July 19, 2021 / 15:58 IST

S Ranganathan, Head of Research at LKP securities

The day clearly belonged to the primary market with the twin listings of Clean Science & GR Infra making IPO investors happy with stellar listing gains. Despite indices losing a percentage, the broader markets were seen buzzing around across select pockets like exchanges & depository names even as HDFC group companies witnessed profit-taking today.

July 19, 2021 / 15:56 IST

Vinod Nair, Head of Research at Geojit Financial Services

Shadowing global sell-off, Indian indices slipped succumbing to world inflation woes, FOMC meeting next week and rising COVID cases. Banks led the domestic downtrend as initial quarterly results pointed to cautious asset quality due to the impact of the second wave. Slackening economic growth in the US led to reports of likely downgrade in growth forecast in the current year triggering global sell-off.

July 19, 2021 / 15:41 IST

Closing updates:

Tracking weak global cues, the Indian equity market benchmarks the Sensex and the Nifty50 fell over a percent each on July 19.

The 30-share pack Sensex fell 734 points while Nifty plunged to 15,707.50 in intraday trade as investors fretted about rising inflation and incessant global spread of Delta variant of coronavirus.

At close, Sensex was 587 points, or 1.10 percent, down at 52,553.40 while the Nifty settled 171 points, or 1.07 percent, lower at 15,752.40.

Midcaps and smallcaps fared relatively better than their larger peers as the BSE Midcap index closed 0.58 percent lower while the smallcap index fell 0.31 percent.

July 19, 2021 / 15:35 IST

Sensex at 1530 hours

July 19, 2021 / 15:28 IST

Ashis Biswas, Head of Technical Research, CapitalVia Global Research

The market witnessed correction after it failed to hold an important support level of 15,800. This levelwill be important supportfrom a short-term perspective. Sustaining above 15,620-15,650, the market is expectedto bounce back, and trade in the range of 15,650-15,900. Technical indicators suggesta volatile movement in the market in the range of 15,650-15,900.

July 19, 2021 / 15:20 IST

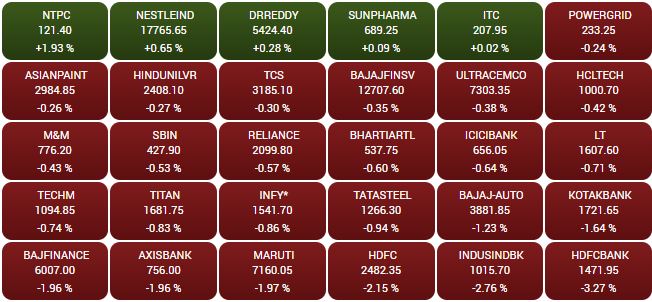

Sensex gainers & losers

July 19, 2021 / 14:51 IST

Adani Group stocks fall up to 5%:

Shares of Adani Group stocks suffered losses in intraday trade on July 19.

Shares of Adani Total Gas hit a 5 percent lower circuit of Rs 854.30 while those of Adani Transmission also fell 5 percent. Shares of Adani Enterprises, Adani Ports, Adani Power and Adani Green Energy fell up to 4 percent.

July 19, 2021 / 14:39 IST

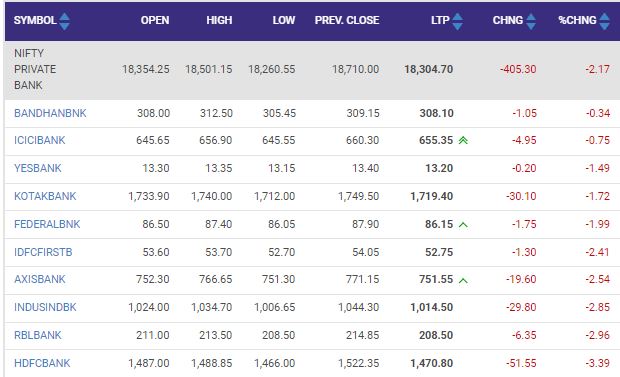

Nifty Private Bank index fell over 2 percent

July 19, 2021 / 14:29 IST

Tapan Patel- Senior Analyst (Commodities), HDFC Securities:

Crude oil prices traded lower with benchmark NYMEX WTI crude oil prices fell by 2% to $70.08 per barrel for the day. MCX Crude oil August futures were down by more than 2% to Rs. 5261 by noon.

Crude oil prices are expected to trade sideways to down for the day with resistance at $72 and support at $68 per barrel. MCX Crude oil August has support at Rs 5180 and resistance at Rs 5320.

July 19, 2021 / 14:22 IST

HDFC Life Insurance Q1

Net premium income grew 31.5 percent at Rs 7,540 crore against Rs 5,733.7 crore (YoY). Net profit was down 40.2 percent at Rs 269.6 crore against Rs 450.5 crore (YoY). Solvency ratio at 203 percent against 190 percent (YoY). VNB at Rs 408 crore against estimate of Rs 395 crore. VNB margin at 26.14 percent against estimate of 25.25 percent.

July 19, 2021 / 14:13 IST

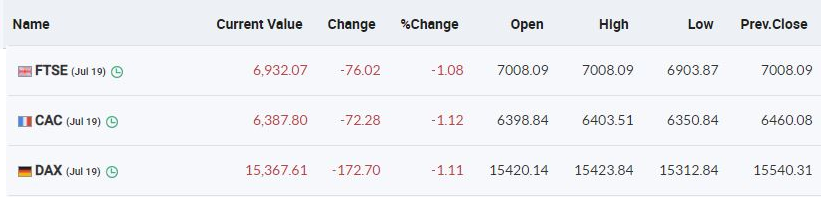

European markets ate trading in the red with FTSE, CAC and DAX down over a percent each

July 19, 2021 / 14:10 IST

Swaraj Engines Q1:

Net profit at Rs 33.7 crore against Rs 7.8 crore (YoY). Revenue at Rs 314.7 crore against Rs 117 crore (YoY). EBITDA at Rs 47.3 crore against Rs 12.9 crore (YoY). EBITDA margin at 15 percent against 11 percent (YoY).