The broader indices continued to outperform the main indices, which reached a fresh record high amid quarterly earnings, progressing monsoon, and supportive global data points with the Fed's indication of a rate cut in the September meeting. However, fear of possible recession and geopolitical escalations dragged indices from record levels.

During the week, BSE Sensex fell 350.77 points or 0.43 percent to end at 80,981.95, while the Nifty50 index lost 117.15 points or 0.47 percent to close at 24,717.70.

However, broader indices outperformed with BSE Smallcap index rising 0.6 percent, BSE Largecap index falling 0.27, and while BSE Midcap index ending on a flat note.

On July 26, the Nifty50 index touched a fresh record high of 25,078.30 while BSE Sensex hit a new high of 82,129.49, on August 1.

Among sectors, Nifty IT and Realty are down 3 percent each, the Nifty Auto index shed 2 percent, the Nifty FMCG index fell 1.6 percent, and Nifty PSU Bank and Metal indices are down 1 percent each. However, the Nifty Energy index added 2.5 percent, and Nifty Pharma and Media rose 1 percent each.

Foreign institutional investors (FIIs)extended their selling this week as they sold equities worth Rs 12,756.26 crore, however, Domestic Institutional Investors (DII) compensated as they bought equities worth Rs 17,226.06 crore.

"The Budget 2024-25 has not sparked any significant excitement in the market, while it was both populist and prudent. The increase in short- and long-term capital gains taxes added to the volatility on budget day. Many of the measures are a reiteration of the interim budget, and the broader market appears to be losing momentum due to a lack of new impetus. Although the government's emphasis on fiscal discipline and growth is appealing, FIIs are cautious due to current high valuations and muted expectations for Q1FY25 results. Meanwhile, DIIs continue to employ a "buy on dips" strategy, which contributed to market gains on the week's last trading day, particularly in the pharma, auto, metal, IT, and FMCG sectors," said Vinod Nair, Head of Research, Geojit Financial Services.

"The market has now recovered its losses from budget day, driven by positive US GDP data and expectations of improved global demand. Moving forward, the direction of the domestic market will likely be influenced by the progress of the earnings season. Additionally, global economic updates, including US Fed & BoE monetary policies, US employment data, and Eurozone GDP figures, are expected to impact market trends," he added.

