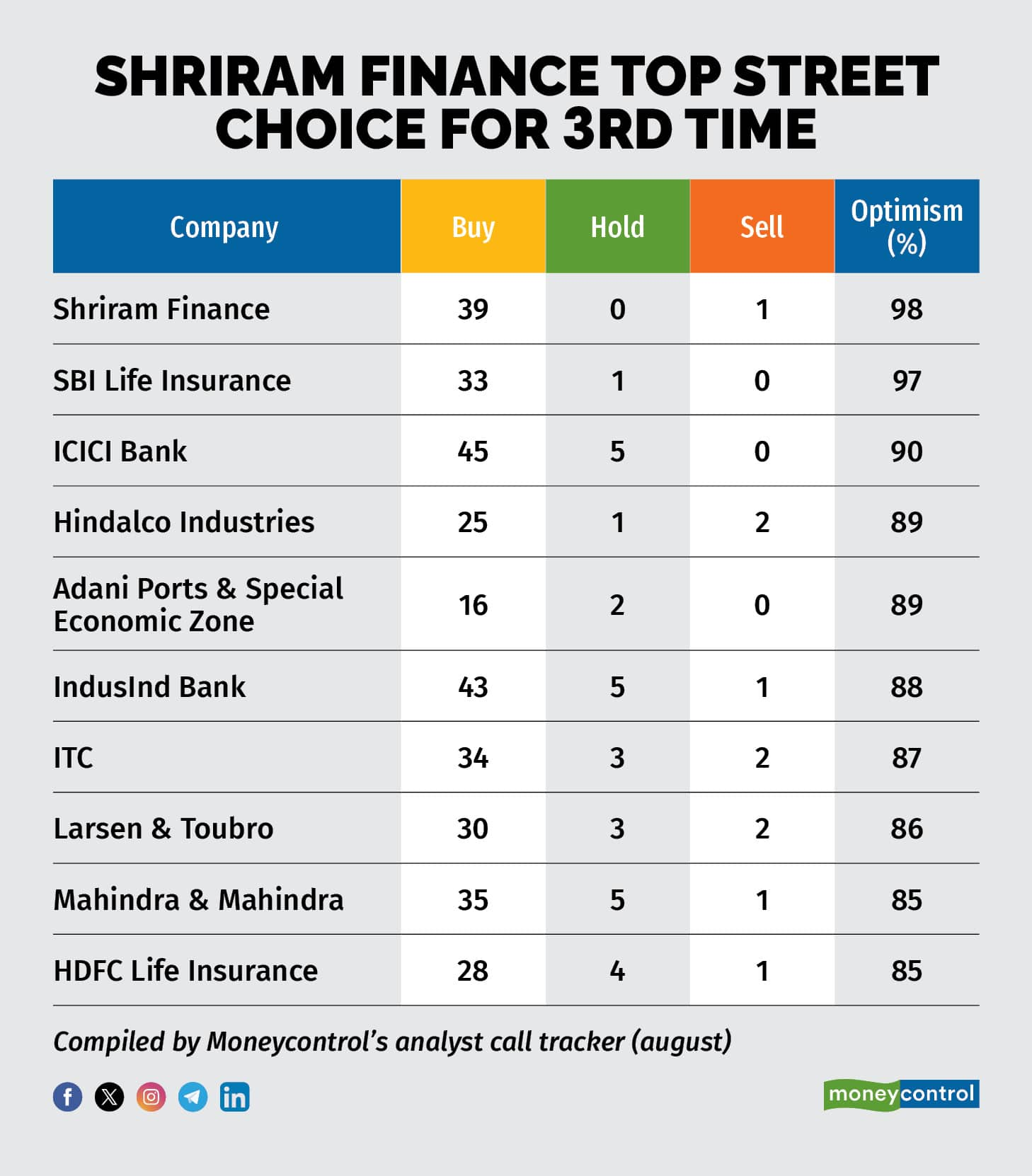

Shriram Finance continued its hot streak, retaining top spot among analysts for the third consecutive time, showed Moneycontrol's August analyst call tracker. While HDFC Life emerged as a new favourite in the BFSI sector, prominent private lenders HDFC Bank and Axis Bank stayed out of favour for the second straight time due to their tepid performance on the bourses so far this year.

