The market witnessed high volatility in morning trade on March 16 which saw the Nifty swing between gains and losses. The headline index recovered early losses and was trading 56.20 points or 0.3 percent higher at 17,028.35 at 11.01 am. Nifty futures were also up 45.56 points or 0.3 percent at 17,083.00.

On the options front, maximum accumulation of put writers was seen at 16,800 which suggests it will be a key support level in today's trade. Put writing was also seen across 16,850 and 16,900 strikes.

Among call options, writers were most active at 17,000 as bears attempt to cut short any scope of recovery in the market.

Santosh Pasi, Trader and Founder of Pasi Technologies expects momentum to remain weak through the session on the back of high volatility. On that account, he predicts the Nifty settling in a range of 16,850-17,200 in the weekly expiry later today.

As for investors, Pasi suggested to follow a non-directional strategy as long as the Nifty hovers around in the aforementioned range. In case the headline index witnesses a decline towards 16,850, he advised investors to initiate a credit put spread.

Bank nifty also followed a volatile trend in the cash market on March 16. Put writers were most active at 38,500 which emerges as a support for the index. On the call options front, writing was seen at 39,000.

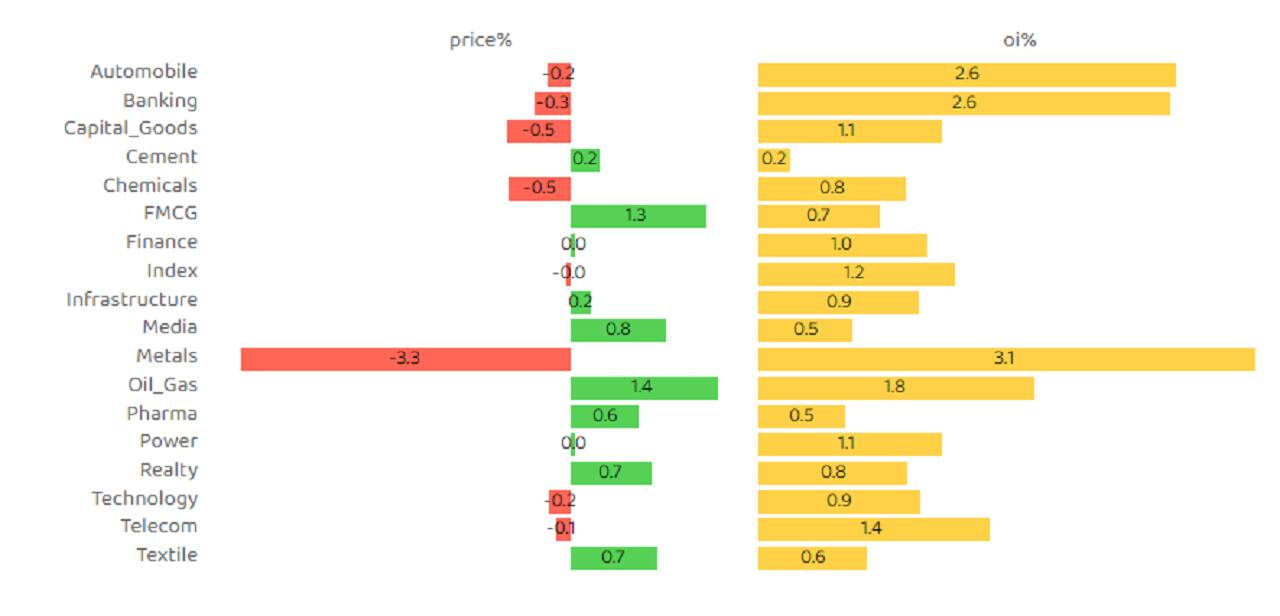

A mixed trend was also seen across sectors as fast moving consumer goods, media, oil and gas and pharmaceuticals witnessed some long additions, whereas short buildup was seen across metals, chemicals and capital goods.

Fresh long buildup was seen in Bharat Petroleum Corporation as open interest in the counter shot up 5.8 percent. Long additions is a bullish sign which happens when price increases along with rise in open interest and volumes. Other stocks that witnessed long additions were Titan, Aurobindo Pharma, Divi's Laboratories, Godrej Consumer Products and DLF.

Few stocks including IndusInd Bank, Biocon, Dabur and Ambuja Cements also saw short covering which is a positive sign.

Short positions were build across major metals names like Tata Steel, JSW Steel, Hindalco Industries, SAIL, NMDC and Vedanta. Maximum buildup of short positions was seen in Motherson Sumi Wiring as traders tried to book profits. Short buildup is a bearish sign which happens when prices fall along with a rise in open interest and volumes.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!