Markets are defying gravity as well as analyst projections across the globe right now, with strong corporate earnings and hopes of the US Fed nearing its rate hike cycle turbocharging sentiment. However, if Goldman Sachs is to be believed, it is in this ‘optimism stage’ that investors should be the most cautious about future returns.

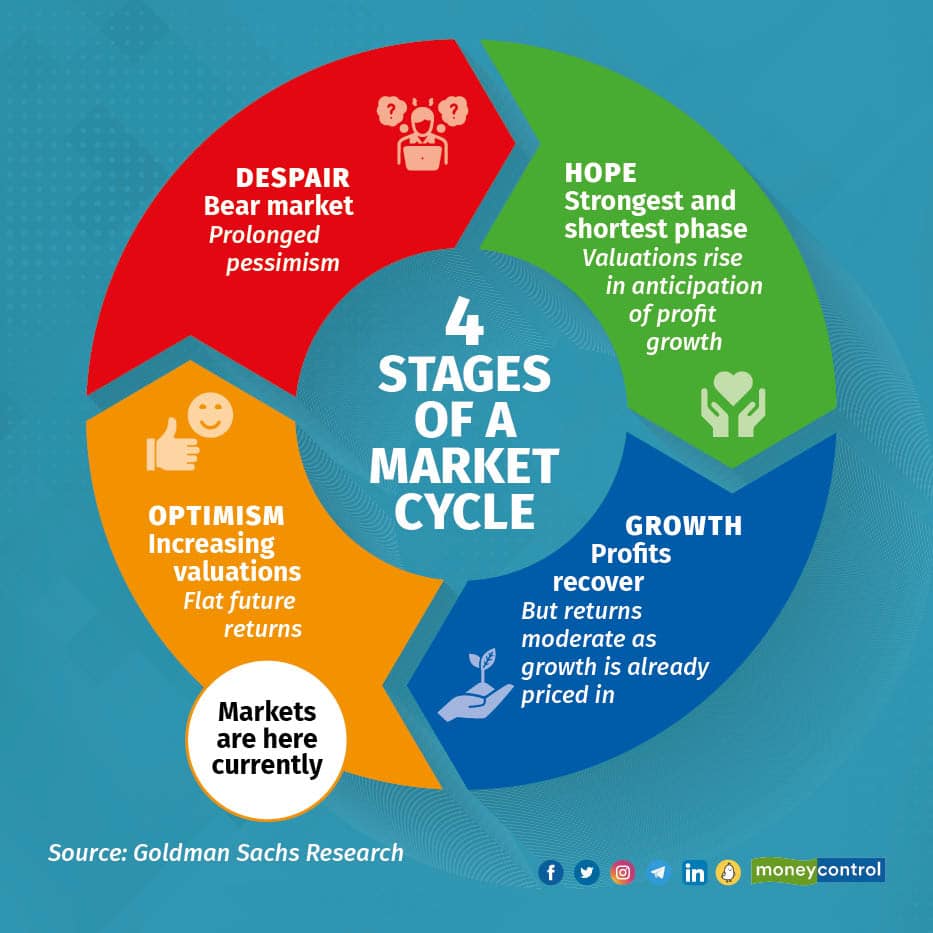

Most market cycles go through four phases -- Despair, Hope, Growth and Optimism, Goldman Sachs’ Chief Global Equity Market Strategist Peter Oppenheimer said in a recent podcast.

Despair refers to a bear market, while Hope is the strongest and shortest phase, where markets and valuations rise in anticipation of a future profit growth recovery.

The ‘Growth’ phase is when profits recover but valuations fall back and returns moderate, mainly because while EPS is rising, it has often already been paid for in the Hope phase.

The final phase ‘Optimism’ is generally associated with increasing valuations even as interest rates rise.

Stocks are right now in the ‘optimism’ stage, which means investors should expect relatively low returns from here, Oppenheimer noted.

“If we look at the history of equity markets, you do tend to get repeating patterns around business cycles — periods of expansion or contraction, recessions, and booms,” Oppenheimer said. “We’ve entered a bit more of what we call the ‘optimism’ phase, sort of later cycle, as valuations start to go up again despite, perhaps, rising interest rates.”

History Repeating Itself

Most market cycles start with ‘despair’ (that is, a bear market), followed by ‘hope’, ‘growth’ and ‘optimism’. The sequence is seen repeatedly, though the duration varies based on the prevailing conditions.

In the current cycle, while the ‘despair’ stage at the start of the pandemic was shorter than normal (only around one month), it was similar in magnitude to the average cycle, according to Goldman Sachs Research.

The ‘hope’ phase was in line with the average in terms of time (nine months) and annualized returns (at over 60 percent).

The growth phase, like in earlier market cycles, saw lower returns sequentially, but this was also weaker than average because of the speed of interest rate rises.

The optimism phase, which started in late 2022, has largely been in line with history, driven by higher valuations.

“While the pattern of returns has been similar to the past — particularly in the despair and hope phases — our analysts have expected a “fat and flat” outcome, with relatively low returns while indexes oscillate in a wide trading range,” the global investment bank said.

They project returns will be constrained by the ongoing tug-of-war between rates and growth fears as well as higher-than-average valuations.

The S&P 500, for example, is at roughly the same level as a year ago. Japan and Europe are a little higher, but Asia is a little lower. Overall, the global equity index is broadly unchanged.

“The ‘fat and flat’ idea really comes from the context of some of these cycles having lower average returns with a wider trading range,” Oppenheimer said. “And that’s really a description of what we’ve seen in the last year.”

Born in the USA

An important trigger for the current global rally has been the unexpected strength of the US economy despite the aggressive pace of rate hikes by the Federal Reserve.

For almost a year, the consensus view was that the US would slip into recession amid the Fed’s fight against inflation, but the world’s largest economy has kept chugging along.

According to analysts at UBS, this is because the monetary policy has only recently become moderately restrictive, even as the US economy has evolved to become less cyclical.

Also Read: Why hasn’t US slipped into a recession?

The US gross domestic product increased at a 1.1 percent annualised rate in the first quarter of 2023, compared to 2.6 percent in the preceding three-month period.

While the pace of expansion has slowed, the US economy has not slipped into a recession – defined as two consecutive quarters of negative GDP growth.

The prime reason is that the current monetary policy is not restrictive enough to cause a recession, UBS said in a recent report.

The Fed has hiked interest rates by 500 bps, but the real funds rate became positive only in March and is still near “neutral”, it noted.

“After extraordinary support in 2020/21, fiscal policy was a drag on growth in 2022, but that stopped in 2023,” the global investment bank said, adding that the government’s social benefits are starting to rise again.

The US Federal Reserve is scheduled to announce its policy decision on July 26, with the CME FedWatch Tool showing a 98 percent probability of a quarter-point hike.

UBS further said strong household balance sheets are supporting spending. Despite the aggressive rate hikes by Fed, consumer debt levels and delinquency rates are in much better shape compared to pre-financial crisis in 2008.

Besides, the US economy has evolved to be less cyclical and recession-prone.

“The economy has evolved to be less cyclical and recession-prone and as a result, economic activity is less volatile and expansions can last longer,” the report said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.