Ashish Kyal, CMT

The Nifty50 and the Bank Nifty have been inching higher, but the momentum has been very slow and it has been hitting the wall consistently!

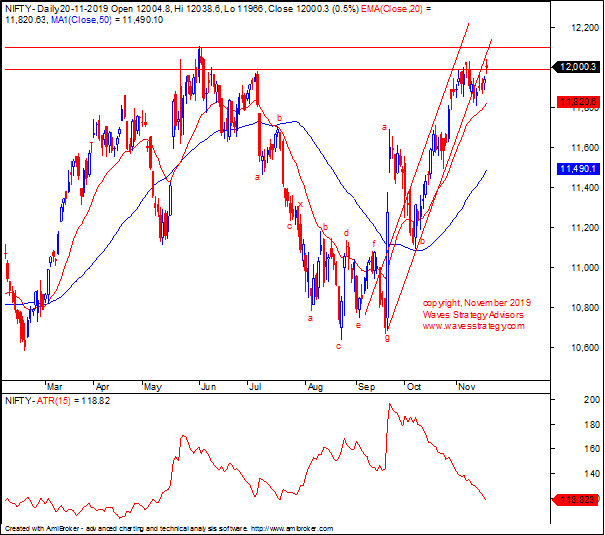

The below chart shows multiple red trendlines that meet at the same intersection. Multiple trendline intersections are very important areas and one needs to keep a close watch on price behaviour from there.

A ‘decisive’ break above the intersection zone will be bullish, whereas a move back below the support area will indicate prices got rejected at higher levels.

Average True Value (ATR):

Average True Value (ATR) is a classic tool to measure the overall daily range of the market. ATR is calculated by taking the difference between the highs and the lows, today’s high compared to the previous close, today’s low compared to the previous close, and taking the average over the period of time.

The 10-day ATR value of the Nifty has cooled off from 200 points to nearly 118 points now. This is a classical indication that option buyers need to be cautious as markets might start consolidation or non-trending behaviour.

Buyers will have to consider buying in the money options, else there will be deterioration in the prices despite the market moving in the expected direction.

The sharp fall in ATR can be seen from the above chart, which has now reached the nominal value.

In a nutshell, one needs to combine various methods together to form a trading strategy. The above chart shows, Elliott wave counts, Trendlines, Channels, Average True Range (ATR) and Moving averages.

It will now be important to see if prices can manage to break above the earlier highs to generate the necessary momentum for further positivity, or start giving up from here and trapping the buyers! It is time to be alert and not complacent. The next few days will be extremely crucial for markets.

(The author is Founder & CEO at Waves Strategy Advisors.)

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.