Foreign portfolio investors (FPIs) bought Indian equities worth $6.5 billion in August, which is more than 10 times what they had invested in the previous month. The FPIs turned net buyers (inflows minus outflows) in July with $634 million pumped into the markets, after selling relentlessly for nine months. The surge in FPI flows can be attributed to the outperformance of Indian markets.

“Outperformance of the Indian markets vis-à-vis regional peers has led to India now having the second-highest weightage in the MSCI Emerging Markets index behind China,” said Sriram Velayudhan, Vice President and Head of Alternative Research vertical at IIFL.

In July, the top three sectors in terms of inflows were FMCG ($620 million), telecom ($580 million) and capital goods ($240 million), according to a report from IIFL-Alternative Research released in August. That month, banking and financials with $130 million came sixth.

In August, banking and financials got the highest share of inflows with $1.6 billion. FMCG, pharma and auto followed with inflows of $1.41 billion, $1.06 billion and $0.47 billion respectively. According to IIFL Alternative Research’s latest report on FPI flows, which was released on September 6, the inflows into bank and financials was the second highest since February 2021, when it was $1.96 billion.

Also, the report added that the inflow into the sector has come after large outflows of $6.38 billion and $12.39bn over the last six months and one year periods, respectively.

Also read: RBI to alert banks if credit growth is too high, says Governor Shaktikanta DasWhy financial sector?“FPIs were selling financials aggressively till July. Now as equity rebound gathered momentum in July and August, FPIs have turned heavy buyers. Also, banking and financials have the highest weights across the key benchmark indices,” said Sriram, who has co-authored the report. Financial services have a weightage of 36.56% on Nifty and 32% on Sensex.

“While FPI flows into FMCG and pharma seem to be defensive bets, flows into auto stocks is a reward for superior performance of the sector,” he added. Bse Auto Index and Nifty Auto have gone up by more than 38 percent and 37.8 percent, respectively over the last six months, while Sensex and Nifty have gone up by 11.86 percent and 11.1 percent, respectively over the same period.

Inflow into the auto sector, as well as into the capital goods sector, was the highest since January 21, according to the IIFL report.

IT allocation dropsSentiment around the IT sector continues to be weak in August. “In the last six months ($4.7 billion) and one year ($10.76 billion), this sector had faced second highest outflows after financials,” said the IIFL’s September report.

Though the sector saw buying of $50 million, “breaking 11-months selling streak”, the FPI allocation in IT dropped for the fifth consecutive month. FPI allocation for the sector was lowest in August 2022 since March 2018.

Also read: Tech stocks lured hedge funds in August: Goldman Sachs ReportInterestingly, allocation to the cyclical sectors are on the rise.

FPI allocation in capital goods, which was around 2.5% in August, rose for the fourth consecutive month, stated the report.

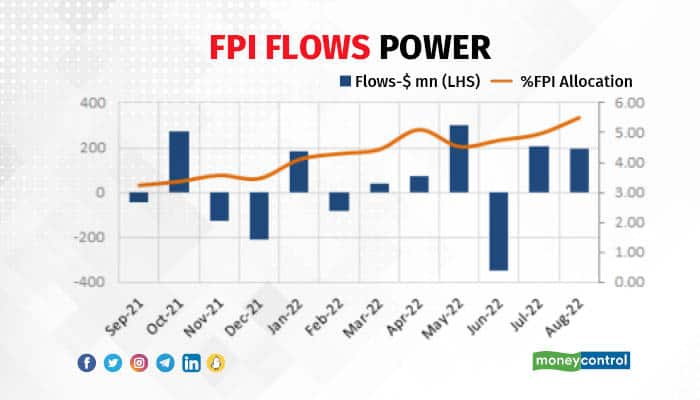

FPI allocation in power was around 5.5 percent in August, which is the highest since January 18, according to IIFL's report. Over the last one year, FPIs have increased a sizable allocation--by around 2.6 percent - in the sector.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.