Indian benchmark indices were trading in negative territory, weighed down by adverse global cues and the post-Budget announcement of increased capital gains taxes. Around noon, the Nifty was moderately lower at 24,315, down 140 points. Meanwhile, the Bank Nifty (BN) has taken a significant hit, falling over 800 points to 50,900 on weekly expiry.

Experts indicate that for the Nifty, the zone of 24,350-24,330 acts as immediate support. If the index slips below the 24,330 level, the next support is placed in the zone of 24,230-24,210.

FII Selling: Long-Short Ratio Declines; India Vix down to 12.5

Following the budget announcement, FIIs' selling in the index led to a decline in the long-short ratio to 73.6% from 77%. FIIs sold 54,771 index futures. In stock futures, FIIs sold 79,114 contracts, while in options, FIIs sold 159,335 call contracts and 63,173 put option contracts.

Fear Index, India VIX fell sharply to 12.50 percent after yesterday's Budget announcement.

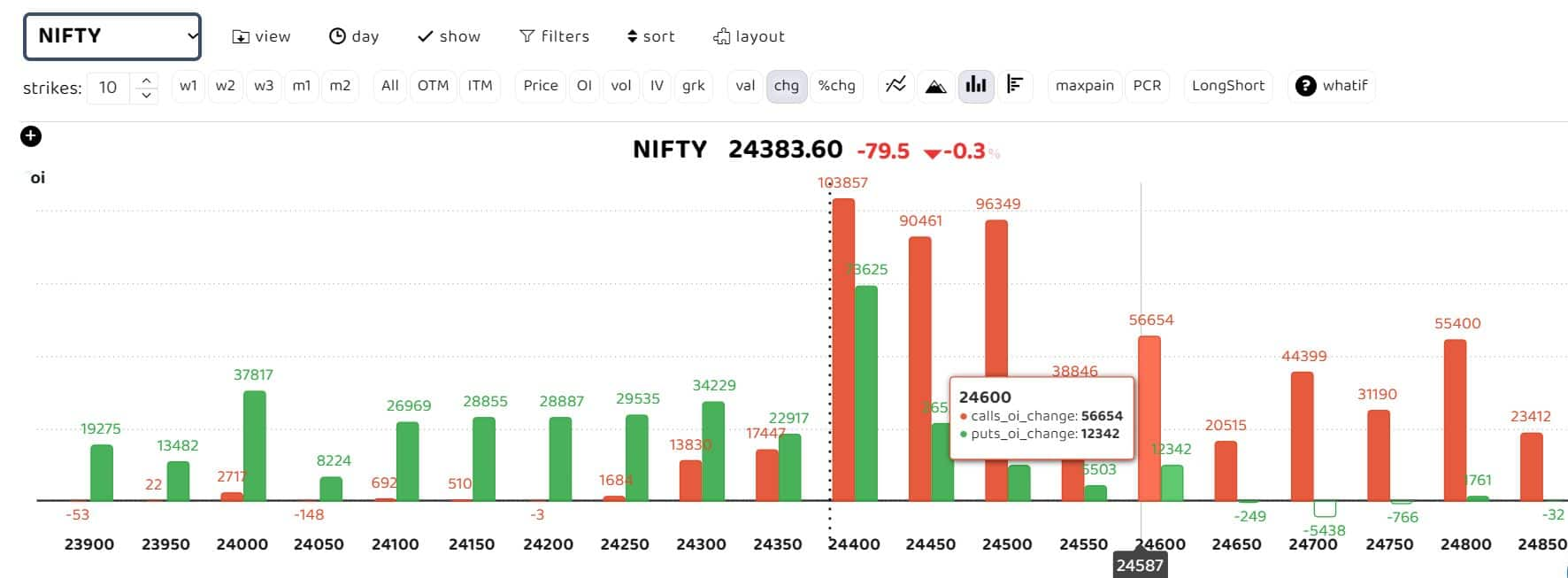

Nifty analysis

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data shows heavy call writing across the 24,650 to 24,850 strikes. According to Tejas Shah, VP of Technical Research at JM Financial: "The short-term moving averages are just below the price action and should continue to support the indices on any decline. Supports for the Nifty are now seen at 24,350 and 24,200 levels. On the higher side, immediate resistance for Nifty is at 24,600 levels, and the next resistance zone is at 24,800-24,850 levels."

Sudeep Shah, DVP and Head of Technical and Derivative Research at SBI Securities, stated, "The zone of 24,350-24,330 will act as immediate support for the index. If the index slips below 24,330, then the next support is placed in the zone of 24,230-24,210."

"On the upside, the zone of 24,550-24,570 will act as an immediate hurdle for the index. Any sustainable move above 24,570 will lead to a sharp upside rally up to 24,730, followed by the 24,840 level in the short term," he added.

Bank Nifty levels to watch out

The 52,000 call option (CE) takes over the 52,000 put option (PE) in total open interest (OI). The highest OI continues to be at 53,000 CE - 52,500 CE, with 1.54 lakh contracts added at 52,000 CE, indicating resistance.

On the PE side, 50,000 PE shows the highest OI with 1.31 lakh contracts. The support of 52,000 was broken on a closing basis, with the next support around 51,200/51,000, below which Bank Nifty will head towards 50,000. Resistance continues to be at 52,500/52,800/53,000.

"On expected lines, Bank Nifty broke the crucial support of 52,000 and headed towards 51,200/51,000 levels. Bank Nifty even closed below 52,000 yesterday. If Bank Nifty fails to cross or close above 52,000 on a weekly basis, it can head towards the 50,000 level," noted JM Financials Derivative Research.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.