The Indian market remained volatile during the week due to the F&O expiry with Nifty able to end above 10,700 on the back of last day (Friday) bounce back.

Rising crude price, depreciating rupee and volatile global market has put pressure on the Indian market. Rupee has crossed 69 per dollar mark during the week and ended at 68.47. Crude prices also jumped to a three-year high.

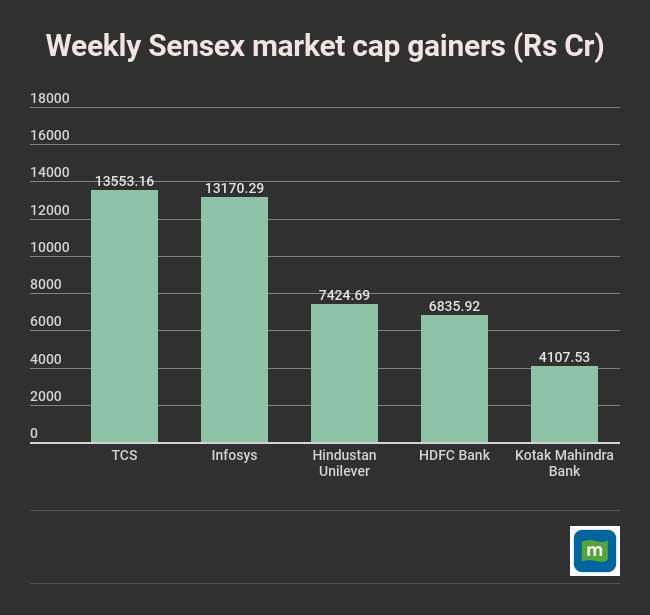

For the week, Nifty shed 107 points (down 1 percent) at 10,714.3 and Sensex was down 266.12 points (0.74 percent) at 35,423.48.

Foreign investors stayed net sellers, while domestic institutions were buyers in the last week.