Based on Moneycontrol's tracker, 39 out of 40 brokerages have given a 'buy' rating for Shriram Finance, with only 1 maintaining a 'sell' recommendation for the non-banking financial company (NBFC). Additionally, SBI Life, ICICI Bank, and IndusInd Bank continue to dominate the optimism charts, securing 33, 45, and 43 'buy' calls, respectively.

A noteworthy debut in the list is HDFC Life, which has caught the Street's attention by securing 28 'buy' ratings, alongside 4 'hold' and just 1 'sell' recommendation, marking a strong entry for the private life insurer.

Strong guidance and improved asset quality: Shriram Finance has projected to surpass its stated guidance of 15 percent year-on-year AUM growth for FY25, driven by stronger-than-expected disbursements in the June quarter. In its AUM mix, the company expects MSME loans to grow by 20 percent, old truck financing by 12 percent, and two-wheeler loans to rise between 15-18 percent in the current financial year.

On the asset quality front, Shriram Finance has shown steady improvement following its merger with Shriram Transport Finance Company and Shriram City Union. Post-merger, gross stage assets 3 (loans that are overdue for more than 90 days) stood at 6.2 percent as of March 31, 2023, improving to 5.39 percent by June 30, 2024. The management aims to reduce this figure to 5 percent by FY25.

Tearaway rally, attractive valuations: Despite the stock's impressive 58 percent surge this year, Shriram Finance still trades at a relatively low valuation of 2.55x price-to-book (P/B) ratio. Even though its credit quality is not comparable to the best in the class of top NBFCs, it trades at significantly lower valuation. Bajaj Finance trades at 6x P/B, while Sundaram Finance and Cholamandalam Investment are both valued at 6x P/B ratio and 4x P/B, respectively.

Fundraising to support growth: To fuel its business expansion, Shriram Finance plans to raise $1 billion (approximately Rs 8,300 crore) from overseas over the next six months. This fundraising will include loans from development financial institutions such as the Asian Development Bank, KfW, and the United States Development Finance Corporation (DFC). The capital raise aligns with the management's target of growing its business by more than 15 percent in FY25, reinforcing its growth trajectory.

Strong premium collections: HDFC Life reported a 12 percent increase in premium growth for the first five months of fiscal 2025. In August alone, the insurer saw a 4 percent year-on-year rise in premium collections to Rs 2,797 crore. This, therefore, helped annualised premium equivalent (APE) grow by 8 percent, with retail APE increasing by 10 percent in August. APE is a common metric used in the insurance industry to measure revenue generated from new policies in a given year.

Growth ingredients in place: The company's management is confident about doubling its Value of New Business (VNB), which refers to the future profits expected from new policies sold, over the next 4 years. They expect this growth to be mainly driven by increasing sales through HDFC Bank. Currently, HDFC Bank is responsible for about 65 percent of their insurance sales, and as the bank improves how it sells insurance, this can help the company grow, noted analysts at Emkay Global. Additionally, the company aims to increase its profits by adding more features that cover risks, such as extra death benefits or riders (additional coverage options) to their savings-based insurance products like Unit-Linked Insurance Plans (ULIPs).

No regulatory overhang: Regarding the revised surrender value norms that seeks to offer better payout to policyholders if they terminate their policy before maturity date, HDFC Life expects some impact in the first year of policy surrender, but none after two years and beyond. This is something investors were worried will impact the profitability of insurers. "With the change in regulation increasing surrender value, we don't anticipate any significant drag on margins when policies are surrendered after two years. The only impact we see is in the first year, where our experience is quite good," the management stated in their earnings conference call. This comes as a relief, analysts said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!