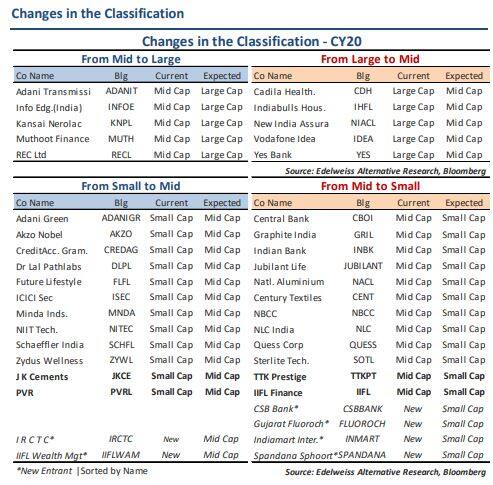

The Association of Mutual Funds in India (AMFI) on January 3 shifted Info Edge (India), Adani Transmission, REC Limited, Kansai Nerolac and Muthoot Finance to the largecap category from midcap.

The changes in the small, mid and largecap club done by AMFI is seen on the expected lines, said some brokerages.

"As per the AMFI official release on the market capitalisation classification, the changes in the large, mid and small-cap has been, largely, as per our expectations," said Edelweiss Securities.

"The cut off for the large-cap is at Rs 26,291 crore whereas the mid-cap cut off came at Rs 8,243 crore. Large-cap stocks attribute 74 percent while the mid-cap stocks attribute 15 percent and the small-cap stocks attribute 11 percent of the total market cap," said Edelweiss Securities.

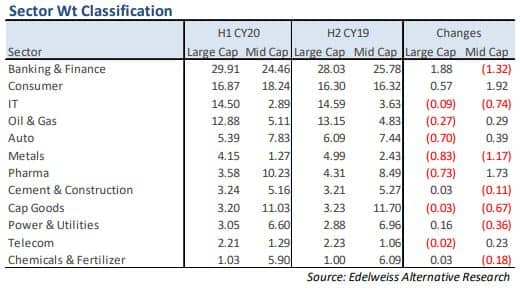

With the full market cap, the largecap classification has the highest exposure to BFSI (30 percent), consumer (16 percent), IT (14 percent) and oil & gas (13 percent) sector.

On the other hand, midcap classification has the highest exposure to BFSI (24 percent), consumer (18 percent), pharma (10 percent) and capital goods (9 percent) sector.

"Midcap classification is heavily overweight on pharma (7 percent) and capital goods (6 percent) whereas heavily underweight on IT (-12 percent), oil & gas (-8 percent) and banking (-5 percent) vis-à-vis largecap classification," Edelweiss Securities pointed out.

In order to ensure uniformity and clarity, the market regulator SEBI had in 2017 defined smallcaps, midcaps and largecaps.

Since then, AMFI, in consultation with SEBI and stock exchanges, prepares a list of stocks once in six months based on the data provided by the BSE, National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI).

As per the new rules, the top 100 companies, in terms of market capitalisation, will be considered as large-caps, the 101st to 250th companies will be considered as midcaps and the 251st onwards will be considered small-caps.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.