Despite its strong Q3 earnings performance, analysts have downgraded Cipla over the past month amid concerns about the lack of upside triggers for the company due to delays in key launches.

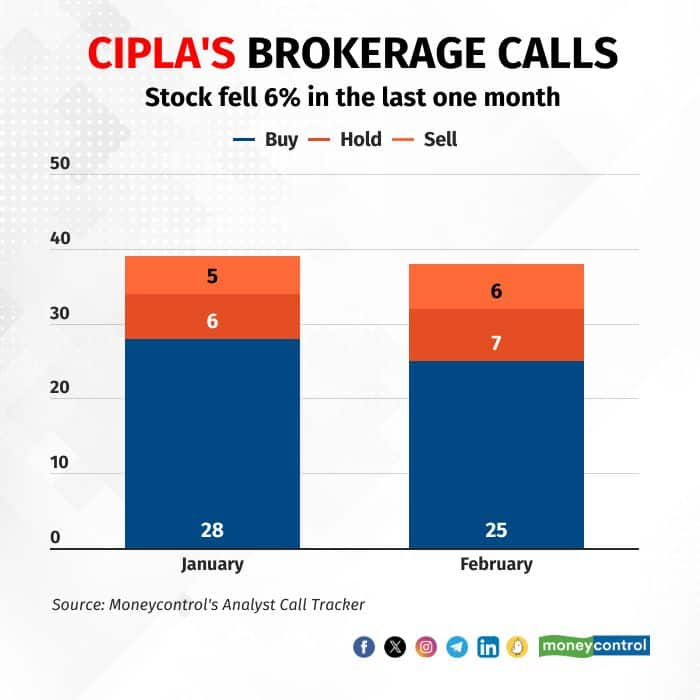

As per Moneycontrol’s analyst call tracker, ‘buy’ calls for Cipla came down to 25 in February from 28 in the previous month after the drugmaker released its Q3 earnings. On the other hand, ‘hold’ and ‘sell’ calls rose by one each to 7 and 6, respectively.

Meanwhile, the stock has also witnessed a sharp rally over the past year, surging over 40 percent, which, in the absence of any major upside triggers, leaves limited scope for more gains on the counter as key launches in the US have been delayed further.

Strong Q3 showCipla clocked its highest-ever quarterly revenue of Rs 6,604 crore in Q3, a 14 percent on-year increase, driven by growth across key markets North America, India and South Africa. The North America business scaled a new peak and posted its highest-ever quarterly revenue for a third straight quarter, to $230 million, supported by positive traction in key assets and the base business.

Net profit for the quarter surged nearly 32 percent on year to Rs 1,056 crore in Q3. The company’s operating margin also reached an all-time high of 26.5 percent in October-December, up from 24.2 percent in the same quarter last fiscal year.

Major US launches delayedTwo of Cipla’s much-awaited major launches, respiratory drug Advair and chemotherapy drug Abraxane, have been delayed further as their production plants remain entangled in regulatory snags.

Clearance for the plants, located in Goa and Indore, will take another six months. A site transfer for Abraxane to the foreign facility could also delay the launch of the product due to trial requirements. Cipla is thus relying on its Goa site to launch the drug in FY25, brokerage firm Jefferies stated. For Advair, it expects filing by Q2 of FY25 and 6-9 month approval timelines.

According to Jefferies, the realistic commercial timelines for both these products have now shifted from FY25 to FY26 as site transfer of complex products can be time-consuming.

The Goa and Indore plants were supposed to manufacture Advair and Abraxane, Cipla’s key upcoming drugs, and hence regulatory snags at these sites have plunged the two launches into a spiral of delays. This will not only hurt the potential revenue from these drugs but also reduce the opportunity size offered by the two products.

Also Read | US FDA plant observations at Cipla cause 6-month delay in product launches: CEO

Analysts estimated Advair's market to shrink by around 7-8 percent annually and hence a delay in its launch from the earlier expected FY25 to FY26 is seen as a big blow to Cipla. Currently, Advair commands a market size of $700 million. Abraxane, too, has a market size of $700 million.

On the back of relentless delays in key launches, Nomura also believes that opportunities are diminished as it expects to launch Abraxane in the second half of FY26 (earlier expected in Q4 of FY25) and Advair in FY26 (earlier late FY25).

Factoring in the faltering opportunities, Nomura has downgraded Cipla’s shares to ‘neutral’ with a price target of Rs 1,427, as it believes the recent run-up in the stock price and warning letter at key sites in Goa and Indore will limit buying interest in the counter. On the other hand, Jefferies has a ‘hold’ call on the stock with a price target of Rs 1,250.

Limited upside triggersAnalysts are also worried over the lack of clarity on the future investments that the drugmaker might make. Nomura noted witnessing limited progress on innovation and biosimilars by Cipla.

“On the specialty front, the company intends to focus on in-house innovation or acquire only late-stage assets,” Nomura added. In the specialty segment, which houses high-margin, complex products, Cipla stands way behind Sun Pharma, which ventured into the field much earlier and is now reaping the benefits.

For now, Cipla is largely focused on in-house capabilities to drive its speciality portfolio and might reconsider speciality asset acquisition only in FY27-28, by when its major drug pipeline should have hit the US market. However, that will not only delay but also trim the company's growth prospects in the segment.

Also Read | Delayed drug launches to hurt Cipla’s earnings in FY24

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.