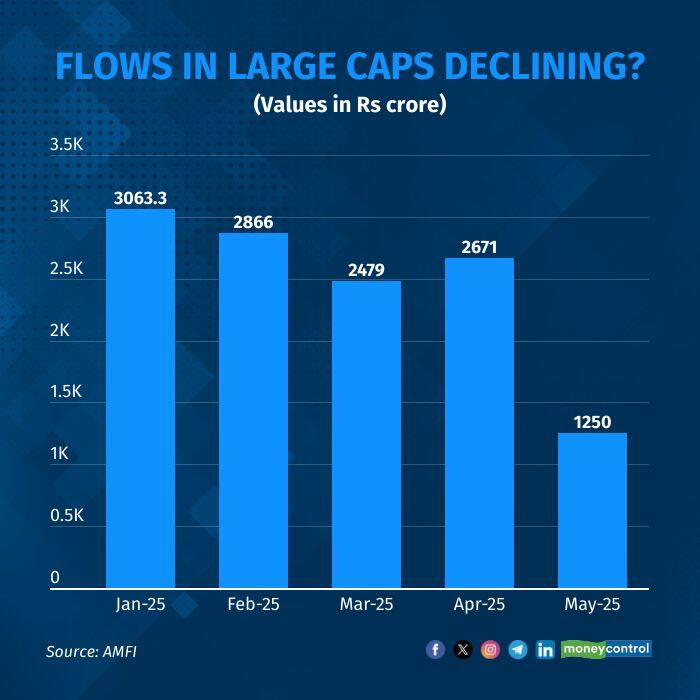

The large-cap fund category saw a sharp decline in inflows in May, with money coming in plunging 53.19 percent month-on-month to Rs 1,250.47 crore, according to the latest data from the Association of Mutual Funds in India. The drop comes despite strong performance in the segment.

In May, the Nifty 50 and Sensex gained around 2 percent each. While inflows into mid- and small-cap funds also slowed, the largest impact was felt by large-caps, which have witnessed mixed flows over the past five months. Analysts and fund managers believe this trend may reflect rising investor appetite for higher-risk segments but continue to remain confident on the large-cap fund space.

“Large-caps have not been completely ignored, but they don’t appear to be the primary choice for many investors at the moment,” said Himanshu Srivastava, associate director at Morningstar India. Srivastava added that while younger or newer investors may be drawn to recent gains in smaller-cap stocks, the prudent approach remains a balanced allocation. “A rational investment strategy would involve maintaining exposure to large-caps regardless of mid- and small-cap performance, in order to maintain portfolio stability,” he said.

Ramesh Mantri, CIO, White Oak Asset Management Company, suggested that recent flows reflect market psychology rather than fundamentals. “Flows follow markets, not the other way around. After a period of weak returns, it’s natural for flows to slow. But as the market recovers like we’ve seen with the recent rally after the surprise rate cut, flows tend to catch up.”

He explained that large-cap investing is generally more tactical and dominated by lump-sum investments, while small- and mid-cap exposure tends to come through SIPs or systematic investment plans. “When the environment was uncertain, due to a domestic slowdown and geopolitical risks, investors understandably hesitated with large-caps,” Mantri said.

If not large-caps, where?

Industry experts also point out that while flows into pure large-cap funds may be declining, investors continue to gain exposure through diversified strategies.

“Many investors are now gaining large-cap exposure indirectly through flexi-cap funds, which typically allocate 59–60 percent to large-caps,” said Srivastava. “Multi-cap funds also hold around 45–50 percemt in large-caps. Additionally, there’s growing interest in passive strategies—such as index funds—where large-cap exposure remains significant.”

Mantri also pointed out the growing popularity of ETFs or exchange-traded funds as a competing option within the large-cap universe, driven by their low-cost and passive structure. “But large-cap isn’t just the top 10 or 20 stocks. It’s nearly 100 companies—there’s room for active managers to generate alpha, though it’s harder compared to mid- and small-caps,” he added.

Fund managers say the opportunity for active, pure-play large-caps is immense. “At the end of the day, investors want alpha. If you can demonstrate consistent alpha, as we’ve done with our fund, then you’ll always find investor interest. So we’re not worried,” said Atul Mehra, fund manager, Motilal Oswal AMC.

How these funds performed

According to data from Ace Equity, only 45 percent of large-cap funds (18 out of 33) beat the benchmark on a one-year basis. On a longer three- and five-year horizon, the number of outperformers dropped to 16 and 8, respectively. Still, a few funds have posted robust returns. The Motilal Oswal Large Cap Fund topped the one-year charts with a 22 percent return, followed by DSP Large Cap Fund (13 percent) and BNP Baroda MF (10.4 percent). Over five years, Nippon Large Cap Fund led with a 26 percent gain, followed by ICICI Prudential Bluechip Fund with 24 percent.

Mehra noted that there’s this perception that large-caps haven’t given strong returns, but that’s not true. “For example, our large-cap fund launched in 2024 is up around 40 percent, while the benchmark is up about 17 percent. That’s 23 percent alpha. If you look at large-caps over the past 16 months, there are several names that have delivered. There are always opportunities. As a fund manager, your job is to find and act on them,” he said.

Fund managers say that despite short-term underperformance in segments such as banking and IT—core components of large-cap portfolios—the category continues to offer value.

“While there were some concerns around large-caps—including volatility due to near-border tensions—valuations in large-caps remain reasonable,” said Narendra Solanki, head of equity research at Anand Rathi. “However, the growth opportunities currently appear more prominent in certain small-cap sectors, such as electronic manufacturing, PLI-beneficiary companies, and railways. These sectors often lack strong representation in large-caps.”

Solanki believes the current tilt towards mid- and small-caps is likely temporary. “This is a preference shift driven by sector-specific themes and perceived rebound potential. Over the medium term, we expect flows and investor interest to normalise across categories, including large-caps,” he said.

Mantri, too, cautioned against reading too much into recent mid- and small-cap outperformance. “If you look at rolling returns over longer periods, it’s not clear that small- and mid-caps consistently outperform large-caps. In fact, they’re now trading at a 20 percent-plus valuation premium to large-caps, which actually gives large-caps a tailwind from a valuation perspective,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!