January 31, 2025 / 12:08 IST

The average return of Nifty 50 four weeks after the Union Budget is presented is -0.9 percent.

The domestic equity markets are eagerly anticipating the upcoming Union Budget to see what fresh measures the Government initiates, what reforms might be undertaken in attempt to spur consumption, and to see how the balancing act between fiscal consolidation and growth will be pulled off.

The markets usually have a very volatile reaction to the measures announced, with the Nifty 50 swinging wildly on the day itself. However, over the next few weeks, experts expect the benchmark to stablise as investors digest the slew of information.

Story continues below Advertisement

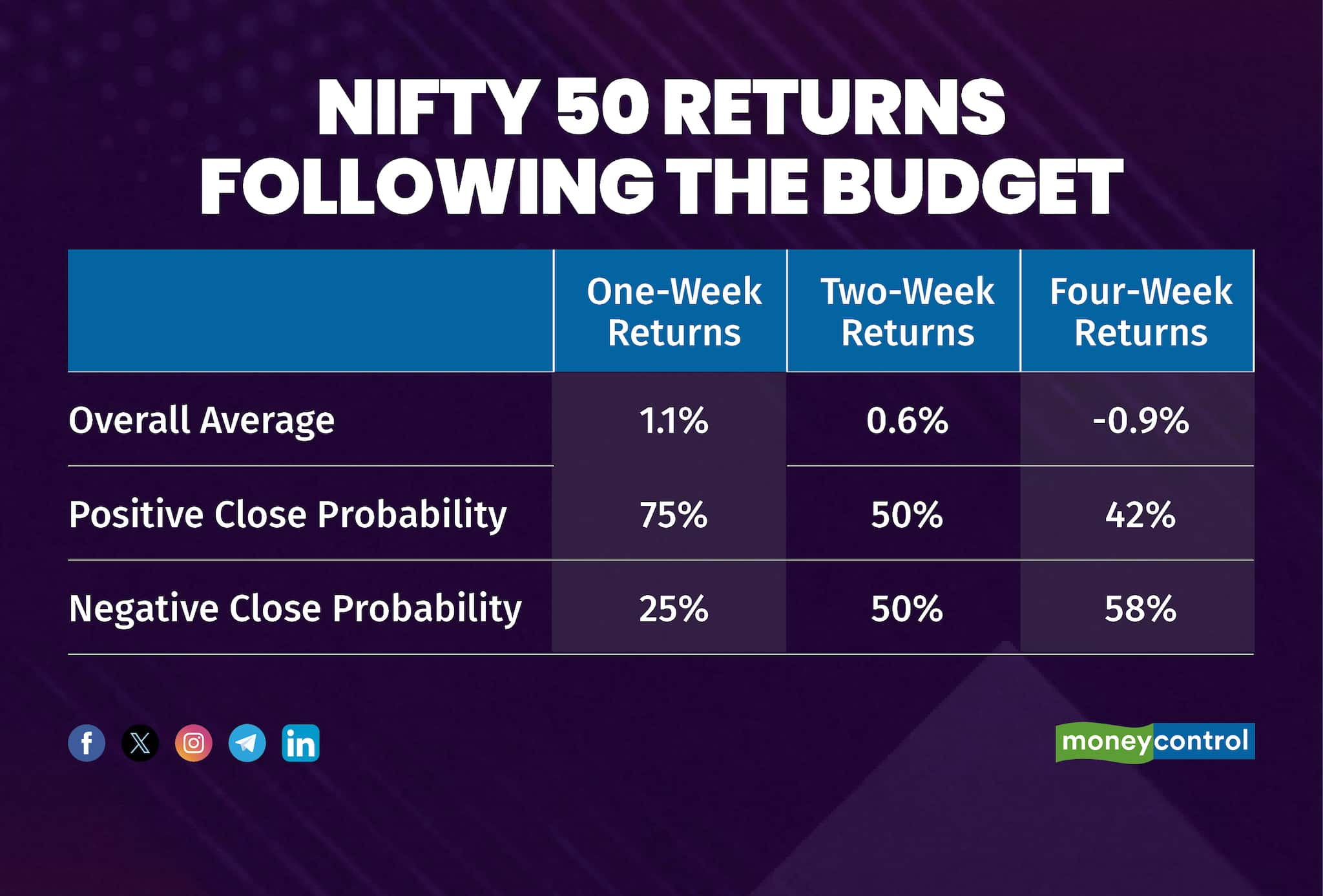

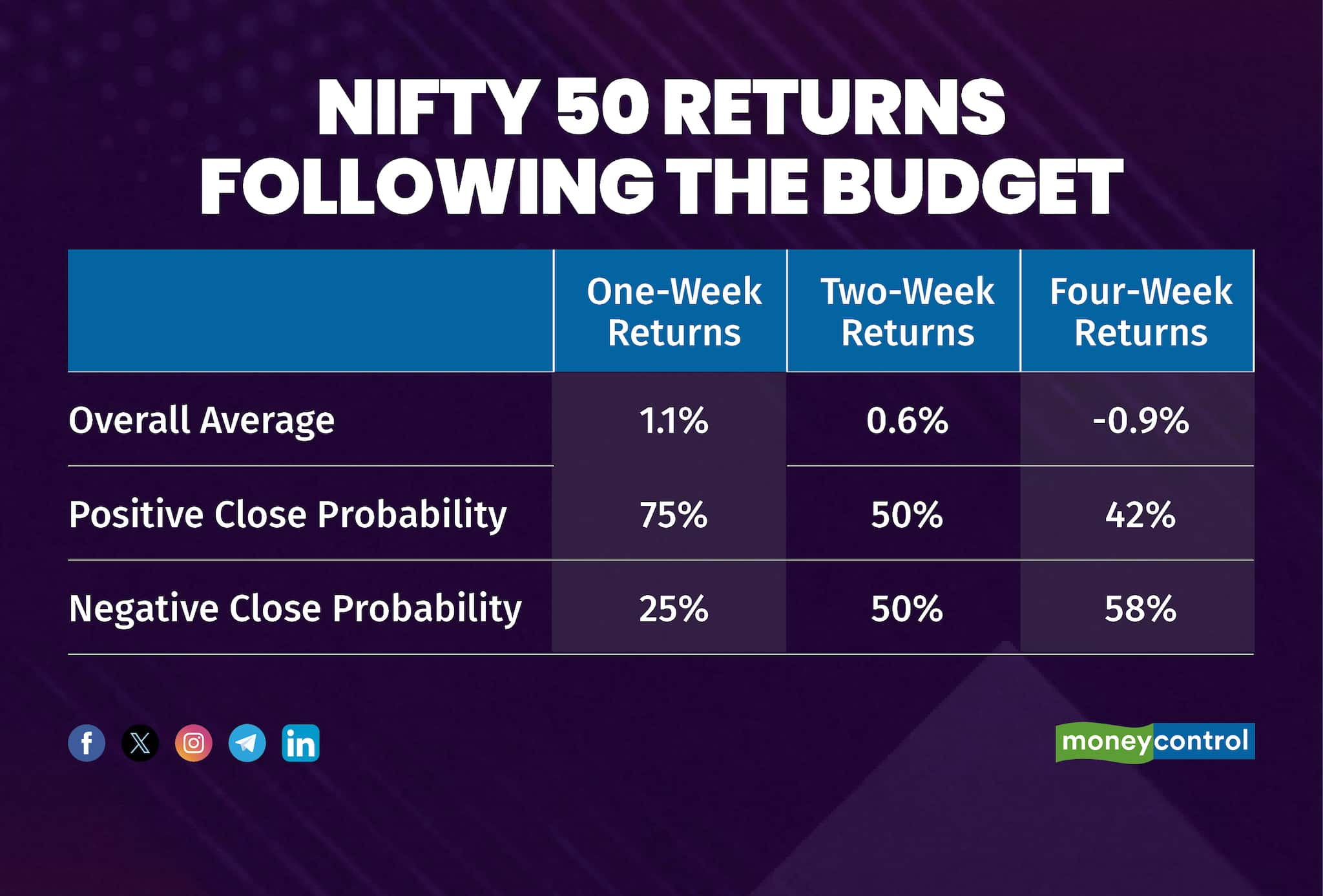

According to a report by domestic brokerage JM Financial, the Nifty 50's average return over one week following the Budget is 1.1 percent, which moderates to 0.6 percent over the next two weeks. However, the average four-week return following a Budget presentation is -0.9 percent.

