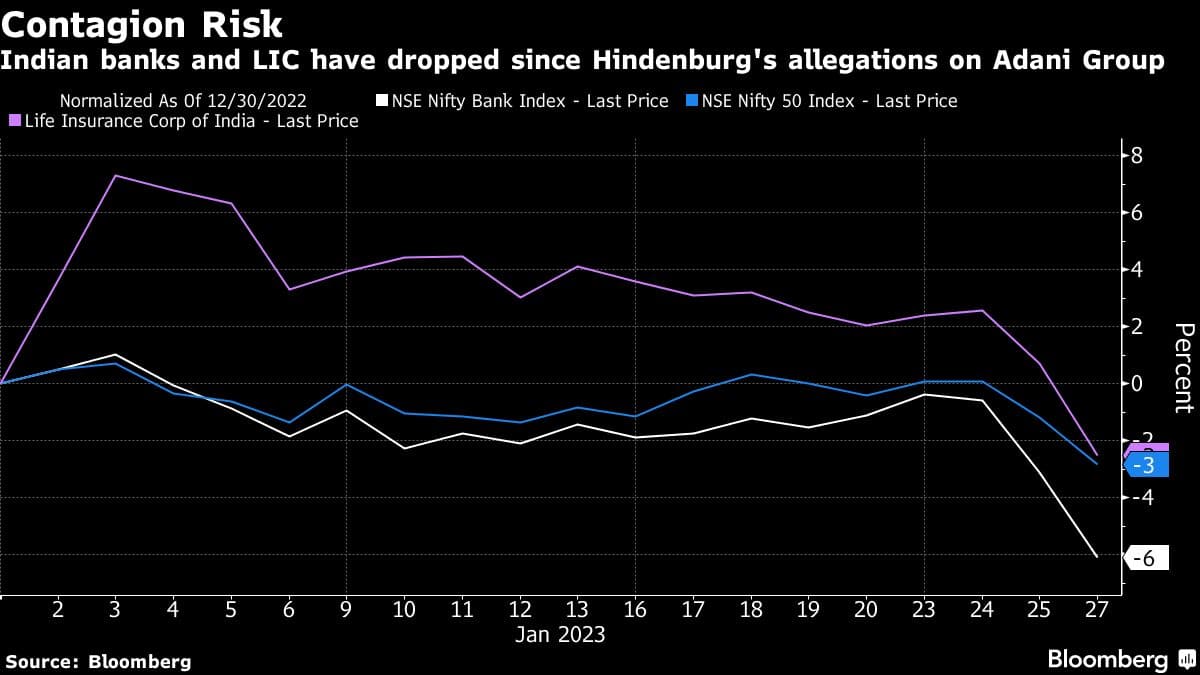

Shares of Indian banks and Life Insurance Corp. of India plunged on Friday amid concerns about their exposure to the Adani Group following a scathing short-seller report.

The NSE Bank Nifty Index extended declines of the previous session, underperforming broader stock benchmarks. Bank of Baroda and State Bank of India were among the biggest decliners.

“Negative sentiment is prevailing in the market, which is weighing on bank stocks,” said Kranthi Bathini, chief market strategist at WealthMills Securities Pvt. “Some of it is due to worries about Adani collateral,” although there’s also a bout of profit-taking after the rally in recent months, he added.

Indian banks have reported sterling results over the past weeks, with their quarterly profits soaring driven by scorching credit demand. That euphoria has now been overshadowed by the drama unfolding in the country after US investment firm Hindenburg Research released a report on Wednesday attacking the corporate empire of Gautam Adani.

Brokerage CLSA Ltd says the exposure is minimal. The Indian banking system’s exposure to Adani Group totals 0.55% of system loans, according to CLSA, which said that bank debt stands at less than 40% of total group borrowing.

State-run banks, referred to as PSU banks, have a higher loan exposure to the conglomerate than the private sector banks, analysts led by Adarsh Parasrampuria wrote in a note dated Jan. 26. “For PSU banks, the exposure is more meaningful at 0.6% of loans and 5% of FY24 net worth.”

Nitin Chanduka, a strategist with Bloomberg Intelligence, said Friday’s bank selloff is partly due to foreign outflows. “PSU banks, notably, have a higher loan exposure to Adani group and there could be a rub-off effect.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.