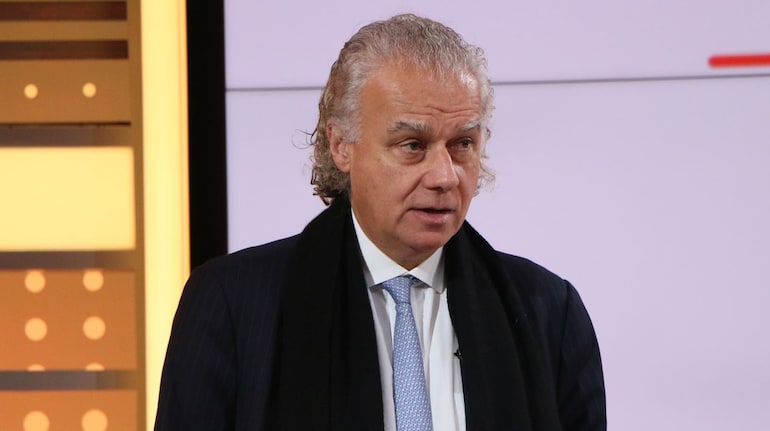

Chris Wood of Jefferies has expressed surprise at the 50 bps rate cut by US Fed, believing that the motivation for this out-sized move may possibly have been 'political'.

Some sections of economists had been calling for a 50 bps Fed rate cut, including Bill Dudley, the Former New York Federal Reserve President.

In a conversation with CNBC-TV18, Chris Wood said though Fed chair Powell did not see any sign of weakness in the economy, Jefferies is of the view that there is a risk of slowdown in the US, along with a worsening of the labor market.

On Fed's projected rate cuts over upcoming FOMC meetings, Chris Wood said he 'does not pay attention to the Dot Plot', as it has been commonly referred to, and he would look at the inflation and jobs data for cues on the pace of interest rate reduction.

The rate cut, he said, is 'good news' for emerging market equities. On relative basis, India may not be the 'most obvious play' to bet within the EM pack after the Fed rate cut, he added, primarily because of the recent and sharp run up along with concerns over high valuations. Instead, Brazil and South East Asian economies may be the markets to place bets on for global funds. "India is not the obvious play, as one, it is expensive, and secondly, the RBI may not be in a hurry to cut rates," he added.

Any correction in Indian equity markets can be a chance to buy for foreign investors, said Chris Wood.

He also mentioned that India is in the middle of a capex cycle, something that has been captured by the strong upmove in the shares of energy and capex plays in recent months. Structurally, he will 'stay invested' in India, said Chris Wood.

"The infra story is the centre of action, and the real estate upturn and capex upcycles are the big positives. We are now seeing private capex happening in India."

Chris Wood said he is very bullish on India's residential property theme, where he sees an upcycle underway that could continue for another four years. Wood also mentioned that a significant portion of his India portfolio has real estate stocks.

"The residential property story of India is a big plus. The focus on 'high-end' is the only weakness here, but I would say that is how property cycles work." Chris Wood said, adding that after a seven-year downturn in shares of India's real estate companies and clearing up of the inventory, he sees 'no reason' to be bearish on this space.

As handouts and government freebies make a comeback in the upcoming state elections, Wood is also finding consumer staples as a play in the Indian investing universe.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.