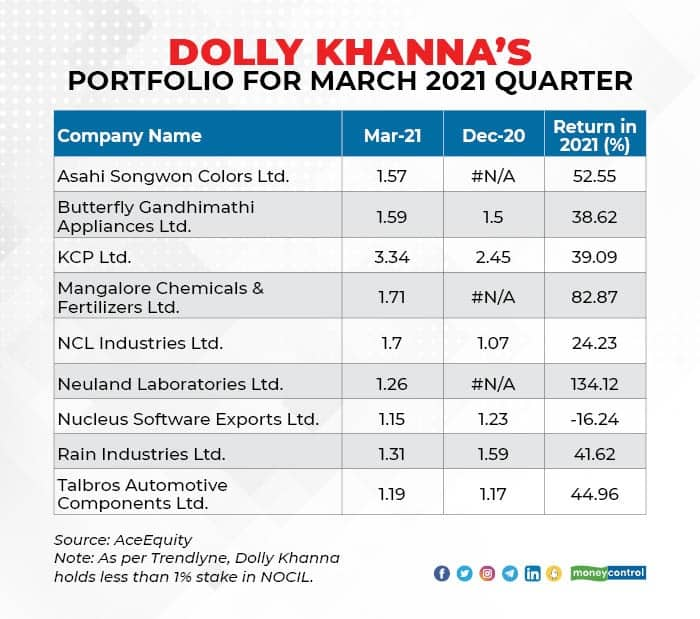

Ace investor Dolly Khanna had shares of 10 companies in her portfolio in the quarter ended March 2021, of which three were new additions. She also increased stakes in four companies during the quarter. The value of her portfolio stood at around Rs 242 crore as per the closing price on May 5.

Khanna, best known for investing in "hidden gems" that tend to outperform markets in the long run, also increased stake in four stocks— Butterfly Gandhimathi Appliances, KCP, NCL Industries and Talbros Automotive Components.

4 stocks in which she increased stakeKhanna raised shareholding in Butterfly Gandhimathi Appliances by 0.09 percent in March quarter to 1.59 percent compared to the previous quarter. She increased her stake in KCP by 0.89 percent to 3.34 percent, NCL Industries 0.63 percent to 1.7 percent and Talbros Automotive Components by 0.02 percent to 1.19 percent.

"In the last one quarter (Q4), midcaps and small caps have outperformed frontliners, hence Khanna has used the opportunity to smarty book profits and trimming stakes to better growth prospects in like Butterfly, KCP, NCL Industries," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

"We also like Butterfly Gandhimathi business model with good room to grow in long term and the stock is available at par compared to its peers like TTK Prestige & Hawkins Cookers," he said.

KCP, too, is a good pick with diversified business interests in cement, heavy engineering, power, sugar, and hospitality, Tapse said. KCP and NCL Industries are trading at cheap compared to mid-small cap cement companies’ valuations, with decent return on capital employed ranging 8-11 percent, he added.

Stocks held by Khanna are from midcap and smallcap segments. In 2021, the BSE midcap and smallcap indices have gained 14 percent and 22 percent, respectively, outperforming the BSE Sensex that gained 2 percent.

Khanna made fresh buying in Asahi Songwon Colors, Mangalore Chemicals & Fertilizers, and Neuland Laboratories.

She acquired a 1.57 percent stake in Asahi Songwon Colors, 1.71 percent in Mangalore Chemicals & Fertilizers, and 1.26 percent in Neuland Laboratories during the January-March quarter of 2021.

"Overall Khanna's new picks have a high probability to generate high returns in the long run," Tapse said.

Stake trimmed in 3 stocksKhanna cut shareholding in total three stocks but as per the shareholding pattern available with the stock exchanges only two stocks are visible where she reduced stake at the end of March quarter compared to December quarter.

Generally, under the public shareholding, the exchanges show the name of shareholders who hold at least 1 percent stake in the company.

As per the shareholding pattern, Khanna reduced stake in Nucleus Software Exports and Rain Industries, while as per Trendlyne.com she also reduced stake in NOCIL wherein her shareholding dropped below 1 percent mark.

In Nucleus Software Exports, she lowered stake by 0.08 percent to 1.15 percent and in Rain Industries, she made trimmed it by 0.28 percent to 1.31 percent.

Stock performanceOut of the 10 stocks, nine not only registered double-digit gains but also outpaced broader markets.

Neuland Laboratories made the most gains, rising 134 percent. Asahi Songwon Colors, Butterfly Gandhimathi Appliances, KCP, Mangalore Chemicals & Fertilizers, NCL Industries, Rain Industries, Talbros Automotive Components and NOCIL gained 24-83 percent.

Nucleus Software Exports was the only underperformer during the same period, falling over 16 percent in 2021 so far.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.