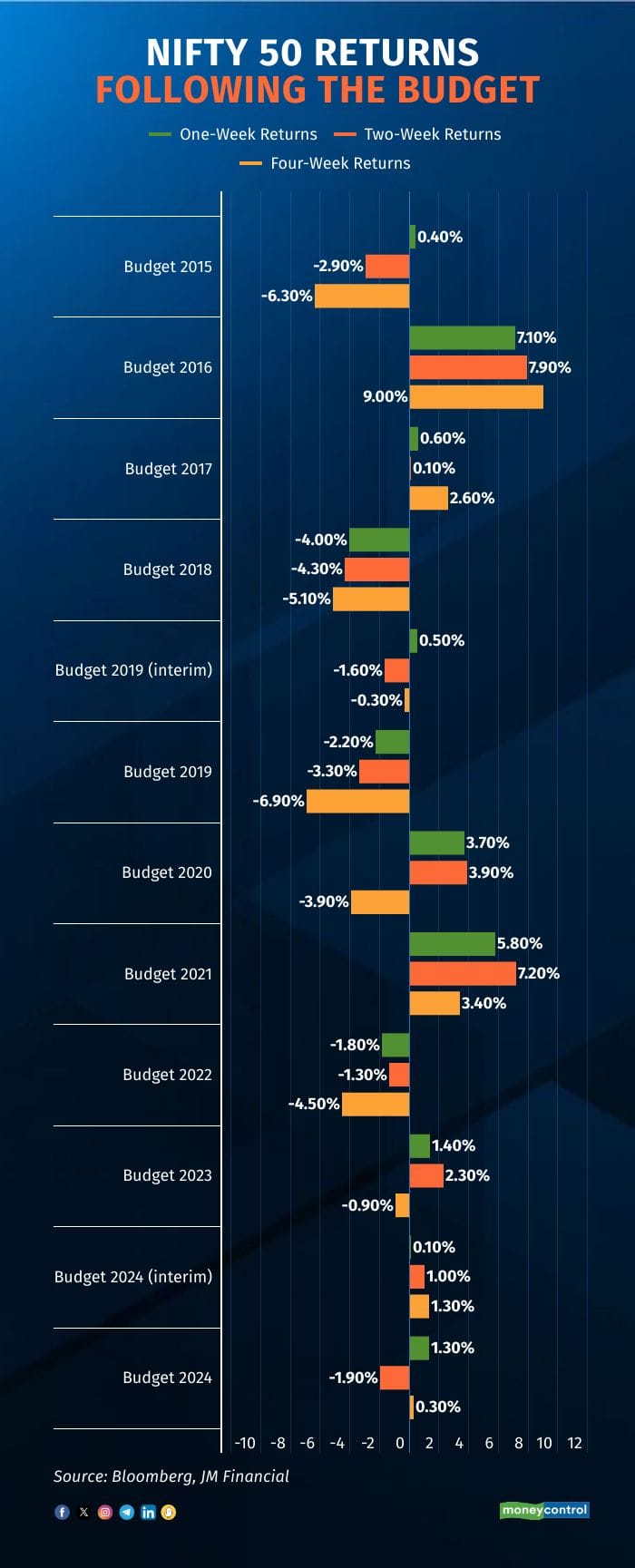

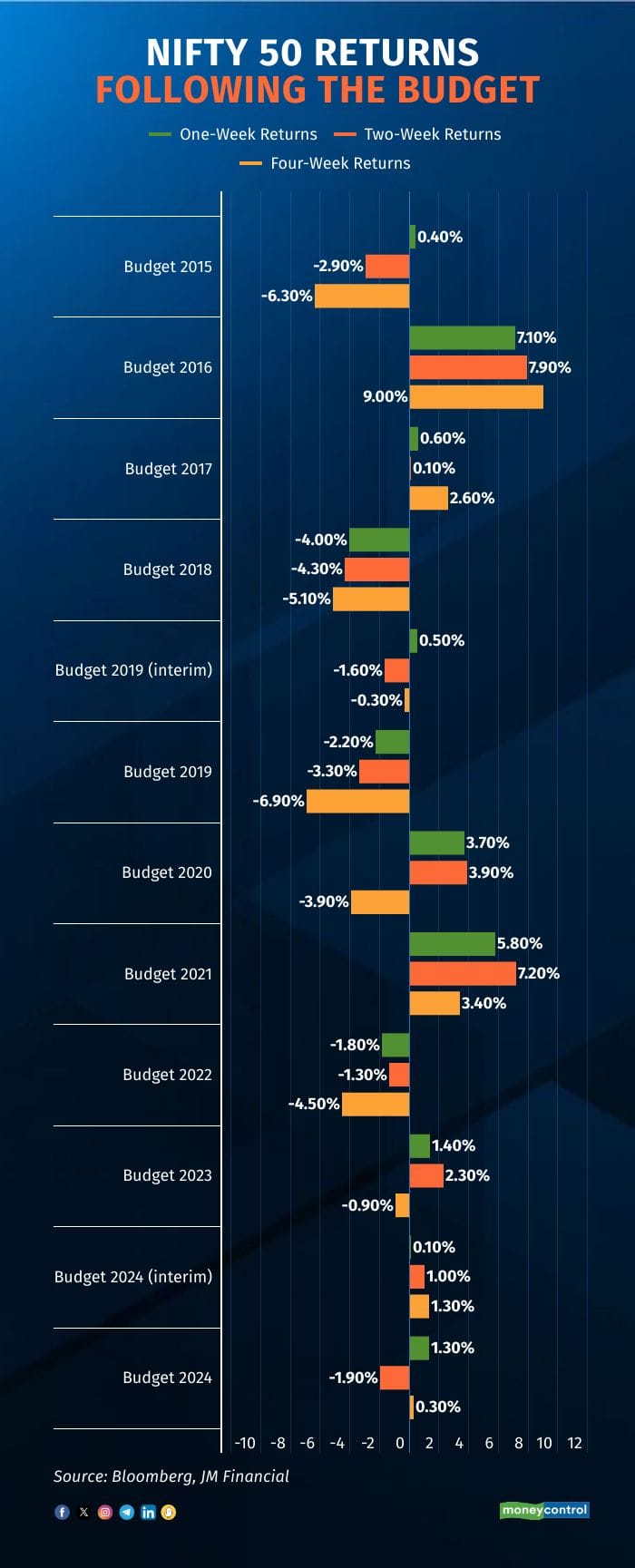

Here's a look at the market returns one week, two weeks and four weeks after the past 10 Union Budgets and 2 interim Budgets were presented since 2015.

One Week Post Budget- The Nifty 50, on a 1-week basis, has closed in the positive territory with a 75 percent probability.

- The Nifty Mid-cap index has closed in the positive territory with a 67 percent probability and an average return of 1.5 percent.

- Sectorally, pharmaceutical index has outperformed the most, closing in the green with a probability of 92 percent and an average return of 3.2 percent.

- Technology index, with a probability of 75 percent, has yielded an average return of 1.5 percent.

- PSU Bank index has closed in the green with a probability of 67 percent and an average return of 3.6 percent.

Two Weeks Post Budget- The Nifty, on a 2-week basis, has closed in the positive territory with a 50 percent probability. The average return stood at 0.6 percent.

- The Nifty Mid-cap index has closed in the positive territory with a 58 percent probability and an average return of 0.1 percent.

- The average return in for the pharma sector declined from 3.2 percent as observed on a 1-week basis to 2.1 percent.

- The technology index has closed in the positive territory with a probability of 58 percent and an average return of 1.2 percent.

- Sectoral indices like Auto, Real Estate and PSU Banks have closed in the red, with a probability of 67 percent each, and an average return in the range of -0.6 percent to 0 percent.

- Sectoral indices like Private Banks, Metals and Energy have closed in the red with a probability of 58 percent each and an average return in the range of -0.4 percent to 0.7 percent.

Four Weeks Post Budget- The Nifty, on a 4-week basis, has closed in the positive territory with a 42 percent probability. The average return stood at -0.9 percent.

- The Nifty Mid-cap index has closed in the positive territory with a 50 percent probability and an average return of -0.5 percent.

- CPSE index has closed in the green with a probability of 58 percent and an average return of 0.9 percent.

- Indices like PSU Banks, Auto, FMCG, Banks and Real Estate's average return stood in the range of -2.5 percent to -0.8 percent.

- Indices like Private Banks, Pharmaceuticals and Energy have an average return in the range of -1.5 percent to 0.5 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!