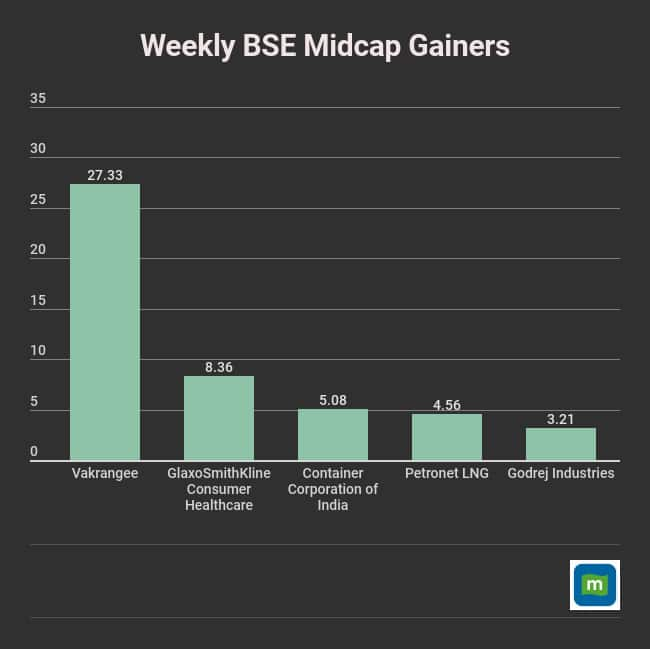

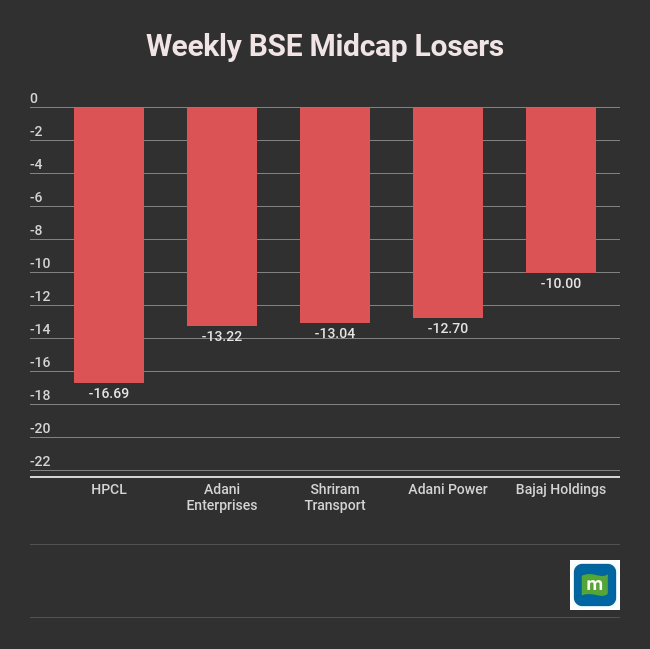

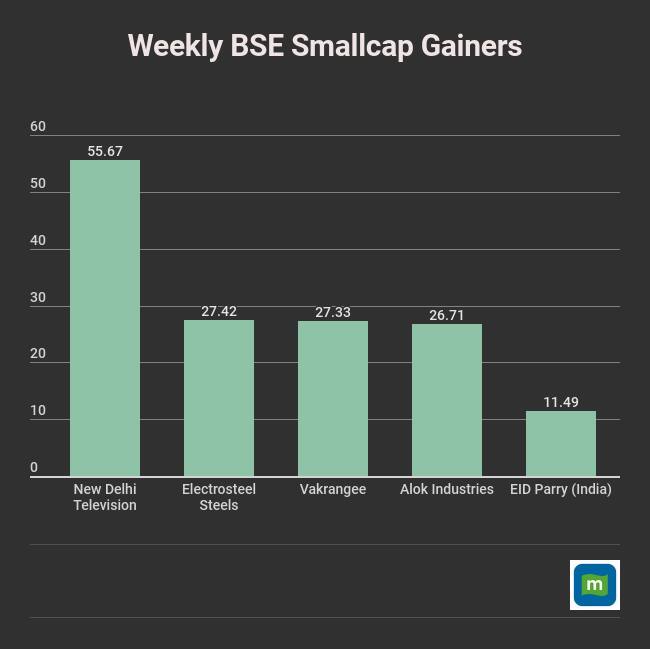

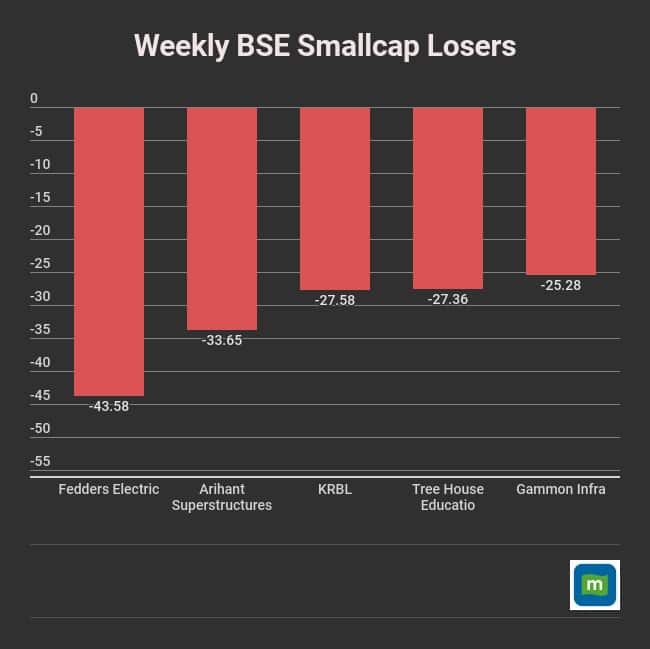

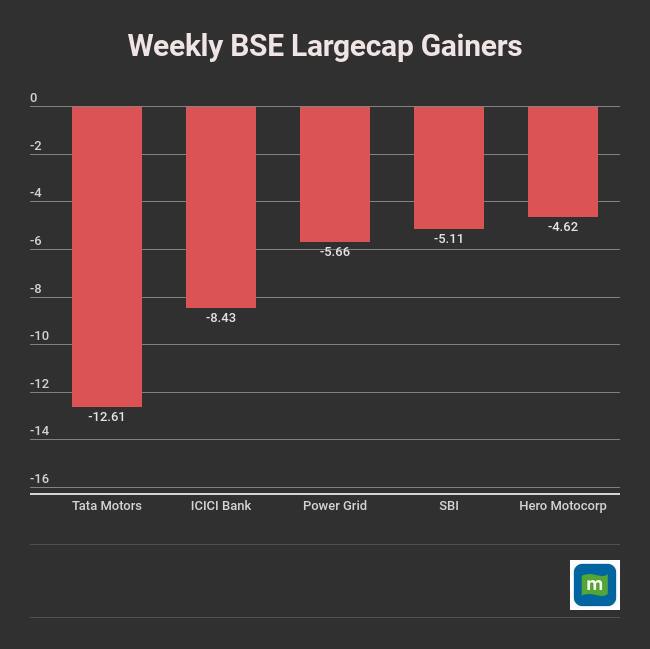

India's volatility index (India VIX) rose 7.6 percent last week, while S&P BSE smallcap index declined 3 percent, S&P BSE Midcap down 2.4 percent, and the largecap index shed 1 percent.

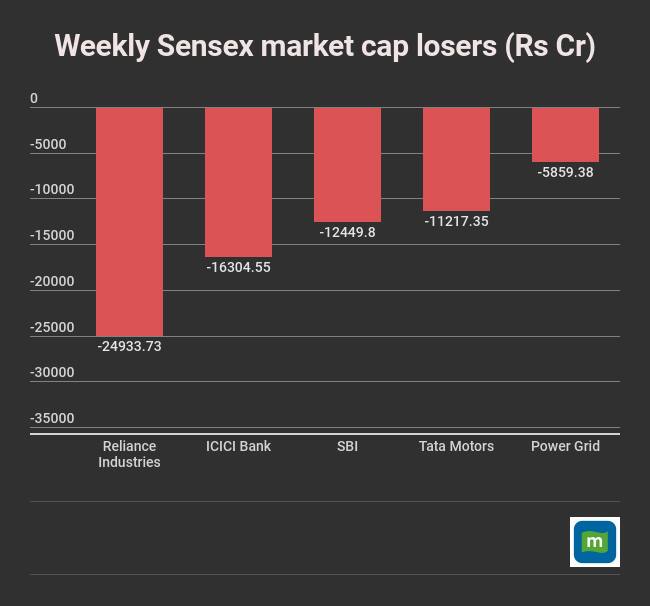

