The secondary market has shown spectacular performance in current as well as previous year, but the same is not true for primary market.

The BSE Sensex has rallied around 12 percent in 2018 year-to-date, in addition to around 28 percent surge seen in the previous year despite intermittent correction, outperforming major global markets (including US, France, Germany, Japan, China and Russia). The rally is largely driven by select largecaps.

However, the BSE Midcap corrected more than 8 percent. Though it recovered from 2018-lows due to buying in select stocks (which are fundamentally strong and reported good earnings in June quarter), it could not catch up with frontline indices due to underperformance of several stocks.

Similar is the case with stocks that have been listed since 2017 after raising money through initial public offerings (IPO).

As per our data collation, after raising money through primary market, 23 companies got listed in 2018 and 32 in 2017. Out of these 55 stocks, 26 are still trading well below their issue price.

Astron Paper was the smallest IPO worth Rs 70 crore and state-run General Insurance Corporation was the largest public issue worth Rs 11,372 crore.

While collecting data, we have considered the companies which have raised more than Rs 500 crore since 2017.

So out of 55, 31 companies raised more than Rs 500 crore which include GIC Re, New India Assurance, ICICI Securities, Hindustan Aeronautics, Indostar Capital Finance, Khadim India, India Energy Exchange, HDFC AMC, SBI Life, HDFC Life, AU Small Finance Bank, Avenue Supermarts, etc.

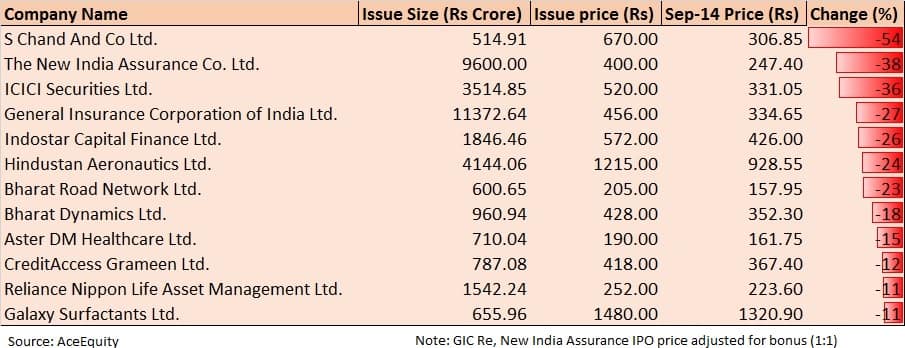

And out of that, 17 stocks are still trading below their issue price. The list includes New India Assurance, GIC Re, S Chand and ICICI Securities which are down 27-54 percent compared to their issue price.

Furthermore, Indostar Capital Finance, Hindustan Aeronautics, Bharat Road Network, Bharat Dynamics, Aster DM Healthcare, CreditAccess Grameen, Reliance Nippon Life Asset Management and Galaxy Surfactants fell between 11 percent and 26 percent as compared to their IPO prices.

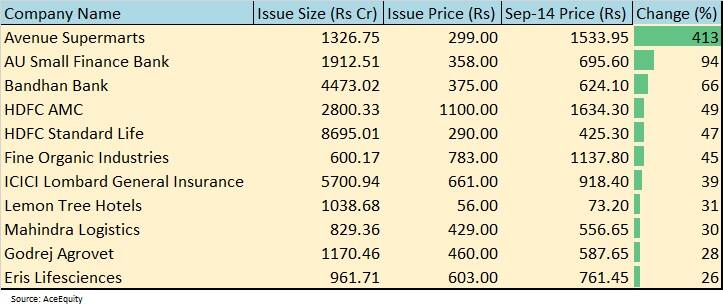

On the other hand, stocks which are still in the positive terrain include Avenue Supermarts (up 413 percent from issue price), AU Small Finance Bank (94 percent), Bandhan Bank (66 percent), HDFC Asset Management Company (49 percent), HDFC Standard Life (47 percent), Fine Organic Industries (45 percent) etc.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!