September marked one of the busiest months for the Indian primary markets in three decades, with more than 25 companies raising over Rs 13,000 crore through mainboard IPOs. Yet, despite strong investor demand during subscriptions, most listings failed to deliver on debut.

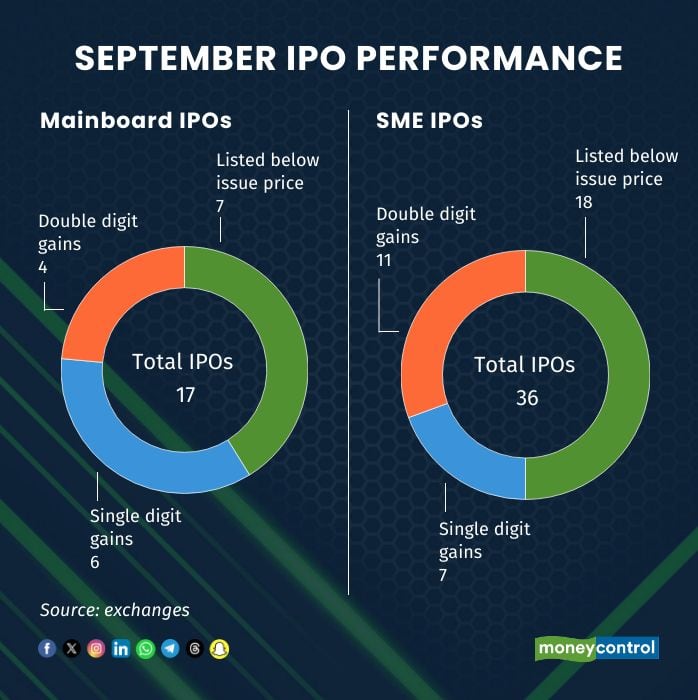

Of the 17 IPOs that hit the market, eight listed below their issue price, while another eight offered muted gains. The sole bright spot was Urban Co Ltd, which debuted with a strong 60 percent premium.

Among the laggards, Jaro Institute of Technology Management tumbled 16 percent on listing, followed by Ganesh Consumer Products and Solarworld Energy, which fell 9 percent and 8 percent, respectively. Saatvik Green Energy, Ivalue Infosolutions and VMS TMT also disappointed, each slipping about 5 percent below issue price.

Analysts attribute the disconnect between oversubscription and weak listings to sluggish market sentiment and muted earnings growth over the past year.

“Even though the IPO pipeline looks healthy for the next couple of months, some issuers may delay their offerings. Valuation corrections are already evident, and many IPOs may be priced below earlier funding rounds,” said Sachin Jasuja, Head of Equities and Founding Partner at Centricity WealthTech.

Experts also pointed out that even high-profile issues such as Vikram Solar and certain IT names — despite strong earnings — are trading below their issue price. “Despite sound fundamentals, valuation derating in the broader market is dragging new listings. Subscription hype is fading quickly once stocks hit the market,” said one analyst.

The SME segment recorded unprecedented activity, with 53 IPOs mobilising Rs 2,309 crore — the highest ever in a single month, both in terms of deal count and funds raised. However, performance was uneven. Of the 36 SME IPOs that listed, 15 opened in the red, nine were flat, and only 12 delivered strong listing gains of 20–100 percent.

The sharpest SME underperformers included NIS Management, which plunged 28 percent, while Sugs Lloyd and JD Cables each fell 24 percent. Oval Projects Engineering dropped 19 percent, and Vashishtha Luxury Fashion declined 16 percent on debut.

Narinder Wadhwa, MD & CEO of SKI Capital Services, cautioned investors: “IPOs don’t guarantee listing gains. Investors must temper expectations and focus on fundamentals, promoter credibility, and track record before participating.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!