Himadri Chemicals Q2 earnings were sequentially flat. Having said that realization witnessed in earlier quarter continued in Q2 2018 as well which underlines sustained end market performance.

As company undertakes new capacity expansion plans particularly for the new advanced carbon material (Used for Lithium ion battery), it makes for an interesting investment opportunity. Having said that it’s worth noting that Himadri Speciality Chemicals is the only company in India manufacturing anode material for Lithium-Ion battery.

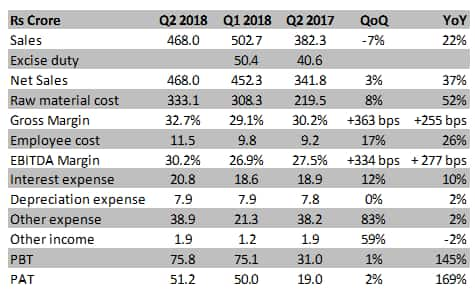

Quarterly update

Himdari’s Q2 2018 sales were up 37 percent mainly backed by pricing gains while volume growth was nearly flat on YoY basis. Though raw material cost increased sharply, EBITDA/ton was up 48 percent YoY on account better pricing trends for carbon black and CTP (Coal Tar Pitch).

It is worth noting that on the advance carbon material pilot stage, company was able to dispatch 72.31 MT of product in Q2 2018.

Advanced carbon material capacity setup for Lithium ion batteriesCompany’s update on the set-up for manufacturing Advance Carbon material is encouraging. This material, as we referred in our earlier note, is used as an anode material for the lithium ion batteries. Last quarter, company mentioned that it is running a pilot (5 tons per month) to manufacture anode material and in the process of setting up 50 metric tonne per month continuous process reactor.

Now, the company is setting up 20,000 MT capacity for advance carbon material in West Bengal. This augurs well for the company and implies that it is reasonably certain of product approvals from the large lithium ion battery manufacturers.

Additional capacity expansion – Carbon blackCompany is also in the process of adding capacity of 30,000 MT for the carbon black taking the total capacity to 150,000 MT (14 percent of the domestic market share).

With these measures, company’s total product capacity is expected to increase by 9 percent to 638,000 MT with the funding requirement of Rs 638 crore.

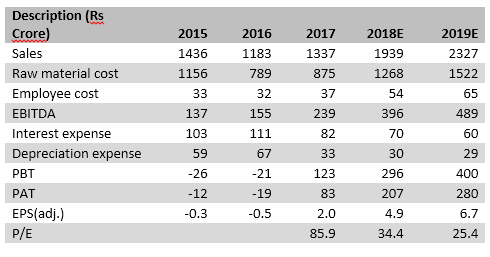

Financial projectionsBased on the quarterly result which points to sustaining of the product pricing trends, we revise our near terms sales growth expectations (32 percent sales CAGR 2017-19E). Stock is currently trading at a price multiple of 25.4x 2019e earnings with the rerating guided by high growth visibility in the aluminum and tyres end markets. We pencil in 84 percent earnings CAGR 2017-19E on account of better capacity utilization (currently 64 percent) and price realization for the existing carbon products that company is manufacturing.

Having said that we have not included earnings potential due to new capacity expansion plans including that for advance carbon material. While we expect a high margin contribution out of this opportunity, pricing trends and the realizations are not predictable at this stage.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.