After a break for one quarter, Mahindra and Mahindra (M&M) has reclaimed the top spot as India’s largest Sports Utility Vehicle (SUV) seller in terms of volumes, latest industry data showed. The country’s leading carmaker Maruti Suzuki India Limited (MSIL) became the highest SUV seller in the third quarter of last calendar year, but eventually lost the crown to Mahindra in the fourth quarter.

A Moneycontrol analysis of sales numbers showed that Maruti Suzuki’s SUV market share during Q1, Q2, Q3 and Q4 of last calendar year were 16.2 percent, 19.9 percent, 23.3 percent and 20 percent respectively. M&M, which was the largest SUV seller during CY 2022, led the pecking order during Q1 and Q2 at 21.44 percent and 21.51 percent respectively.

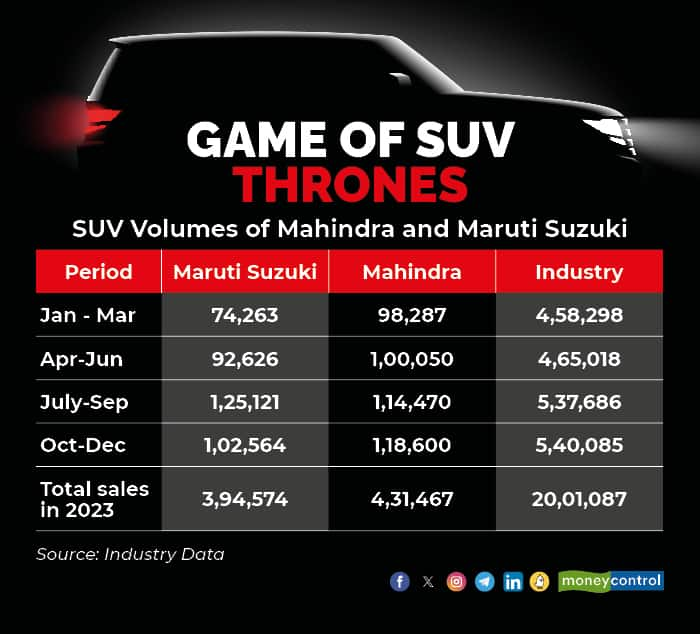

While M&M gave way in Q3 (21.28 percent) to Maruti, it regained its position in Q4 by attaining a 21.97 percent market share in the domestic SUV market. (See Table below:)

During the entire calendar year, while M&M’s SUV share was the highest at 21.7 percent, Maruti Suzuki came close second at 20 percent, followed by Tata Motors at third at 18.1 percent and Hyundai at fourth at 18 percent.

“The gap in revenue market share in the second quarter (FY24) between us and the market leader (Maruti Suzuki) was about 0.5 percent. As we ramp up our volumes, that gap will either narrow or disappear, as we have seen in the month of October,” said Rajesh Jejurikar, Executive Director (ED) and Chief Executive Officer (CEO) of the auto and farm business at Mahindra & Mahindra, while giving a presentation of the company’s Q2 FY 24 results.

Apart from reducing the waiting period of its SUVs, M&M is now gearing up to launch the facelifted version of XUV 300 and the four-door version of Thar Lifestyle during this year. Meanwhile, a senior Maruti Suzuki official asserted that it doubled its market share in the SUV segment from 10.5 percent in calendar year (CY) 2022 to 20 percent in CY 2023 due to the availability of new models such as the Fronx, Jimny and Grand Vitara. The official attributed the decline in Q4 auto wholesales to “limited despatches’ planned during the year-end months.

“The fourth quarter is an aberration and not much should be read into it," Shashank Srivastava, Senior Executive Director, Marketing and Sales of Maruti Suzuki told Moneycontrol.com over a phone call recently. “Also, it should be noted that in 2023 CY Maruti was Number two in the SUV segment because of semiconductor supply issues and Fronx and Jimny came in Q2 of CY.”

“In entry SUVs, our market share is slightly above 27 percent (and in) mid-SUV it is 12.5 percent. So it is a very competitive segment and we have to obviously fight (it) out. In the SUV space, 48 models are there (in the market). This is a large segment and we have to be at our best to keep increasing your market share. Definitely, with all our sales and network strength, we hope we will achieve our objective,” noted Srivastava.

Data showed that around 2,o01,087 units of SUVs across various price points were dispatched to dealers by OEMs during January to December 2023. Out of those numbers, 4,58,298 units were during Q1 (Jan-March), 4,65,018 units during Q2 (April-June), 5,37,686 units during Q3 (July-September) and 5,40,085 units during Q4 (October-December) of last calendar year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.