There’s been plenty of commentary in the past few months on the risks that freebies pose to state finances. With another round of Assembly elections due later this year, political parties have already begun to promise free power, free bus rides, unemployment allowance and so on. Many more such promises are bound to be made in the coming months by incumbents as well as rivals, notwithstanding the Prime Minister cautioning against the revdi culture at a public event in Uttar Pradesh.

The Supreme Court is also hearing a public interest litigation filed by lawyer Ashwini Upadhyay on the need to regulate freebies. The apex court has proposed a committee comprising politicians and technocrats drawn from bodies such as the Reserve Bank of India (RBI), NITI Aayog and Finance Commission to suggest measures to regulate freebies.

Mixer-grinders, laptops, bicyclesPolitical parties pursuing populist agendas often promise freebies in their quest for power. Political rivals in Tamil Nadu — the All India Anna Dravida Munnetra Kazhagam (AIADMK) and the Dravida Munnetra Kazhagam (DMK) — have used freebies successfully for decades to wrest power from each other. They handed out a range of durable goods such as fans, television sets, mixers and grinders over the years. Political parties in the north have handed out free laptops and bicycles in recent years.

Free power to households is increasingly becoming a tool to win elections. States such as Punjab have been giving free power to farmers to operate pump sets in the fields, with dire consequences. The Aam Aadmi Party (AAP) government has now decided to give 300 units of free power per month to all households in Punjab with effect from July 1. The move will cost the state’s exchequer Rs 1,200 crore annually.

Additionally, bills remaining unpaid in the first six months of the calendar year, estimated at Rs 1,298 crore, are to be waived. The state has set aside Rs 6,947 crore to provide free power to farmers and another Rs 6,395 crore for power subsidies, an analysis of the state budget by PRS Legislative Research shows.

Households in Delhi, where AAP runs the government, have been getting 200 units of free power and 20 kilolitres of free water. A significant share of the benefit has gone to households that can afford to pay their utility bills. The free power policy is set for a revamp with effect from October.

AAP has now promised free power to households in Gujarat if it were to form the government after the forthcoming Assembly elections.

The trouble with freebies is that the short-term benefits get offset by higher taxes and other costs arising from the low priority accorded to infrastructure creation in the long term. Lower investment in infrastructure creation means fewer jobs, continuing inefficiencies in the economy and depressed revenue growth in the future.

The share of subsidies and freebies in the revenue expenditure of states has climbed from 7.8 percent in 2019-20 to 8.2 percent in 2021-22, a Reserve Bank of India study found. Jharkhand, Kerala, Odisha, Telangana and Uttar Pradesh recorded the largest rise in subsidies over the last three years, the authors of the study wrote. Gujarat, Punjab and Chhattisgarh spend more than 10 percent of their revenue expenditure on subsidies.

Many subsidies are part of the welfare package meant to benefit targeted sections of the population. However, governments are increasingly delivering some subsidies as freebies. Farm loan write-offs, often promised by the Congress Party during election campaigns, and pending utility bill waivers are best described as freebies. Such waivers create moral hazard and induce defaults by those capable of paying.

