The government is looking to dilute a part of its residual shareholding of 29.5 percent in Hindustan Zinc in the current financial year, CNBC TV-18 reported on September 12. ICICI Securities, Axis Capital, HDFC Bank, Citigroup and IIFL Securities have been appointed as merchant bankers for the issue, it said.

As many as six merchant bankers had made a presentation before government officials on August 12. The Department of Investment and Public Asset Management (DIPAM) had in early July invited bids from merchant bankers for managing Hindustan Zinc Ltd (HZL) residual stake sale and set July 28 as the deadline for placing their bids.

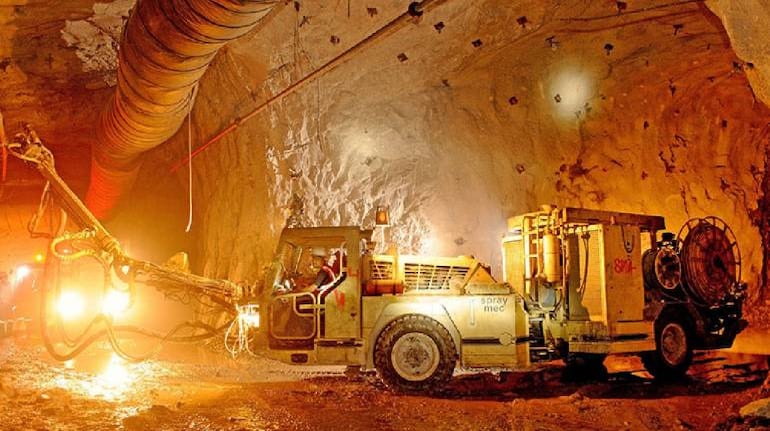

Hindustan Zinc was a central public service enterprise (CPSE) under the administrative control of the mines ministry and was privatised in 2002. Vedanta Ltd holds 64.92 percent in the company, while the government holds 29.53 percent. Only a 5.5 percent stake is with the public now.

The government has budgeted to raise Rs 65,000 crore through CPSE disinvestment in the current fiscal. It has so far realised Rs 24,544 crore.

Shares of HZL settled at Rs 289.45 apiece on Friday, up 0.26 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.