Credit cards are a double-edged sword for lenders. When deftly managed, they can be a big source of income. But errors in risk assessment invariably lead to stains on the balance sheet. For banks, credit cards have given the occasional heartburn but the pandemic has tested lenders on this business.

Credit cards are instruments to avail unsecured interest-free loans with an average tenure of 30-45 days. A delay in repayment triggers the interest rate charge which can be as steep as 25 percent at times.

It is clear that the lender earns more if you default on your credit card payments on the due date, or convert your outstanding into equated monthly instalments (EMIs). The trick for the bank is to get the money with the interest back. This is where lenders find themselves in a tough spot.

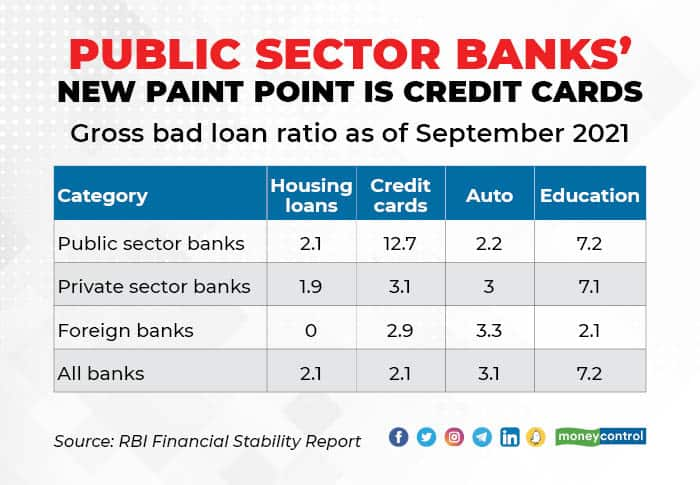

The Reserve Bank of India’s (RBI) financial stability report (FSR) shows that public sector banks saw delinquencies in their credit card portfolio surge to double digits by March 2021.

As of September, credit card defaults stood at 12.7 percent for these banks. That is close to the high bad loan ratios seen in the previous cycle involving corporate loans (see chart).

So are banks staring at a credit card crisis?

There is clearly an increase in distress. As pointed in our story, a high proportion of unsecured retail loans including credit cards outstanding is causing trouble for lenders.

As such, the FSR showed that demand for consumer credit has grown the fastest among the subprime category of borrowers. Subprime refers to borrowers having low credit scores and one of the riskiest to lend to. To be sure, lenders seem to be wary of this category.

“From an origination standpoint, the preference of this category is still low suggesting lending standards are still quite tight which has led to a drop in approval rates,” wrote analysts at Kotak Institutional Equities in a note. What’s more, the migration of borrowers across weaker risk tiers suggests that underlying stress in consumer credit is far more than what headline numbers show.

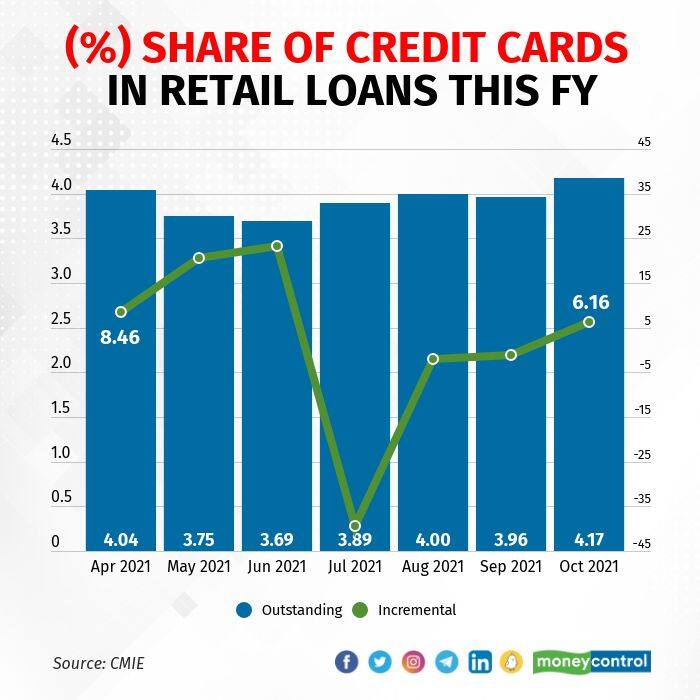

Credit card spends along with unsecured personal loans have seen the fastest growth in the past three years (see chart). But this is waning in recent months. Some of the slowdowns in spending could be attributed to the regulator’s ban on HDFC Bank from issuing fresh cards for eight months. As such, discretionary spends have remained tepid post the pandemic.

A recovery in card spends is now under risk as the new coronavirus variant limits Indians from discretionary consumption. The upshot is that Indians won’t be bingeing on credit at the pace expected earlier. That said, a bigger worry for banks is the asset quality of the portfolio than growth. Delinquency rates need to be curbed.

Note that public sector banks have higher loan approval rates in consumer credit than private-sector lenders. This has coincided with high delinquency rates as well. Public sector lenders need to tighten their underwriting rules. Other lenders must also watch out for risk.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.