The broader indices performed inline with main indices, posting strong gains in the second consecutive week post GST rationalizations, positive global markets, hopes of ease on US-India trade tension, and DII supports.

For the week, Nifty50 added 373 points or 1.50 percent to end at 25,114, while the BSE Sensex index added 1193.94 points or 1.47 percent to end at 81,904.70.

BSE Largecap, Midcap and Smallcap indices rose 1.5 percent each.

Foreign Institutional Investors (FIIs) extended their selling in the 11th straight week, as they offload equities worth Rs 3,577.37 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying in 22nd week, as they purchased equities worth Rs 13,703.23crore.

Among sectors, except Nifty Consumer Durables (down 1 percent), all other indices ended in the green with Nifty Defence index rose 7 percent, Nifty IT index jumped over 4 percent, Nifty PSU Bank index added 3 percent, while Nifty Auto, Metal, Pharma jumped 2 percent each.

"Indian markets ended the week on a strong footing, with the Nifty closing above the 25,000 level and broader indices outperforming the benchmark. The upturn was supported by optimism over the anticipation of stronger H2FY26 earnings, driven by GST rationalisation and the benefits of monetary easing, which also provide resilience to valuations. Sentiment was further lifted by reports that the EU may reject U.S. tariff proposals on India’s Russian oil imports," said Vinod Nair, Head of Research, Geojit Investments.

"Continued foreign outflows weighed on the rupee, while gold reached fresh highs on strong safe-haven demand amid global trade tensions. The market, however, found support in improving prospects for India–US trade negotiations, suggesting tariff-related risks may prove short-lived. Although global bond yields have risen to new peaks, investors currently do not view them as a major threat."

"The IT index exhibited its rally, driven by renewed hopes of a Fed rate cut, Infosys’ buyback announcement, and optimism over a revival in technology spending. Consumer-centric sectors, particularly Auto, displayed steady resilience, supported by expectations of GST-driven demand recovery and festive season tailwinds. Domestic CPI inflation registered a slight uptick; however, ongoing tax reforms are expected to help ease pressures in the period ahead," he added

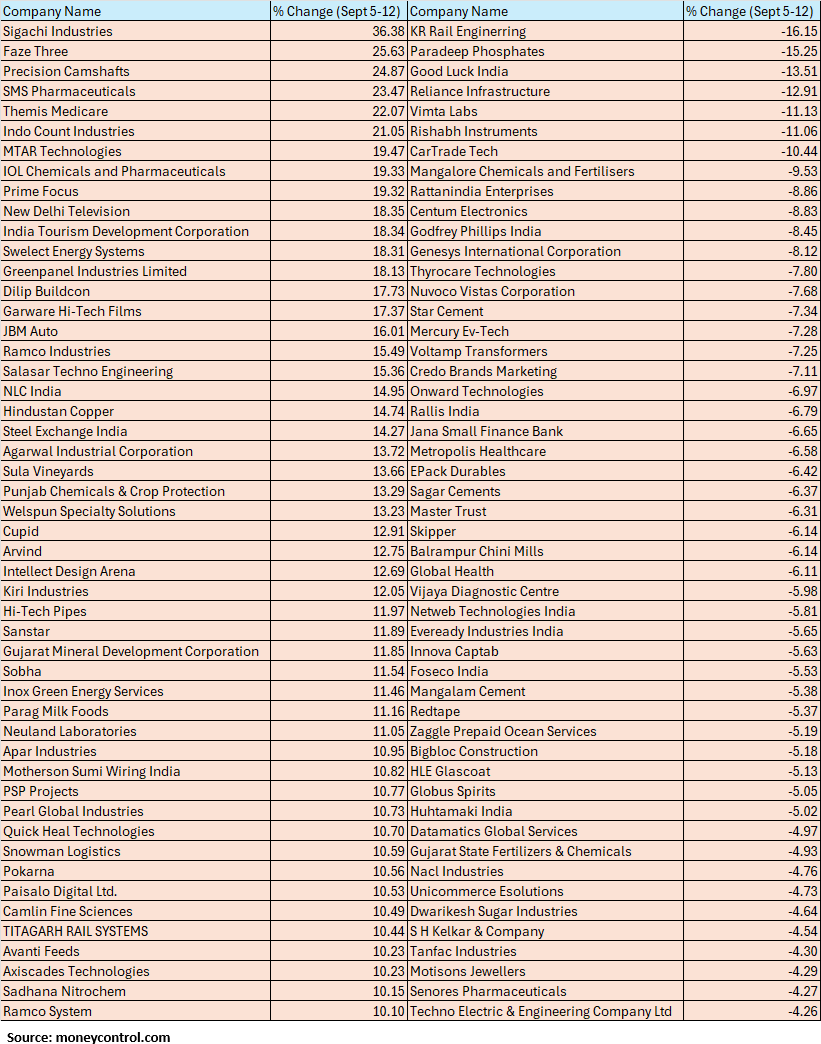

The BSE Small-cap index rose 1.5 percent with Sigachi Industries, Faze Three, Precision Camshafts, SMS Pharmaceuticals, Themis Medicare, Indo Count Industries, MTAR Technologies, IOL Chemicals and Pharmaceuticals, Prime Focus, New Delhi Television, India Tourism Development Corporation, Swelect Energy Systems, Greenpanel Industries, Dilip Buildcon, Garware Hi-Tech Films, JBM Auto, Ramco Industries, Salasar Techno Engineering rising 15-36 percent.

On the other hand, KR Rail Enginerring, Paradeep Phosphates, Good Luck India, Reliance Infrastructure, Vimta Labs, Rishabh Instruments, CarTrade Tech fell between 10-16 percent.

On the levels front, the intermediate support level is anticipated to reside within the 25000-24900 range, which is expected to provide a buffer against potential declines. Furthermore, the positive crossover of the 20 and 50 DEMA around 24800 is regarded as a critical support zone from a positional perspective.

At the higher end, intermediate resistance levels are identified around 25250, followed by a bearish gap located in the 25340 zone. Nevertheless, given the current technical configuration, the range of 25500 to 25600 appears to be attainable in the near term.

Amol Athawale, VP Technical Research, Kotak SecuritiesWe believe that as long as the market is trading above 25,000/81800, the bullish sentiment is likely to continue. On the higher side, 25,150–25,200/82200-82400 would act as immediate resistance zones for the bulls. A successful breakout above 25,200/82400 could push the market up toward 25,500–25,550/83300-83500.

On the flip side, below 25,000/81800, the uptrend could become vulnerable. Traders may consider exiting their long positions if the market falls below this level.

For Bank Nifty, the 20-day SMA and the level of 54,300 could act as key support zones. Above these levels, the pullback move could continue toward 55,300–55,500 or the 50-day SMA. Conversely, if the index falls below 54,300, it could retest levels around 54,000–53,700.

Rupak De, Senior Technical Analyst at LKP SecuritiesNifty managed to stay in the green as put writers provided support around the 25,000 mark. The index appears to be consolidating its recent gains, gradually forming a base.

As long as it sustains above 24,850, the undertone remains constructive.

A decisive move beyond 25,150 may set the stage for a rally towards 25,500 in the near term.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesThe crucial hurdle of down sloping trend line and previous two weeks high has been surpassed quietly around 25000 mark and the market closed higher. Nifty closed above the weekly close of the last eight weeks at 25100 levels, which is signaling positive outlook for coming week.

The underlying trend of Nifty continues to be positive. Having sustained above the key overhead resistance of 25000–25100 levels, Nifty is likely to move towards the next overhead resistance of 25350-25400 by next week. Immediate support is placed at 24900 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.