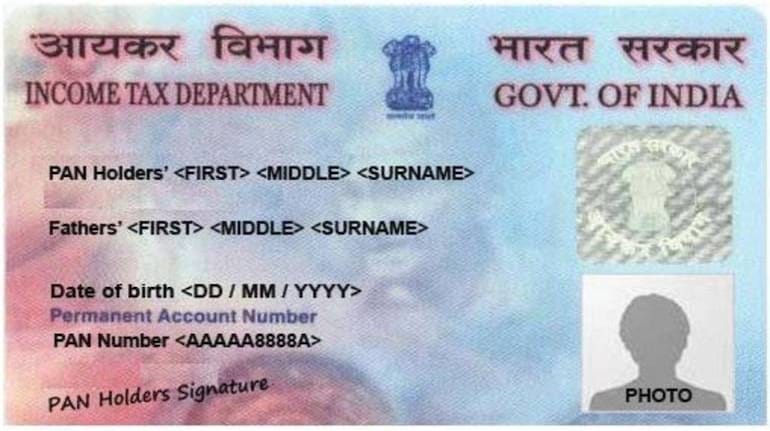

The CBIC on Thursday cautioned the public against sharing Aadhaar and PAN details without a valid reason or for monetary gains, saying that the information could be misused by fraudsters for GST evasion.

In a tweet, the Central Board of Indirect Taxes and Customs (CBIC) said Aadhaar and PAN details can be used for creating fake entities in GST for evasion of taxes and hence people should refrain from sharing these without a valid reason.

"Protect your personal data which may be used for creating fake entities in GST for evasion of taxes," the CBIC tweeted.

Over the past years, Goods and Services Tax (GST) officers have busted several bogus firms, which were used to raise fake invoices without any actual supply of goods.

The sole intention is to fraudulently claim input tax credit (ITC).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.