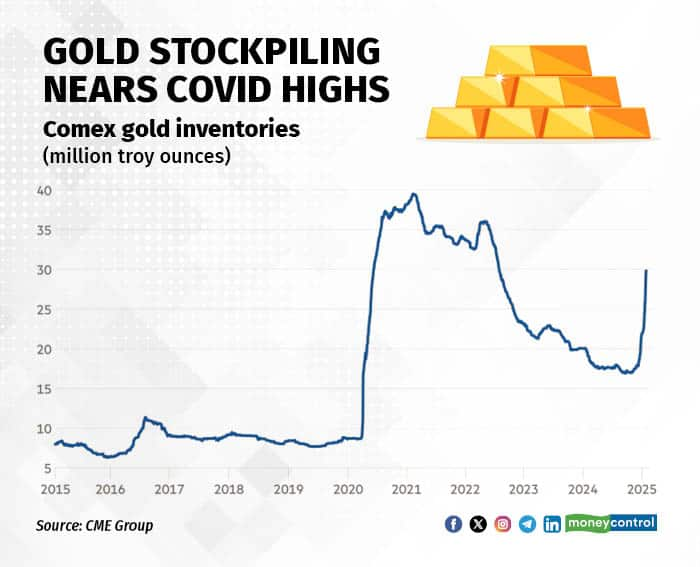

Something unseen since the pandemic is unfolding in the gold markets. Instead of cash settlements, traders are requesting physical delivery of the precious material, sending gold reserves soaring.

As the threats of US President Donald Trump's trade tariffs caused significant disruptions across the globe, investors in the US have rushed to secure gold reserves in the US.

Further, US-based investors are worried that the President might impose tariffs on imports of the precious metal as well, which would cause the price of the safe-haven asset to skyrocket. This has set of a chain effect, sending prices of gold futures higher.

Gold stockpiles in New York, where CME Group's COMEX gold is stored, have almost doubled from November levels as traders hoard the asset ahead of possible trade disruptions. From 17.5 million troy ounces in November, COMEX gold inventories surged to 33.38 million troy ounces in early February.

This recent hoarding is among the clearest indicators of caution among financial institutions, as risk managers aim to mitigate potential trade-related risks, noted Jigar Trivedi, Senior Analyst, Reliance Securities.

As a result, COMEX futures are seeing a significant premium over spot prices, as the increased demand for physical gold has sent prices of futures soaring. Traders are shifting their reserves to New York order to benefit from the sharp spread of US gold futures over London spot prices.

As a result, the Bank of England is seeing a bank-run on gold store. Earlier, it would take a few days to a week to withdraw physical gold from the Bank of England's vaults, but the timeline has been pushed to 4-8 weeks for withdrawals, according to reports.

However, the gold rush is not just limited to London. Trading hubs in Asia also are moving their gold reserves, with bullion banks across Asia catering to burgeoning demand from across the pond.

The real figures could be higher than expectations, according to the Financial Times, as there are likely to have been additional shipments to private vaults in New York owned by HSBC and JPMorgan.

What does this mean for India?As prices of physical gold hits highs, on the commodity front, the demand sentiment in Asia, especially India, is muted. In India, physical gold prices are trading at a discount compared to gold futures. This indicates that the demand for physical gold is weak in India, as a result of high prices, explained Bhavik Patel, Senior Analyst, Tradebulls Securities. Further, on the MCX, the trading for gold is purely speculative.

Also Read | Titan flags hike in gold lease rates by banks amid Trump tariff scare

However, jewellery players could be impacted by tightening supply. In the earnings call for the quarter ended December 31, 2024, the management of Titan Company expected the rates of their gold lease to rise over the next few quarters, as supply dried up.

"We're seeing a phenomenon over the past one month: a slight increase in the gold on lease rates indicated by the banks. But, there is a supply situation that they are also trying to address. So we need to see how the supply situation of gold plays out and, in that context, how rates stabilise," said Vijay Govindarajan, Associate Vice President - Finance, Titan Company.

He added that according to initial indications, the rates on gold leases could see an uptick. "Gold moved from London to COMEX because of anticipated tariffs. Suddenly, there was gold shortage in the market over the last one week and gold metal loan interest rates are also fluid. Banks themselves don't know what to do!" Govindarajan added.

The commentary was echoed by the top brass at Kalyan Jewellers. However, the jewellery player's CEO Ramesh Kalyanaraman noted that the higher interest rates on the gold leases will not be passed onto the customers.

However, consumers of these gold financing NBFCs might get a bigger bang for their buck as the LTV (loan-to-value) ratio rises for the same grammage of gold.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.