Shubham Agarwal

The open interest (OI) activity in Nifty50 was conducive for the bulls and was indicative of incremental optimism in the index via the addition of longs.

The weekly increment of OI in the index was over 4 percent. On the other hand, Bank Nifty futures had long additions of almost 9 percent and an equal amount of short unwinding was seen with almost no change in open interest.

Among stock futures, for the first time in many weeks, the number of stocks with long additions were higher than the number of stocks with short additions.

However, OI activity with the highest number of stock futures was short covering. This indicates a push from the outgoing pessimism being higher than the incoming optimism.

Last week, India VIX hit the lowest level since August which is a positive sign for the bulls. On the options front, Nifty’s movement did trigger some upward shifts in the call writers, however, repeated reversals from 11,200 and around keeps the strikes above the said level highly congested.

On the other hand, at the lower end of the range, the level of 11,000 is almost equal to the heaviest Put of 10,800 in terms of OI.

After many weeks even in Bank Nifty, more liquid weekly expiry options are now composed with moderately bullish OIPCR of greater than one.

Also, the infamous level of 28,000, which was a hurdle, with futures trading higher could now halt the index in case of nervousness.

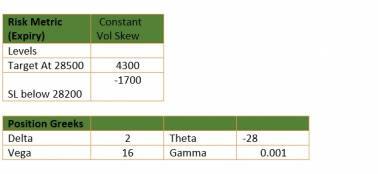

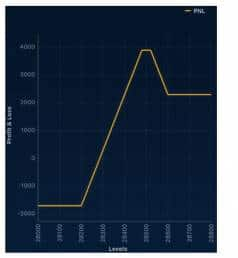

Considering the expected continuation of outperformance in Bank Nifty due to dual force of incremental optimism and exiting pessimism a low cost modified Call Butterfly on Bank Nifty is advised.

Modified Call Butterfly is a four-legged strategy where 1 lot of Call close to current underlying level is bought against that 2 lots of higher strike calls are sold and 1 more lot of Call is bought but closer to the call sold strike.

This keeps the lower but constant profits in case of an upward breakout. This is a fairly risk-averse and a universal strategy.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.