Veeresh Hiremath

Gasoline prices are directly related to crude oil prices and in the recent scenario, crude oil prices have been trading volatile amid geopolitical tensions in the Middle East peninsula and over the worries about a global recession due to US-China trade war.

The global crude oil market had witnessed prolonged supply overhang since previous years. But measures like the deal by OPEC to cut production and US sanctions on Venezuela and Iran has changed the focus of market towards the demand side fundamentals.

And due to US-China trade war, global economic growth outlook has also hampered, resulting in lower demand. Gasoline is one of the major demand side indicators which suggest the consumption pattern in US economy and other countries about the pace of growth in the market as the US accounts for about 10 percent of global gasoline demand.

The prime factors affecting the demand of any commodity is its prices and gasoline prices are directly correlated with crude oil prices, whereas the gasoline demand is having an inverse correlation with the prices.

As per the EIA STEO data, gasoline demand in year 2018 averaged around 9.32 Mbpd when gasoline prices averaged around $62.19 per barrel.

In 2019, average demand of gasoline until August 2019 stood at 9.34 Mbpd, wherein the lower crude oil prices have pushed down the prices of gasoline to average at $58.50 per barrel.

Hence, it can be stated that although the economic growth of US economy could be slower but the gasoline demand is getting support from the lower prices as compared to previous year.

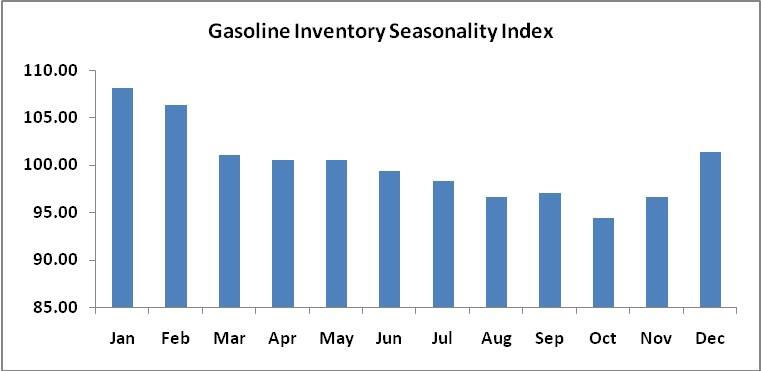

Another important economical fundamental for a commodity is its inventory levels available in the market, and in the case of gasoline, the refineries in lieu of summer driving season in the US produces more of the products like gasoline and distillate to meet the expected upcoming demand.

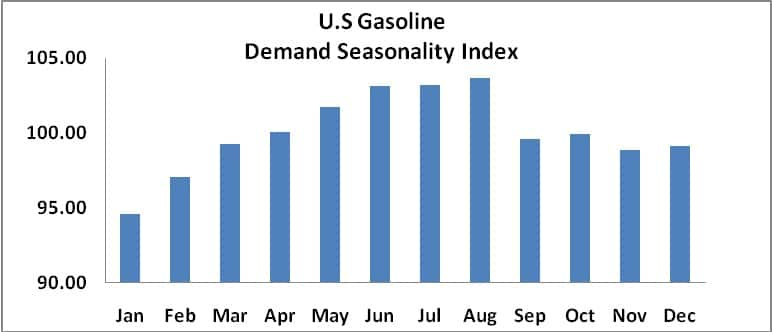

The summer driving season in US starts from May ending and lasts till September 2 and during vacation season more driving and higher gasoline demand is witnessed than during any other period of the year.

In 2019, demand in summer driving season averaged at 9.63 Mbpd, which is 1 percent lower than the demand in prior year. Separately, stocks are also at subdued levels during September and October when the US refineries goes into maintenance and also experiences hurricane season keeping the demand for products at lower levels.

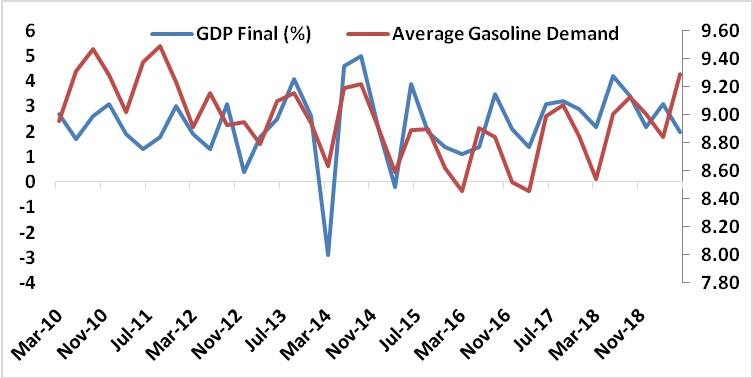

In the determining factor of gasoline demand, GDP also holds the great weightage as major component in calculation of GDP includes personal spending of the citizen of country.

In US, change in GDP is clearly stating a positive correlation with average gasoline demand. As per data compiled by US Bureau of Economic Analysis, GDP final for the quarter ending in June 2019 was 2 percent which in thet previous year during same quarter was 4.2 percent.

Similarly, demand for gasoline in June 2018 stood at 9.51 Mbpd, which is higher than the demand during June 2019 quarter totalling at 9.48 Mbpd.

The total numbers of vehicles, especially the light vehicles requiring the gasoline as fuel, are also major driving factor for gasoline demand. As per the latest available data from US Department of Commerce, the total number of vehicles sold in August 2019 totalled around 17.53 million units which during August 2018 were 17.36 million units.

Similarly, US gasoline demand for Aug 2018 totalled at 9.75 Mbpd whereas in August 2019, it went higher at 9.77 Mbpd. Hence, gasoline demand can be referred to have a positive aligned movement with total vehicle sales.

As to summarise, it can be stated that crude oil prices and recent trade war impact over the gasoline prices will wave path for gasoline demand in future scenario. And in the recent scenario, demand side fundamentals are stricken and slower but still the demand curve is expected to remain vertical with snail paced nominal gains as US-China could further advance in settling their trade war concerns.

(The author is Head of Research at Karvy Comtrade.)Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.