The recent bullish crossover of moving average, or a Golden Cross pattern, formed on the daily charts of Reliance Industries (RIL) suggests that there is more upside of up to 10 percent in the offing in the short term, suggest experts.

Golden Cross is a bullish breakout that indicates a rally in the stock or the underlying. The most commonly used moving averages are the 50-period and the 200-period moving average.

Experts are of the view that RIL has good support near Rs 2,080-2,050 levels, and the stock could see a bounce-back that could take it towards Rs 2,300-2,360 levels which translates into an upside of about 10 percent from the last trading price of Rs 2,104 on June 25.

“Barring the last 3 sessions, the June series did mark a revival in strength in the stock which was lacking since March series as the stock surged from Rs 2,000 level right from day one,” Sacchitanand Uttekar, DVP – Technical (Equity), Tradebulls Securities said.

“The recent pullback has been good and looks arresting around the Rs 2,080-2,050 zone. We have a classic Rising Three bullish formation on its expiry-on-expiry price scale with its monthly ADX retaining its strength above 28-30 zone which is a good sign of strength,” he said.

Uttekar further added that it is likely that the stock post the event may witness some stable price action going forward & reverse its trend towards the Rs 2,300-2,360 zone soon.

Shares of RIL rose 6 percent on a YTD basis, and over 22 percent on a 1-year basis compared to a 13 percent rally seen so far in 2021, and over 50 percent gain on a 1-year basis.

Shares of RIL fell by over 5 percent for the week ended June 28 which was largely on account of profit-taking, suggest experts amid announcements made in AGM.

The company's Chairman Mukesh Ambani unveiled a Rs 75,000-crore green energy plan at its AGM on June 24 as he also laid out for the shareholders the growth path for the conglomerate’s telecom, retail and O2C businesses. Brokerage firms raised target price post the AGM.

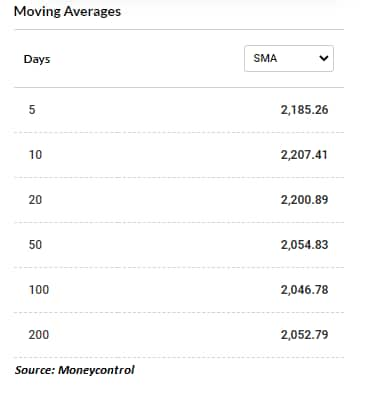

Reliance Industries witnessed profit booking last week and slipped below 20-days (SMA) which indicates that the stock may face some more pressure in the near term; however, the stock is in a bullish zone for the long term, suggest experts.

“One can use dips as a buying opportunity. The daily chart pattern suggests that the stock has important support around the 2050 level; however, on the higher side, 2150 -2200 are the resistance area,” Rajesh Palviya, VP - Technical & Derivative Research, Axis Securities said.

“Once the stock manages to cross above 2200 levels, it may regain strength on the near-term chart and can scale up further towards 2250-2300 in the short term,” he said.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by the investment experts on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!