India’s urgent defence procurement drive — cleared by the Defence Acquisition Council (DAC) to the tune of Rs 40,000 crore — is expected to significantly benefit listed defence majors such as Bharat Electronics Ltd (BEL), Bharat Dynamics Ltd (BDL), and newer tech players like IdeaForge, Zen Technologies, and Data Patterns. But much of the upside is already priced in, say leading defence sector analysts.

On May 20, Nifty India defence index was down 2%. Among few stocks, Paras Defense was trading a loss of over 5%, BEML was down over 3%, and HAL was also 2% lower. However, Zen Technologies stocks were trading at a gain of about 2%.

With a focus on drones, missile systems, loitering munitions, and radar technologies, the emergency procurement approvals aim to fast-track critical acquisitions under India’s Defence Emergency Procurement mechanism, bypassing standard protocols to meet immediate security needs.

BEL and BDL are seen as core beneficiaries, especially due to their roles in supplying electronics and manufacturing for systems like Akash and MPATGM missiles. “Soft-kill and hard-kill counter-drone systems are gaining traction. Zen Technologies and BEL, with proven deployments, should benefit here,” said Harshit Kapadia, VP – Industrials, Consumer Durables, and Renewables, Elara Capital.

Amit Anwani, Prabhudas Lilladher's Capital Goods and Industrials & Defense Analyst highlighted L&T, IdeaForge, and Data Patterns as potential gainers in segments like drones, electronics, and advanced surveillance. “The DAC’s Rs 40,000 crore approval signals urgent readiness-building,” he said.

According to Hardik Rawat of IIFL Securities, this push could lift FY2026 defence capex by over 20%, from the budgeted Rs 1.9 trillion to Rs 2.3 trillion — if fully utilised. “Even if actual spending falls short, the order inflows and execution pipeline could be strong over the next 12 months,” he noted.

Valuation risks remain

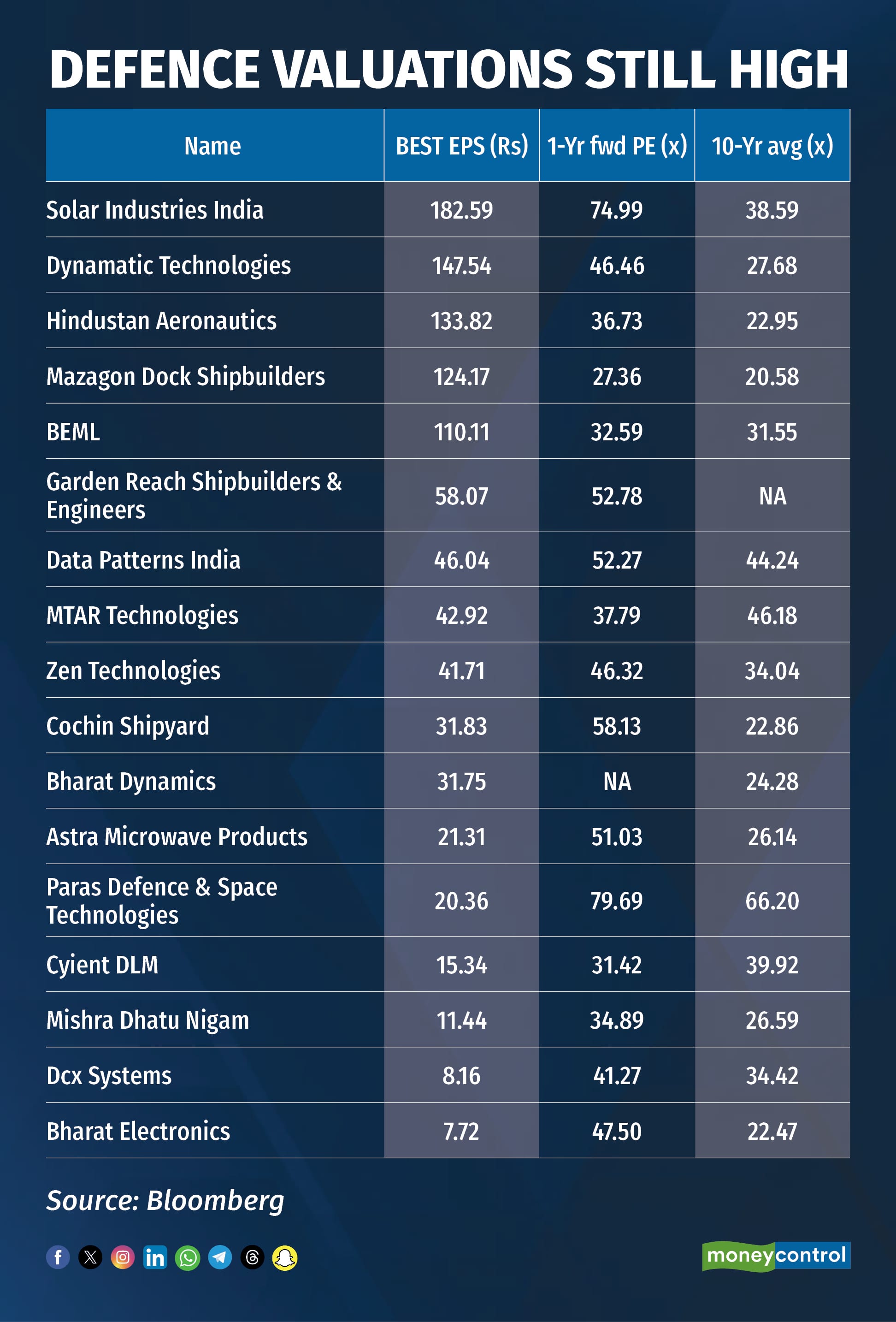

Despite the upbeat outlook, analysts warn that defence stock valuations have run up considerably. The Nifty Defence Index has surged 25% in the past five months, compared to just 5% for the Nifty 50. Most listed players are now trading near their all-time highs.

