The financial year 2021 (FY21) is ending on a positive note for the Indian equity market as all sectoral indices, along with the benchmarks, look set to end in the green for the year.

In FY21, so far, the Nifty has jumped 73 percent, while the Sensex gained 70 percent even as COVID-19 continues to be a major threat. While metal, auto and IT sectors have taken the front seats in terms of gains, FMCG, PSU bank and pharma indices have underperformed.

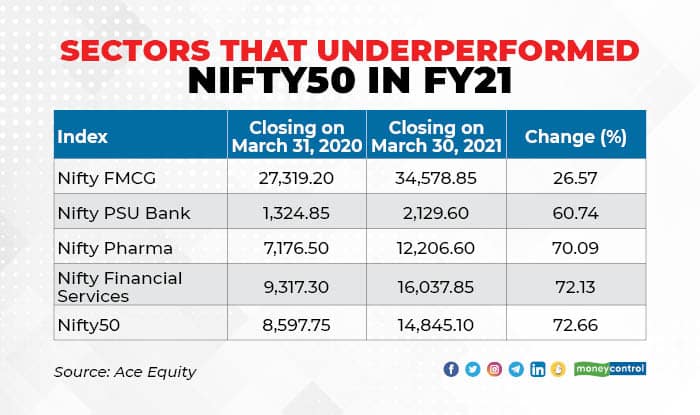

Against a 73 percent rise in the Nifty in FY21, Nifty FMCG rose 27 percent, PSU bank 61 percent and Nifty pharma 70 percent. Nifty financial services gained 72 percent during the period.

PSU bank stocks (PSBs) had not been doing well since the beginning of the year 2020 and saw a significant correction later.

Vishal Balabhadruni, Senior Research Analyst at CapitalVia Global Research, said FY21 started on a negative note for PSBs.

"Due to RBI's intervention and slashing of interest rates, the segment saw some gains. However, with the introduction of the moratorium, the gloomy situation persisted. The concern over the NPAs (non-performing assets) and the moratorium period can be said to be the main reasons that weighed on PSBs," Balabhadruni said.

While the pharma sector performed significantly well in the first half of the year, it failed to keep up the momentum in the next quarters due to inelastic growth in demand and supply and with fewer cases of acute diseases, OPDs and elective surgeries, the growth is expected to choppy, he said.

The FMCG sector experienced disruption in a real sense after the outbreak of COVID-19. "Health, immunity, etc, became the keywords after the pandemic outbreak. For gauging the demand and consumer preferences, the companies had to come up with new ideas and approaches which may have affected the optimal product mixes of the firms," said Balabhadruni.

The road aheadHe believes the PSU bank space may progress with mixed notes during the year, with the government's decision to privatise two banks and recapitalisation of these PSBs.

"The decision of the government to not privatise SBI, PNB, Union Bank, Canara Bank, Bank of Baroda, Indian bank has brought certain positivity. The concerns of RBI regarding the severe stress scenarios materialising

and the possible deterioration of asset quality suggests a bumpy path ahead," said Balabhadruni.

The pharma sector, has got a good amount of opportunities with the increased focus of government on healthcare in Budget 2021, and with production at nearly 90 percent of pre-pandemic

levels, there are expectations that margins may again be as of pre-COVID levels, he said.

The FMCG sector now sees opportunity in rural and semi-urban areas as the preferences of these areas have changed.

"With the vaccine now an actual thing, the resumption of many products has started. COVID has now made consumers conscious and companies may have to add immunity and healthy items and re-create optimal product mix. The demand for snack items also seems to have increased and therefore the year ahead seems bright for this segment," said Balabhadruni.

As per Deepak Jasani, Head of Retail Research, HDFC securities, FMCG could perform in mean reversion after the COVID situation comes under control and commodity prices also start softening.

"PSU bank stocks' moves will depend on the progress of privatisation and pace of creation of fresh stressed assets. Healthcare stocks will depend on micro developments in the respective companies," Jasani said.

With a V- shape recovery expected in the economy, sectors like financials, financial services and manufacturing are gaining more attraction rather than the defensive sector like FMCG.

Nitin Shahi, Executive Director of FINDOC, advises avoiding PSU banks. "Avoid PSU bank stocks or book profits but can add SBI on dips as the future looks bright for the stock," said Shahi.

"In case of pharma and FMCG sectors, add on every dips as they provide a defensive cover to a portfolio. In case the COVID situation worsens, these sectors will outperform," said Shahi.

He believes some bluechip stocks in the pharma space such as Sun Pharma, Cipla, Dr Reddy's Labs, look good for a two-year perspective.

In the FMCG space, stocks like HUL and ITC look good at the current levels and as the demerger of ITC is expected in the upcoming months, it can lead to a re-rating of the stock. Even stocks like Marico, Dabur and Godrej Consumer Products are good buys at the current levels," Shahi said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!