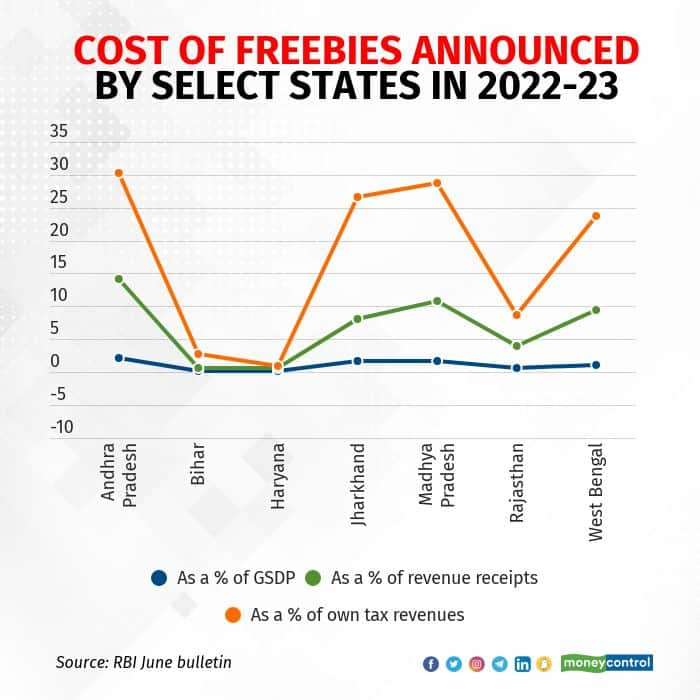

The cost of these freebies is substantial and rising due to competitive politics. The RBI estimated it at about 30 percent of the own tax revenues of states such as Andhra Pradesh and Madhya Pradesh and about 25 percent of these revenues in Jharkhand and West Bengal.

Many states that announce free hand-outs can ill-afford this expenditure. They don’t earn enough revenues from taxes to pay for the freebies and other committed and non-committed expenditure, and are thus forced to borrow. That leads to the deterioration of the state’s debt-to-gross state domestic product (GSDP) ratio.

Punjab has the worst ratio and was identified as the most fiscally stressed state by the RBI study. The state’s debt-to-GSDP ratio for 2021-22 was at 49.5 percent, as per revised estimates. The state expects that to improve to 48.5 percent by the end of March 2023. The state has projected a gradual improvement in its fiscal consolidation; the debt-to-GSDP ratio is expected to improve to 45.8 percent by 2024-25. The RBI is less sanguine, it expects that ratio to be 46.8 percent in 2026-27.

States such as Bihar, Kerala and Rajasthan are also running very large debt relative to their GSDP. So are Andhra Pradesh, Uttar Pradesh and West Bengal.

However, not all debts are reflected in the state budgets. State governments are notorious for borrowing on the books of their public enterprises, a point underscored by former RBI governor Duvvuri Subbarao in an article in The Hindu in July. That’s also true of the Union government, but there is an attempt to clean up now.

Such borrowings appear as contingent liabilities of the government, as they are guaranteed by the state. Credit rating agency CRISIL, in a note in May, estimated off-budget borrowings of states at about 4.5 percent of GSDP, or Rs 7.9 lakh crore, in 2021-22. That was about 100 basis points higher than such borrowings in 2019-20. (One basis point is one-hundredth of a percentage point.)

The CRISIL analysis was based on a study in 11 states including Maharashtra, Gujarat, Karnataka and Tamil Nadu, which together account for about 75 percent of the aggregate GSDP. The power sector accounted for about 40 percent of these guarantees.

If the state governments were to take over 75 percent of the debt of power distribution companies as of the end of March 2020, as the Centre did under the Ujjwal Discom Assurance Yojana, the debt burden of Rajasthan might increase by 3.7 percentage points, the RBI study estimated. The debt of Punjab and Bihar may rise by 2.5 and 1.8 percentage points, respectively.

Higher borrowing means higher interest outgo. Punjab is expected to spend about 21 percent of its revenue receipts on interest payments in the current fiscal year. Haryana, Kerala, Tamil Nadu and West Bengal have also estimated their interest payments to revenue receipts at 20 percent.

Budgets for the current fiscal year show that most of these states had estimated to spend 85-90 percent of the expenditure on the revenue account, leaving just 9-15 percent for capital expenditure.

Committed expenditure — spending on salaries, pensions and interest payments — was a sizeable chunk of revenue expenditure. Committed expenditure was as high as 70 percent of revenue receipts in Kerala, Punjab and Tamil Nadu. That leaves states with little leeway to spend on developmental schemes, hurting their ability to grow more rapidly and improve revenue growth. Rationalisation of subsidies and freebies is the need of the hour.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.