Reliance Industries lost most of its market value on the Sensex, followed by ICICI Bank, SBI, and Tata Motors.

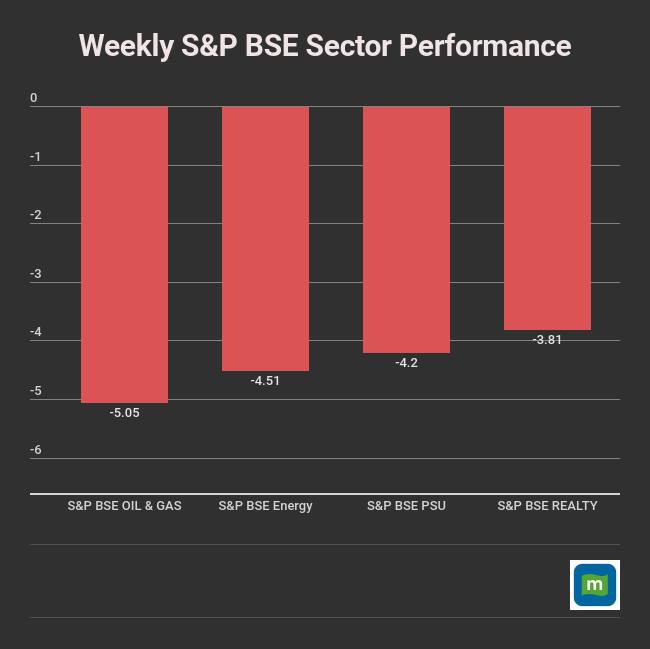

Oil & gas index underperformed the other sectoral indices with 5 percent fall during the week.

A total of 108 stocks touched the 52-week high including Dabur, Bata, Bajaj Finance, Jubilant Foodworks while 500 stocks touched 52-week low including Max Financial Services, LT Foods, Kwality, and JK Tyre in the week ended June 29, 2018.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.