Ever since its listing debacle almost two months ago, Paytm parent One97 Communications has remained in the eye of the storm. But founder Vijay Shekhar Sharma has used every forum to defend his company’s value and, in a recent event, compared Paytm with leading consumer lender Bajaj Finance.

“For our credit business, we should be benchmarked against only one guy and that is Bajaj (Finance),” he said on Wednesday. Sharma couldn’t be further from the truth, according to analysts. “He is just comparing apples with oranges. There are absolutely no similarities between the two. Paytm is a distributor but Bajaj Finance gives loans from its own balance sheet,” said an analyst requesting anonymity.

Paytm does not have a licence to lend and what it does is sell and process loans through tie-ups with other banks and NBFCs. This is the modus operandi of most fintech companies today.

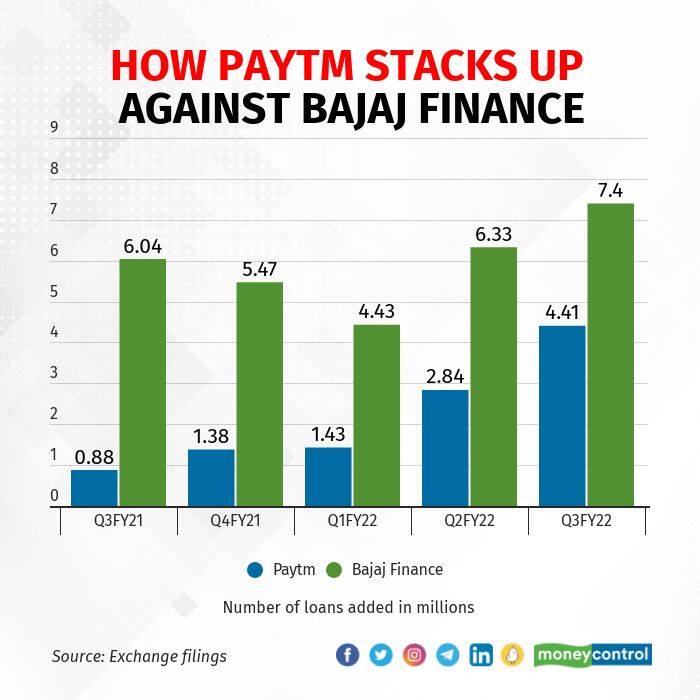

As a distributor and processing agent, Paytm earns a fee. In the December quarter, the company sold and processed 4.4 million loans totalling Rs 2,180 crore, it said in an exchange filing. While the payment and financial services segment makes up more than 80% of the company’s revenues, the share of its credit business is not public.

But analysts reckon that the share is low. Note that the credit business is expected to be a key growth engine for the company in coming years. This is where brokerage firm Macquarie Capital expressed its concerns. “In the past 12 months, Paytm’s average ticket size for loans has been consistently coming down and stands at sub-Rs 5,000 levels. At this size, we don’t think it is doing many merchant loans and most of the loans are small-value BNPL loans (buy now pay later),” it said in a report.

Now let us look at Bajaj Finance’s business.

Bajaj Finance got its NBFC licence in 1998 and is primarily into unsecured consumer loans with assets under management (AUM) of Rs 1.81 trillion as of December 2021. In the December quarter, the lender added 7.4 million new loans, taking its total customer franchise to 55.4 million, it said in an exchange filing.

The lender has discontinued giving out its quarterly disbursement numbers which makes a like-to-like numerical comparison with Paytm difficult. Even so, the lender is far ahead of the fintech company in its loan volume. The lender earns interest as well as fees by way of processing charges on the loans it gives. The revenue potential for Bajaj Finance is far higher than Paytm as far as lending goes. To be sure, revenue loss through delinquencies is also a bigger risk for Bajaj Finance than Paytm as the latter doesn’t have those loans on its balance sheet.

Paytm’s revenue source is largely its payments business and the growth here has been healthy with the company keeping its leadership in the merchant payment operations. The December quarter update shows that it has seen healthy growth with average monthly transacting users growing 37% year-on-year.

But Bajaj Finance is now foraying into the payments market through Bajaj Pay. The lender aims to be an omnipresent company that offers consumers a range of products from payments to credit at one platform. Paytm may not be a straight competitor for Bajaj Finance in the lending business but the latter can become a rival in the payments business. It would be interesting to see how the payments market shapes up in the coming years.

For now, their market valuations may not be an accurate gauge of their value.

One97 Communications has a market cap of Rs 68,000 crore while Bajaj Finance’s market cap is Rs 4.7 trillion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.