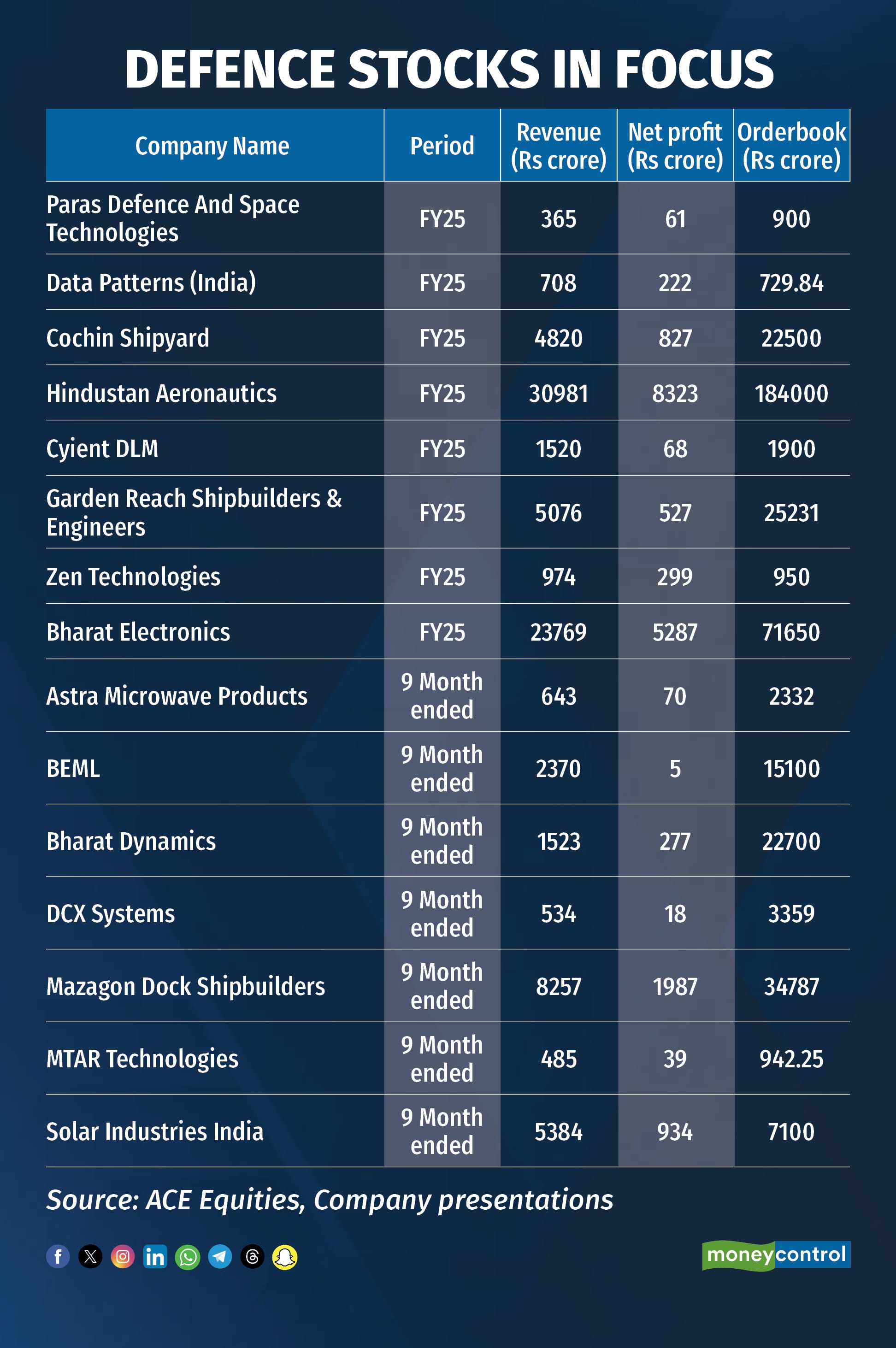

“The recent rally in defence stocks, particularly in electronics and strategic systems, has been sharp. Many are now trading above 40x earnings,” Anwani said. BEL’s total order book stood at Rs 76,000 crore as of April 1, 2025 — over 25% higher year-on-year—reflecting robust order visibility. But analysts caution that much of the bullish sentiment around emergency procurement and long-term reforms is already priced in.

While the opportunity is sizable, analysts suggest investors should watch earnings delivery and margin performance to justify current valuations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.