Benjamin Graham, who is also known as the father of value investing, once said — "The individual investor should act consistently as an investor and not as a speculator."

After three straight months of fall (June to August), the month of September gave relief to investors as both the Sensex and the Nifty managed to break above crucial resistance levels, thanks to reforms introduced by the government to kick start growth in the economy.

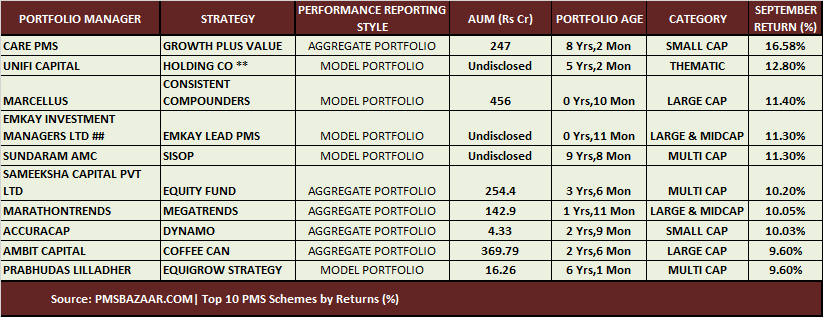

The S&P BSE Sensex reclaimed mount 38,000 and rallied by about 3.5 percent. But there are as many as 79 Portfolio Management Services (PMS) schemes across largecap, midcap, and multicap category that outperformed the Sensex in September.

These portfolio schemes were able to create alpha or outperform the benchmark index in the same period, data from PMSBazaar.com showed — an online portal used for PMS comparison, investment and analytics.

The top gainer, or the baton this time around, was in the hands of Smallcap stocks compared to largecaps in the previous month (August). The S&P BSE Smallcap index delivered a 5 percent return in September.

Portfolio Management Services cater to wealthy investors with portfolio sizes exceeding Rs 25 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

Care PMS with an AUM of Rs 247 crore in the smallcap category topped the charts with returns of 16.58 percent, data from PMSBazaar.com showed.

CARE PMS – Growth Value Plus scheme is a smallcap strategy that aims at creating wealth through long term investment in equity stocks which are dominant players in the particular field or sector.

Here, a bottom-up approach is followed while selecting stocks and companies which have a high growth rate along with good management, attractive valuations, and strong financial conditions are chosen for the portfolio.

UNIFI Capital, a specialized portfolio management company offering innovative investment strategies with superior risk-adjusted return, delivered 12.80 percent return in the month of September, data showed.

Marcellus Consistent Compounder scheme, which falls under the largecap category, gave a 11.4 percent return in September.

Consistent Compounders, with an AUM of Rs 456 crore, identifies firms with high pricing power that helps sustain a large gap between returns on the cost of equity and capital employed.

Emkay Investment Managers recorded 11.3 percent return in September. The PMS scheme ‘Emkay Lead PMS’ falls under the large and midcap category. The scheme is aimed at investing in stocks to achieve long term capital appreciation by investing in large and midcap categories.

Sundaram AMC, SISOP scheme, which falls under the multicap category, gave 11.3 percent return for the month of September, and Sameeksha Capital’s Equity Fund scheme, which also falls under the same category, a gave 10.2 percent return.

Marathon Trends scheme ‘Megatrends’, which focuses on the large and midcap space, gave a 10.05 percent return. The objective of the strategy is to create wealth by consistent compounding in the long term and keeping drawdowns low. The allocation is limited to just 20 stocks.

Accuracap’s, Dynamo scheme, which is predominantly a smallcap scheme, gave a 10.03 percent return in September. Dynamo has a diversified portfolio which comprises of 12-35 high-quality companies with an intelligent ranking algorithm.

Disclaimer: The above report is for information only and not recommendation to buy or sell. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.