This industrial products manufacturer has been jacking up focus on defence and aerospace businesses, both of which have been celebrity sectors lately.

Shares of Dynamatic Technologies have generated a return of close to 40 percent in the past three months. In the last three years, the scrip has skyrocketed to almost 500 percent.

Dynamatic Technologies is the world’s largest manufacturer of hydraulic gear pumps and has a leadership position in this market for over 45 years.

It is also a Tier I supplier to global aerospace original equipment manufacturers (OEMs), such as Airbus SE, Bell Helicopter, Boeing Company, Hindustan Aeronautics Limited (HAL), GKN Aerospace and Spirit Aerosystems.

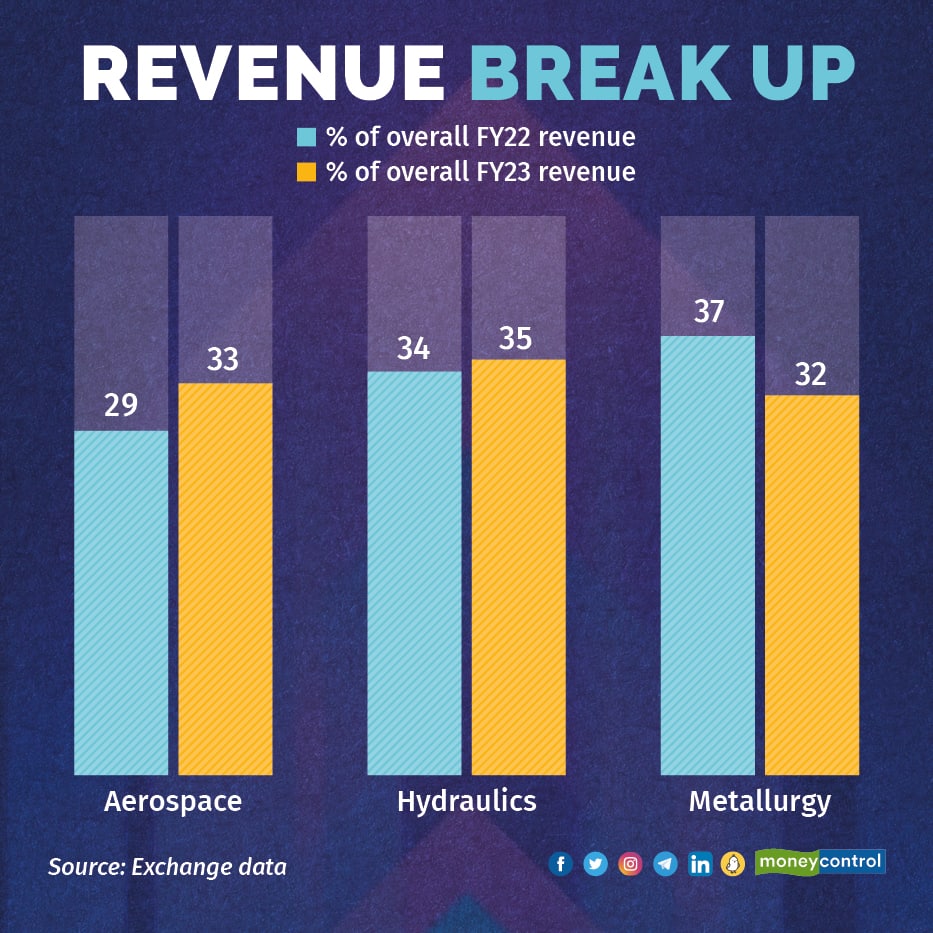

It operates in three business segments: Aerospace, Hydraulics, and Metallurgy.

The positioning of Dynamatic Technologies in the entire value chain is solid as it is well-placed in the aerospace and defence segments, said Nirav Karkera, Head of Research, Fisdom.

Besides, being well-placed in the sunrise sectors, the company enjoys a dominant position in the hydraulic gear pumps market which diversifies application and also reduces the risk of concentration, he added.

Read more | Hammer and tongs: Taparia Tools’ dividend yield comes in at 1550%

Ramping up focus on aerospace bizDespite global supply-chain constraints, the company has registered a decent growth of 20 percent year on year (YoY) in the March 2023 quarter, at Rs 119.4 crore, thanks to the strong demand for commercial jetliners.

Even on a YoY basis, the aerospace segment clocked a 21 percent sales growth, led by a strong commercial order book and supply-chain improvements.

Of late, IndiGo has placed the largest commercial order in Airbus history -- 500 A320 aircraft -- as per reports.

Airbus, which is one of the leading global aircraft manufacturers, is a marquee client of Dynamatic Technologies.

The company is successfully associated with Airbus in the A330 long-range aircraft variant programme, said Vinit Bolinjkar, Head of Research, Ventura Securities.

The supplier to aerospace OEM is also focused on developing capabilities in large aero-structural assemblies, composites and high precision aero-structure designing and manufacturing, going ahead.

The company has delivered over 7,000 aircraft sets till date and is working closely with Spirit Aero Systems for the re- design of the Flap Track Beam with a Monolithic structure. It is a single source supplier of flap track beams in the world, highlighted Bolinjkar.

“The rise in contribution of the aerospace segment to Dynamatic Technologies’ total revenue -- from 15 percent in FY15 to 33 percent in FY23 -- is a significant growth trend, indicating that the segment has experienced substantial expansion and has become a more substantial part of the company’s overall business,” Bolinjkar pointed out.

He also pointed out that commercial deliveries and ramp-up of parts of F-15EX Eagle and Escape Hatch Doors for A220 aircraft is anticipated to start from the coming quarters. This will contribute to the top line and new business opportunities.

A larger view is that with global chain issues getting resolved, a strong order book by major aircraft producers will drive both defence and commercial demand.

Meanwhile, the defence ministry is planning to rope in domestic players to set up repair and overhaul facilities for Western-origin aircraft, as part of the 'Make-in-India' initiatives.

These aircraft and helicopters are said to include Rafale fighter jets, C-130J transport aircraft, Chinook and Apache helicopters, among a few others. The move comes at a time when the maintenance support contracts of some Western-origin aircraft, for instance Rafale jets, are coming to an end.

Several market participants see the Maintenance, Repair & Overhaul (MRO) of military aircraft and helicopters as a big opportunity because these platforms require regular checking and maintenance and repair work.

According to the estimate provided by ICICIDirect Research, the cost of repair and overhaul support for military platforms through their service life can be twice or thrice the initial purchase price. The brokerage firm sees Dynamatic Technologies as one of the beneficiaries since it is already involved in manufacturing aircraft and helicopters.

In March, seasoned investors Sunil Singhania and Madhusudan Kela had invested in the company.

Read more | New-tech businesses exciting, set to produce true multi-baggers, says Raamdeo Agrawal

Deleveraging balance sheetThe company successfully raised Rs 130 crore through a preferential allotment of equity shares during the end of FY23. Dynamatic Technologies has utilised the fund-raise proceeds in April for the repayment of debt and optimisation of balance sheet, the company said in its latest investor presentation.

The fund infusion would support the company's deleveraging efforts, said India Ratings & Research, a Fitch Group company.

Dynamatic Technologies further intends to trim its high-cost long-term debt through divestment proceeds from the Windfarm land.

The company’s total debt, excluding lease liabilities, was Rs 610 crore at the end of nine months in FY23, with a term debt of Rs 360 crore. The credit ratings agency expects the company’s balance sheet to deleverage in FY24-25, with the equity infusion an improvement in operations and the likely materialisation of asset monetisation.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.