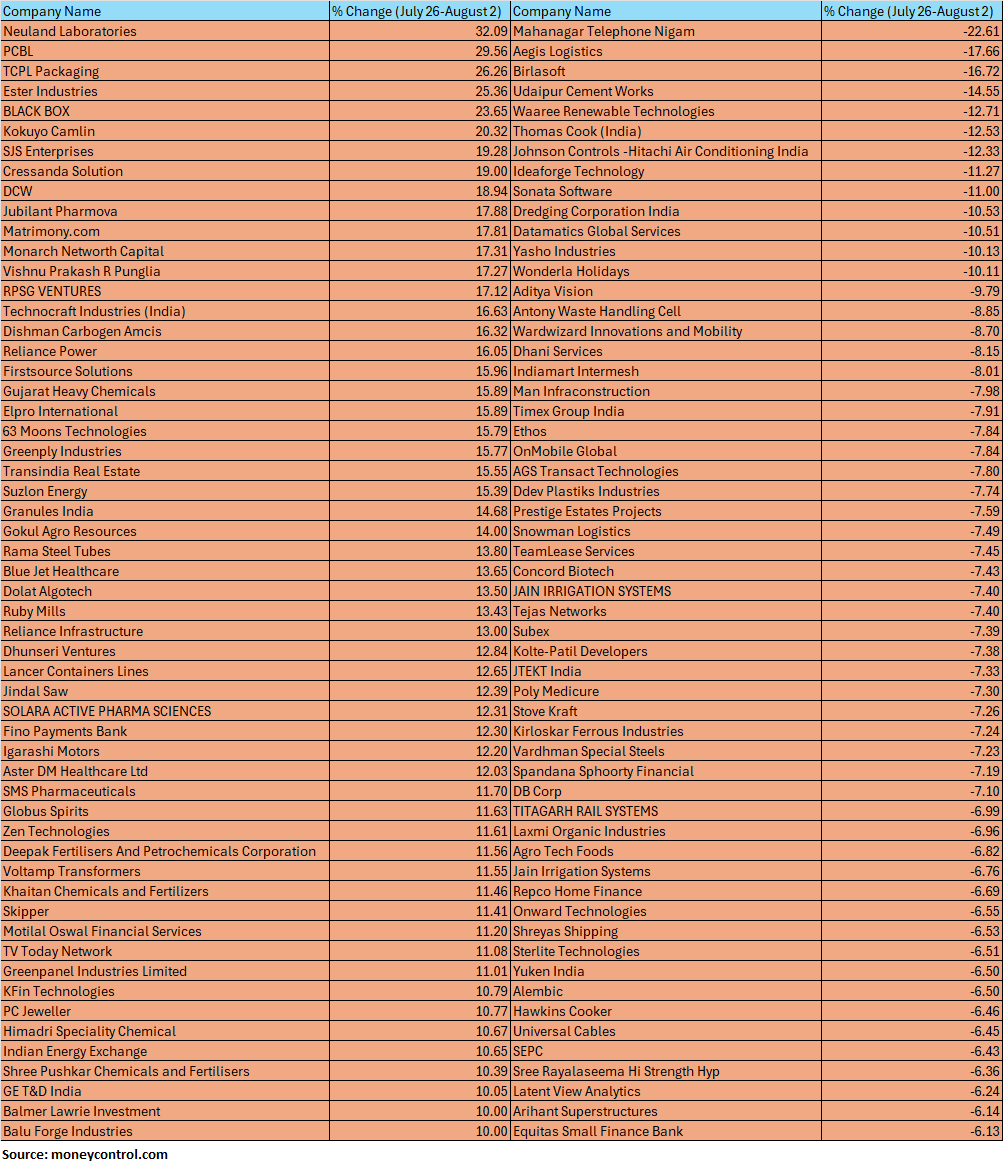

The BSE Small-cap index rose 0.6 percent with Neuland Laboratories, PCBL, TCPL Packaging, Ester Industries, Black Box, Kokuyo Camlin, SJS Enterprises, Cressanda Solution rising between 19-32 percent. On the other hand, Mahanagar Telephone Nigam, Aegis Logistics, Birlasoft, Udaipur Cement Works, Waaree Renewable Technologies, Thomas Cook (India), Johnson Controls -Hitachi Air Conditioning India, Ideaforge Technology, Sonata Software, Dredging Corporation India, Datamatics Global Services, Yasho Industries, Wonderla Holidays fell between 10-22 percent.

Where is Nifty50 headed?

Amol Athawale, VP-Technical Research, Kotak securities:

On an immediate basis, the market is finding support between 24,600/80900 and 24,500/80,600 levels. On the other hand, until the market crosses 25,100/82,200, we may see a range-bound movement in the market. The strategy should be to buy selective stocks between 24,600 and 24500/80900 and 80,600 levels. A close below 24,500/80,600 may take the market towards 24,250/79,900 or 24100/79,500 levels. Any bounce towards 24,900-25000/81,700-82,000 levels will be an opportunity to reduce long positions.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The short-term trend of Nifty is down, but the near-term uptrend status of the market is intact. There is a possibility of some more weakness in the coming sessions down to 24,600-24,500 levels before showing any upside bounce from the lows. Immediate resistance is at 24,900 levels.

Osho Krishan, Senior Analyst - Technical & Derivatives, Angel One

From a technical standpoint, the Nifty index continues to maintain a position above all its major Exponential Moving Averages (EMAs), with robust nearby support identified around the subzone of 24,600-24,500. Also, till Nifty remains above this level, there shouldn't be any significant cause for concern for market participants.

On the higher end, the bearish gap on the daily chart, around 24,850-24,950, is likely to act as intermediate resistance, followed by the psychological mark of 25,000 in the near period. Moreover, a sustained breakthrough beyond this level is anticipated to catalyse the next series of rallies in the benchmark.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.