November 10, 2021 / 16:43 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.89 timeson November 10, the third and final day of bidding, receiving bids for 9.13 crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.66 times, while the reserved portion of non-institutional investors was subscribed 24percent, and qualified institutional buyers have put in bids 2.79 times the portion set aside for them.

November 10, 2021 / 16:42 IST

Grey Market Premium

Paytmshares traded at Rs 2,210 in thegreymarket, a premium of Rs 60 or 2.8 percent over upper price band of Rs 2,150 per share, as per the IPO Watch and IPO Central.

November 10, 2021 / 16:05 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.88 timeson November 10, the third and final day of bidding, receiving bids for 9.12 crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.64 times, while the reserved portion of non-institutional investors was subscribed 24percent, and qualified institutional buyers have put in bids 2.79 times the portion set aside for them.

November 10, 2021 / 16:04 IST

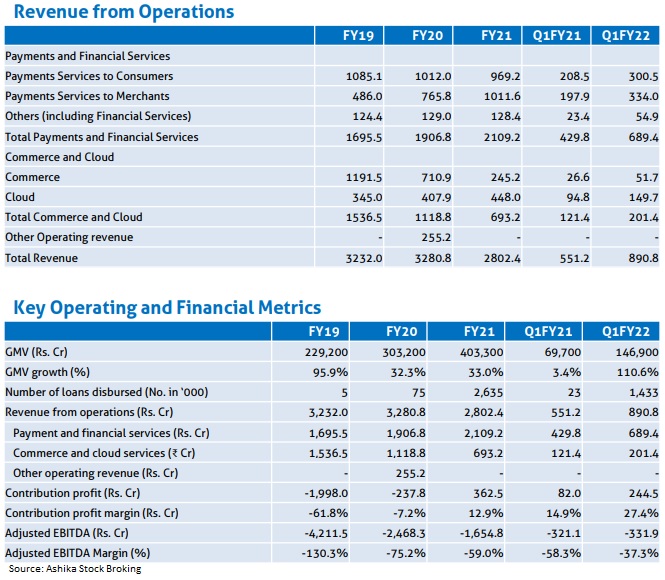

Paytm Financials

November 10, 2021 / 15:26 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.51 timeson November 10, the third and final day of bidding, receiving bids for 7.3crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.61 times, while the reserved portion of non-institutional investors was subscribed 20percent, and qualified institutional buyers have put in bids 2.13 times the portion set aside for them.

November 10, 2021 / 15:17 IST

Jyoti Roy Recommends Paytm IPO

"At the upper end of the price band,Paytmis valued at 49.7x its FY21 revenues. While valuations may appear to be expensive,Paytmhas become synonymous with digital payments through mobile and is the market leader in the mobile payment space. Patym is well positioned to benefit from the exponential 5x growth in mobile payments between FY2021 – FY2026 and hence believe that the valuations are justified. We recommend investors to subscribe to the issue," saysJyotiRoy, who is DVP- Equity Strategist atAngel One.

November 10, 2021 / 14:58 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.36 timeson November 10, the third and final day of bidding, receiving bids for 6.59crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.58 times, while the reserved portion of non-institutional investors was subscribed 17percent, and qualified institutional buyers have put in bids 1.89 times the portion set aside for them.

November 10, 2021 / 14:57 IST

Anand Rathi Says Subscribe Paytm IPO

"At the upper end of the IPO price band, One 97 Communications Ltd. is offered at P/B of 9.5x with a market capitalization of Rs 1,39,378.8 crore. The company benefits from both customer side and merchant side by providing payment and other services through Paytm app, the company further aims to expand its reach and benefit from scale which is challenging for other players. The company reported contribution profit of Rs 363 croreand EBITDA loss of Rs 1,655 crorein FY21. Given that the company’s ecosystem allows it to address large market opportunities, scale and reach, product, technology and leadership," says Anand Rathi which gives this IPO a "Subscribe (Long-Term)" rating.

November 10, 2021 / 14:36 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.35 timeson November 10, the third and final day of bidding, receiving bids for 6.55 crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.57 times, while the reserved portion of non-institutional investors was subscribed 15percent, and qualified institutional buyers have put in bids 1.89 times the portion set aside for them.

November 10, 2021 / 14:35 IST

Key Strategy of Paytm

One 97 Communications is focused on rapidly scaling up its financial services business. The company will focus on consumers and merchants who have limited access to financial services products, and continue to work in close collaboration with its financial institution partners to create products and services addressing their requirements while leveraging its technology and insights. A key strategic focus for it is to scale up its consumer and merchant lending businesses, including Paytm Postpaid (buy-now-pay-later), in collaboration with its financial partners, as well as its wealth management offerings. The company plans to continue to leverage its partnership with Paytm Payments Bank to expand the suite of banking solutions for consumers and merchants.

November 10, 2021 / 14:19 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.34 timeson November 10, the third and final day of bidding, receiving bids for 6.47 crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.53 times, while the reserved portion of non-institutional investors was subscribed 13percent, and qualified institutional buyers have put in bids 1.88 times the portion set aside for them.

November 10, 2021 / 13:58 IST

Paytm IPO Day 3 updates

One97 Communications-owned Paytm opened its initial public offering for subscription on November 8. This is the largest-ever public issue in the history of Indian capital markets.

The Rs 18,300-crore IPO had been subscribed 1.33 timeson November 10, the third and final day of bidding, receiving bids for 6.44 crore equity shares against offer size of 4.83 crore shares. The portion set aside for retail investors was subscribed 1.50 times, while the reserved portion of non-institutional investors was subscribed 13percent, and qualified institutional buyers have put in bids 1.88 times the portion set aside for them.