Indigo Paints will be the second public issue to open for subscription in the year 2021 after the Indian Railway Finance Corporation IPO. Indigo Paints public offer will open on January 20.

The maiden public issue of the paints company will close on January 22. The bidding for anchor book is expected to take place for a day on January 19.

Equity shares are proposed to be listed on the BSE and NSE. Kotak Mahindra Capital Company, Edelweiss Financial Services and ICICI Securities are the book running lead managers to the offer.

Here are 10 key things one should know before subscribing the issue:

1) About Public Issue

The IPO comprises a fresh issue of Rs 300 crore by the company and an offer for sale of 58,40,000 equity shares by promoters and investors.

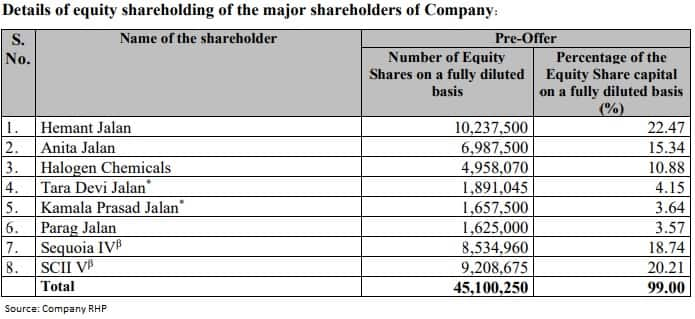

Investors - Sequoia Capital India Investments IV and SCI Investments V - are going to sell 20.05 lakh equity shares and 21.65 lakh shares, respectively via offer for sale, while the promoter Hemant Jalan will offload 16.70 lakh equity shares in the public issue.

The offer includes a reservation of up to 70,000 equity shares for subscription by employees of the company. The eligible employees will get these shares a discount of Rs 148 per share.

One can put in minimum bid for 10 equity shares and in multiples of 10 equity shares thereafter.

2) Price Band

The company and investors in consultation with merchant bankers has fixed the price band at Rs 1,488-1,490 per share for its public issue.

3) Fund Raising

The company targets to raise Rs 1,168.99 crore - Rs 1,170.16 crore at a price band of Rs 1,488-1,490 per share.

4) Objectives of the Issue

The company proposed to utilise the net proceeds from its fresh issue for expansion of the existing manufacturing facility at Pudukkottai, Tamil Nadu by setting up an additional unit adjacent to the existing facility (Rs 150 crore); purchase of tinting machines and gyroshakers (Rs 50 crore); repayment certain of borrowings (Rs 25 crore); and general corporate purposes.

The company will not receive any proceeds from the offer for sale, which will go to selling shareholders.

Also read: Indian Railway Finance Corporation IPO opens: Should you subscribe?

5) Company Profile

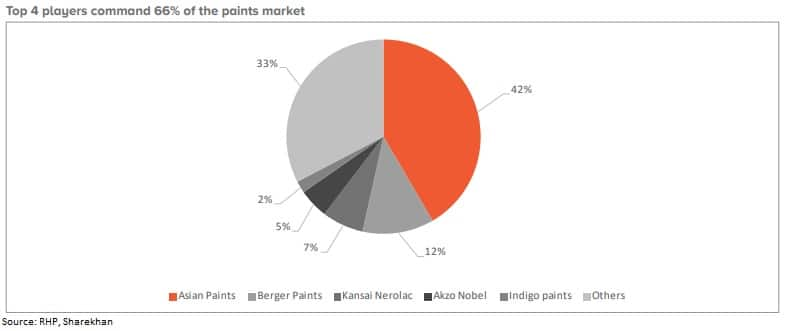

Indigo Paints is the fastest growing amongst the top five paint companies in India. It is also the fifth largest company in the Indian decorative paint industry in terms of revenue from operations for FY2020, as per F&S Report.

The company sells its products under the brand 'Indigo', through its distribution network across 27 states and seven union territories as of September 2020. It engaged Mahendra Singh Dhoni, a sportsperson with pan-India appeal, as its brand ambassador, to enhance brand image amongst end customers.

The company manufactures a complete range of decorative paints including emulsions, enamels, wood coatings, distempers, primers, putties and cement paints. As of September 2020, Indigo Paints owns and operates three manufacturing facilities located in Jodhpur (Rajasthan), Kochi (Kerala) and Pudukkottai (Tamil Nadu) with an aggregate estimated installed production capacity of 1,01,903 kilo litres per annum (KLPA) for liquid paints and 93,118 metric tonnes per annum (MTPA) for putties and powder paints.

It also intends to expand manufacturing capacities at its facility at Pudukkottai in Tamil Nadu, by adding capacities to manufacture water-based paints to cater to the growing demand for these paints. The proposed installed production capacity of the expansion unit is 50,000 KLPA and it is expected to be operational during FY2023.

As of March 2018, 2019, and 2020, its distribution network comprised 33, 33 and 36 depots, and 9,210, 10,246 and 11,230 active dealers in India, respectively. In same periods, the total number of tinting machines that it placed across network of dealers was 1,808, 3,143 and 4,296, respectively.

