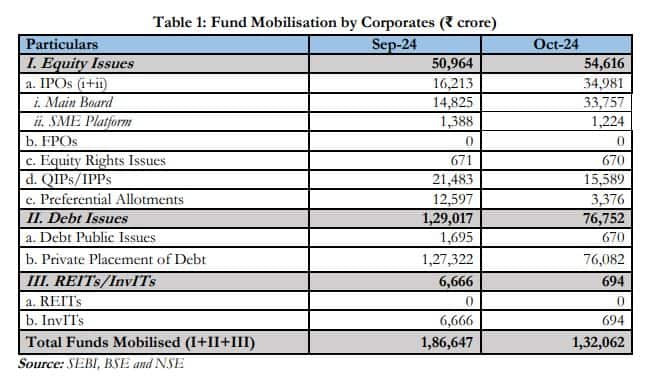

The amount raised through debt issue dropped by 40 percent month-on-month in October, according to a SEBI bulletin released on Friday.

Fundraising through InvITs crashed by nearly 90 percent to Rs 694 crore in October from Rs 6,666 crore in September.

The monthly bulletin issued by the Securities and Exchange Board of India (SEBI) said, "The amount raised through debt instruments dropped with public issues mopping ₹670 crore and private placement raising ₹76,082 crore, a decline of 40% compared to September 2024."

In September, debt issues had raised Rs 1,29,017 crore.

In the equity segment, things looked a little better, with it raised Rs 54,616 crore or around 7 percent more than Rs 50,964 crore raised in September.

Also read: NSE, BSE will act as alternative trading venues for each other from April 1, 2025, says SEBIFund raising through initial-public offers (IPOs) saw a healthy growth of over 115 percent, to Rs 34,981 crore from Rs 16,213 crore in September. This performance was mainly driven by IPOs on the main board, with them raising Rs 33,757 crore in October versus Rs 14,825 crore in September.

IPOs on the SME platform raised Rs 1,224 crore in October versus Rs 1,388 crore in September.

Under REITs and InvITs, REITs did not see any activity in October. Only InvITs raised Rs 694 crore this month. This was a sharp fall from the last month, when InvITs raised raised Rs 6,666 crore and REITs did not mobilise any funds.

Other trends in the secondary marketThe secondary market witnessed decline after four months of consecutive gains in benchmark indices.

* Market Indices: Both Sensex and Nifty registered declines, closing at 79,389 and 24,205 respectively on October 31, 2024. Market capitalization of BSE and NSE declined by 6.2%. Average price-to-earnings (P/E) ratio for the month of October 2024 for Nifty and Sensex stood at 22.6 and 23.3 respectively.

* Sectoral Indices: All sectoral indices posted negative returns with BSE Oil & Gas (-13.8%) and BSE Auto (-12.3%) declining the most. Volatility was highest in Nifty PSU Bank and Nifty Realty (both 1.8%) followed by BSE Capital Goods and Nifty PSE (both 1.5%).

* Market Turnover: Gross turnover in the equity cash segment declined by 10.6% at BSE and 8.1% at NSE, reflecting subdued trading activity.

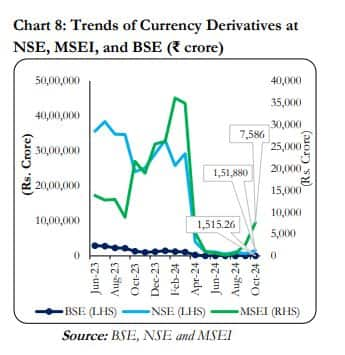

Derivatives marketThe currency derivatives segment is showing a significant recovery with trading activity going up by 136 percent month-on-month, across NSE, BSE and MSEI.

Interest-rate derivatives also saw its monthly notional turnover go up, though by a much smaller extent, by 17 percent over the September turnover. The activity in this segment was limited to NSE with none seen in BSE for the seventh consecutive month, according to the bulletin.

In equity-derivatives segment, the notional turnover at BSE declined by 12.34 percent, whereas NSE registered an increase of 6.04 percent over the previous month.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.