FY22 started on a frightful note. The deadly second wave of the pandemic had just hit the country. The cities across the country were gasping for oxygen. The hospitals were terribly overcrowded and so were cremation grounds. In a country that supplies medicine to the entire world, thousands of people were begging for couple of doses of medicine. Remdesivir, Tocilizumab, Dexamethasone and Ivermectin had become common household names. Vultures were hoarding and black marketing essential medicine.

There were many instances of an entire building or neighbourhood being infected by the deadly delta variant of SARS-CoV-2 (Corona). Many middle class families had to rely on charity for daily meals. It was tough to find people who have lost no family member, relative or close friend to the pandemic. Everyone had an awful experience to share. The corpses floating in Ganges; mysterious graves on her banks and long queues of dead waiting for their turn to be cremated became symbols of the national tragedy.

The economy that was limping back to normalcy after a prolonged lockdown in 2020 regressed back into recessions. Pessimism and negativity dominated the sentiment, before a sense of resignation and renunciation overtook. The rich, the top medical professionals, the powerful and influential who could not save their dear ones were speaking about futility of money, knowledge, power and influence. Stock market was obviously not one of the priorities for most people.

Thankfully, the year has ended on a rather satisfactory note. Though the pain would linger for those who lost their people, businesses or jobs; most of the population appears to have moved on from the tragedy.

During the year, the country faced numerous macroeconomic and geopolitical challenges. Much of the challenges are still persisting. Considering the circumstances, the Indian stock market did extremely well in FY22.

India Market performance for FY22

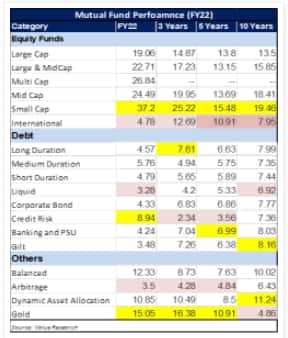

The benchmark Nifty yielded an above average return of ~18% for FY22. The broader markets did even better with Nifty Midcap yielding a return of ~23% and Nifty Smallcap yielding a return of ~26% for the financial year.

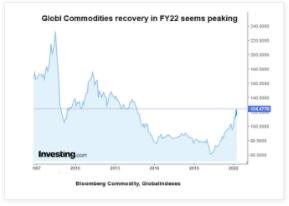

Metals rallied hard on the back of a global commodity rally, yielding ~54% return for the financial year. IT, Energy and Realty were other top outperformers.

Though all sectoral indices ended the year with positive returns, consumption (both discretionary and non-discretionary) was a notable underperforming sector. Retail credit (mostly private banks), FMCG, Auto, and Pharma were top underperformers.

The market breadth was strong with three shares advancing for every one share declining.

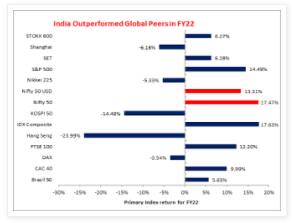

Indian equities amongst best performers globally

Indian equities were amongst the top performing markets globally. Despite persistent selling by the foreign portfolio investors, Indian equities did better than the global peers. Even in USD terms, Indian equities did better than most European and Asian markets.

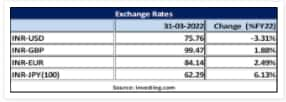

INR weathered the crisis remarkably well

Despite challenges on macro (higher fiscal and current account deficit and inflation) INR remained mostly stable. It weakened only marginally (~3%) against USD in FY22. INR; and ended stronger against EUR, JPY and GBP.

Bond yields higher

The benchmark 10-year bond yields ended at 6.77%, about 10% higher, as compared to the beginning of FY22. Considering the global trend of rising rates, higher inflation and sharp rise in fiscal deficit, this is a reasonable performance.

Amongst debt funds, high yield (credit risk) performed the best with ~9% average yield; while liquid funds were the worst performers with ~3.3% average yield.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.