Kshitij Anand

A flurry of IPOs hit D-Street in the first 3 months of 2018 to capitalise on the raging bull which drove D-Street to record highs in the month of January. But then, the momentum fizzled out slightly even as IPOs kept on hitting D-Street.

As many as 47 companies (including SMEs) have collectively raised over Rs 20,000 crore so far in the year 2018. Some of these companies are listed on both NSE and BSE and some are listed on either of the two exchanges. But, only 21 out of the 47 companies, or 44 percent of stocks, have managed to give positive returns of up to 188 percent, according to data compiled from AceEquity.

“Since there was a lot of liquidity in the system, a lot of primary issues were able to raise a large amount of capital. Mutual funds were desperate for new investment ideas due to large cash pile sitting in their funds there was some disregard of valuations while investing these IPOs,” Abhimanyu Sofat, Head of Research, IIFL told Moneycontrol.

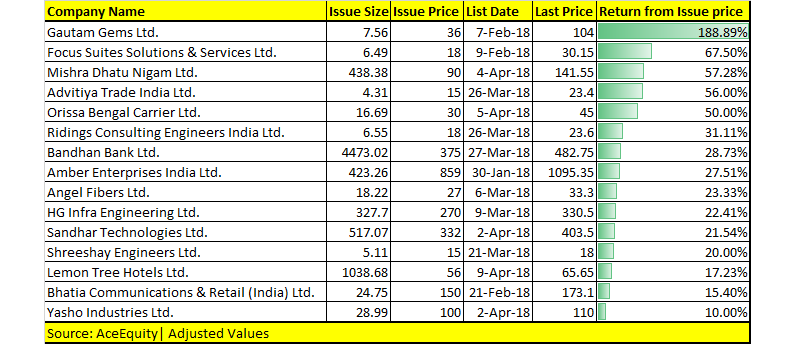

Companies which managed to hold on to gains include names like Gautam Gems (listed only on BSE), followed by Focus Suites, which rose 67 percent, and Mishra Dhatu Nigam gained 57 percent from their issue price, data showed.

As many as 24 out of the 47 companies that raised funds gave negative returns of up to 69 percent which includes names like Ashoka Metcast, Kenvi Jewels, LEX Nimbles Solutions, etc. among others. Most of the stocks belong to the SME segment.

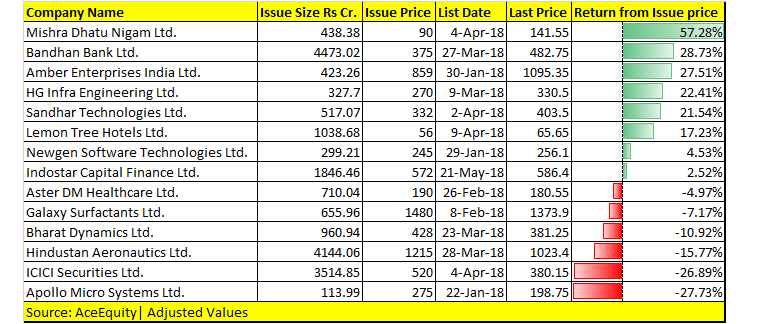

As many as 14 companies, out of the 47, with an issue size of Rs 100 crore to over Rs 4,000 crore made their way to D-Street in 2018 collectively raising about Rs 19,463 crore, but only 8 of them managed to outperform the Nifty.

As many as 8 out of 14 companies gave positive returns which include names like Mishra Dhatu (up 57 percent), Bandhan Bank (up 28 percent), Amber Enterprises (up 27 percent), HG Infra (up 22 percent), Lemon Tree (up 17 percent) etc. among others.

The remaining 6 out of these 14 companies gave negative returns which include names like Apollo Micro Systems (down 27 percent), ICICI Securities (down 26 percent), Hindustan Aeronautics (down 15 percent), Bharat Dynamics (down 10 percent), and Galaxy Surfactants (down 7 percent).

“Large IPOs usually enter the market during the peak, which results in their valuations being stretched. Recently, the markets have undergone a period of correction and therefore, IPOs, too, are trading at discount,” Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote told Moneycontrol.

“However, a company with strong fundamentals will definitely deliver returns in the long term. Listing gains are not assured in uncertain market conditions and high valuation has been the major reason for the negative returns with these companies,” he said.

The Road Ahead!

The IPO lane seems to be getting busier going ahead as three dozen companies have lined up initial share sale plans worth Rs 35,000 crore in the coming months, largely to fund their expansion projects and working capital requirement, said a PTI report.

These include six state-run entities — Indian Renewable Energy Development Agency, Rail Vikas Nigam, IRCON International, RITES, Garden Reach Shipbuilders and Engineers and Mazagon Dock — as the government intends to unlock the real value of such PSUs and bring in greater accountability.

The key question here is — looking at the history of the state-run companies, should investors bet on IPOs of these companies? Well, most experts feel that it is better to avoid them.

“Most of the IPOs, which have come from the government have limited growth prospects, in addition, threat of government intervention always leads to lower valuations for public sector units. Hence, we would be more cautious on public sector issues relative to private sector issues,” said Sofat of IIFL.

In this year, Barbeque-Nation Hospitality, TCNS Clothing Company, Nazara Technologies and Devi Seafoods are among the 12 companies that have secured Sebi's nod to float their public offers.

In addition, 24 companies including Route Mobile, CreditAccess Grameen, Sembcorp Energy India, Flemingo Travel Retail and Lodha Developers are awaiting the regulators approval to float IPOs. Together, these companies are expected to raise about Rs 35,000 crore, merchant banking sources said.

“Investors should have a medium to long-term perspective to earn decent returns. They need to research about the company’s current affairs and the future outlook,” Ritesh Ashar, Chief Strategy Officer, KIFS Trade Capital told Moneycontrol.

“The Investors also need to compare the new comers with the listed peers which will give them a fair idea of the company’s financial toughness,” he said.

Is there a formula for selecting IPO?

Well, there is no specific formula for selecting IPO buy investors should valuations, business model, management pedigree, the lifecycle of the product, as well as growth potential. And, the idea should always be to hold for long term.

“Before investing in IPO one should look at valuations, business model and standard of corporate governance for the company. Most of the companies that do not do well after listing have issues with management integrity, disclosures standards, and valuation issues,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

“Recent example of this is Manpasand beverages. Thumb rule says 30 percent of the companies disappear (destroys 50% wealth) after 3 years of listing, this increases to 50% after 5 years and only 2 out of 10 companies will keep creating wealth after 10 years of listing,” he said.

Matlawala further added that in current times most of the retail investors’ look at the grey market premium and invest in IPOs only for listing gains. If you have to invest for the long term then do proper due diligence before investing.

There is no point going overboard while investing in IPOs if valuations are not correct. A thought second by Modi of Samco Securities.

“There is no rule regarding the timing of investing in IPOs. An investor should evaluate the business model of the company and subscribe if it is attractive and available at an attractive price,” added Modi.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!