50 post strong gains for the second consecutive week, and the index formed a large bullish candle on the weekly charts.

In fact the index surpassed its multiples hurdles as well as short-term moving averages in a single day rally, engulfing the range of the last 4 weeks and created new support base at the 11,000 levels, up from the 10,600-10,700 levels earlier. It closed just below 200-day moving average of 11,229.66 but above 200-EMA of 11,205.69.

Experts feel that the index, after a steep rally, may see some consolidation initially in coming week, but overall sentiment may remain positive with intermittent correction, and may get a support around 11,000 and resistance around 11,350-11,450 levels.

"Market will continue to move higher with intermittent deep corrections which should not shake the confidence of long traders. 11,000-11,100 are good levels to go long. Buy on decline should be a strategy for traders and short selling should be avoided," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote told Moneycontrol.

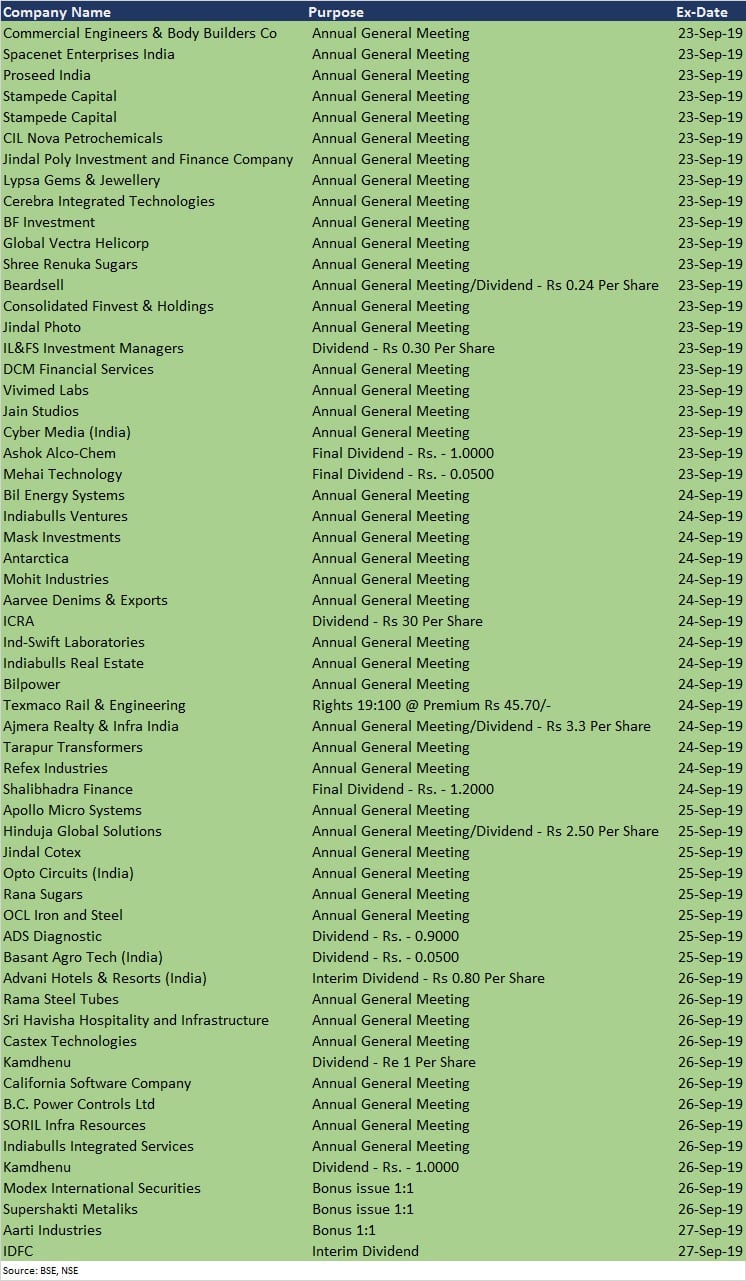

Corporate Action

Here are corporate action which will take place in coming week:

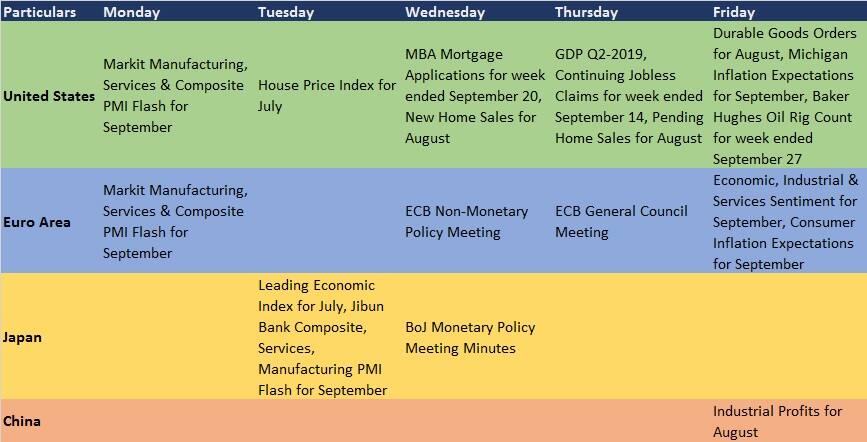

Global Data Points

Along with US-China trade developments, gold volatility, keep an eye on following global data points:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.