Also read: Rakesh Jhunjhunwala-backed Nazara Technologies refiles IPO papers with Sebi

6) Strengths

a) The company has track record of consistent growth in a fast growing industry with significant entry barriers.

b) It has differentiated products leading to greater brand recognition and enabling expansion into a complete range of decorative paint products.

c) It has strategically undertaken brand-building initiatives to gain visibility with prudent use of resources, gradually increasing branding and marketing expenses consistent with the growth of business.

d) It has an extensive distribution network for better brand penetration.

e) It has leveraged brand equity and distribution network to populate tinting machines.

f) The company has strategically located manufacturing facilities with proximity to raw materials.

g) It has well-qualified and professional management team with a committed employee base.

7) Strategies

a) It intends to continue to focus on developing differentiated products to grow market share.

b) It intends to further strengthen the brand to consolidate position as a leading paint company in India.

c) It aims to deepen penetration in existing markets and expand presence in select new territories by populating tinting machines.

d) The company intends to expand manufacturing capacities to aid the growth efforts and consolidate pan-India presence.

8) Financials and Peer Comparison

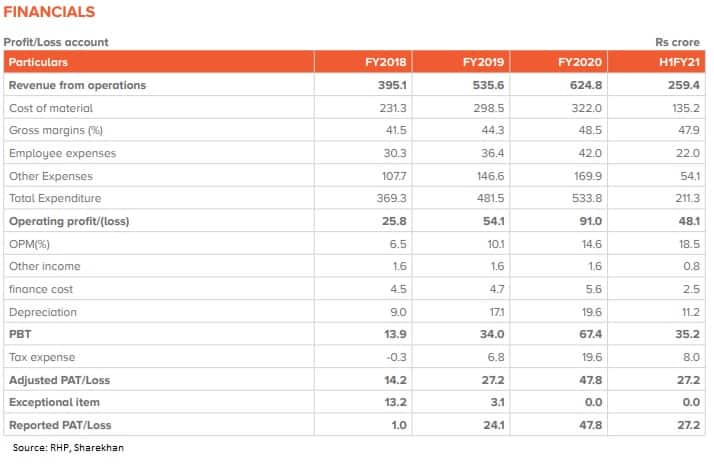

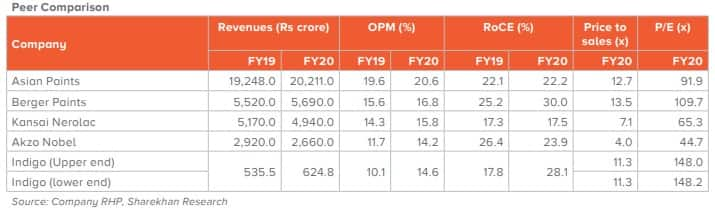

Indigo Paints registered a revenue growth at a CAGR of 25.8 percent during FY2018-20, largely on account of strong growth in categories such as putty, emulsion and distempers which grew at CAGR of 25-30 percent over the same period. The gross margins expanded to 48.5 percent in FY2020 compared to 41.5 percent in FY2018.

The operating profit margin improved strongly from 6.5 percent FY2018 to 14.6 percent in FY2020 (and further improved to 18.5 percent in H1FY2021), which led to around 88 percent growth in the operating profits during FY2018-20. The profit during same period grew by 84 percent.

"Better working capital management aided net working capital days standing low at 20-23 days. The cash generation from operating activities improved by Rs 48.5 crore to Rs 72.23 crore over FY2018-20. Higher cash generation took care of the capex programme. Hence debt: equity remained stable at 0.3x. The company has strong return profile with RoE and RoCE (pre-IPO) standing at 24.2 percent and 28 percent respectively," Sharekhan said.

Indigo Paints' IPO is valued at 148x its post-issue FY20 EPS of Rs 10.05 (and 130x its annualised FY2021 EPS of around Rs 11.4), which is at premium to some of the listed paint companies, said Sharekhan.

Within the paints industry, the organised sector has a 67 percent market share, while unorganised players hold the remaining 33 percent. Until 2015, the unorganised sector had a market share of approximately 35 percent, which has been penetrated by the organised sector due to challenges faced by smaller players such as demonetisation and implementation of GST.

9) Promoters and Shareholding

Promoters of the company are Hemant Jalan, Anita Jalan, Parag Jalan, Kamala Prasad Jalan, and Halogen Chemicals Private Limited. The promoters, in aggregate, hold 2,73,56,615 equity shares, representing 60.05 percent of paid-up equity share capital of the company.

10) Management

Hemant Jalan is the Managing Director and Chairman of the company. He has over 20 years of experience in the paint industry. Previously, he was associated with AF Ferguson & Co. as a consultant. Presently, he is associated with Halogen Chemicals as a director.

Anita Jalan and Narayanan Kutty Kottiedath Venugopal are Executive Directors on the board. Praveen Kumar Tripathi, Sunil Goyal, Ravi Nigam and Nupur Garg are the independent directors of the company.

Sakshi Chopra is the Nominee Director and Ravi Shankar Ganapathy Agraharam Venkataraman is the Alternate Director to Sakshi

Chopra.

Chetan Bhalchandra Humane is the Chief Financial Officer of the company. He has been appointed as the Chief Financial Officer of the company with effect from March 11, 2020. He has over 19 years of experience in accounting and finance. Prior to this, he was associated with Jenson & Nicholson (I) Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.