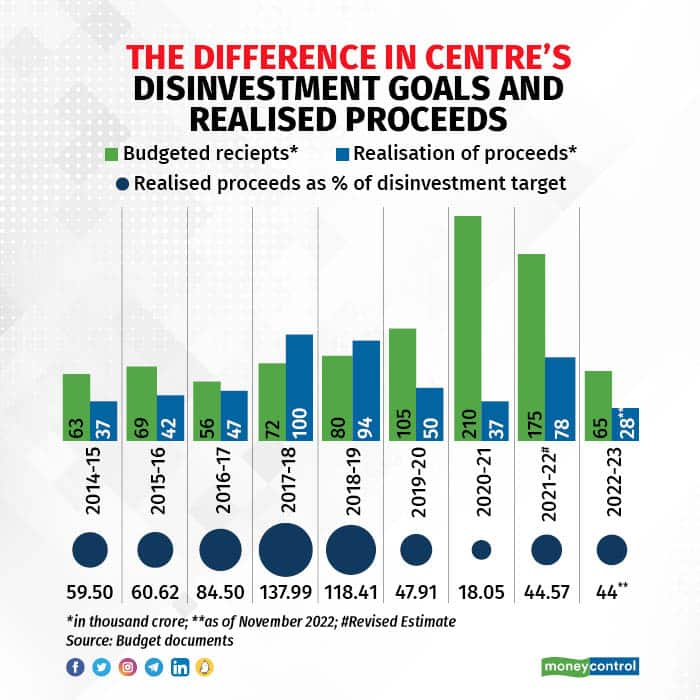

Despite the government’s frequently restated commitment to privatise state-owned enterprises, the realisation of these moves have been uneven over the years and have largely missed their targets.

An analysis of previous budget documents shows that in FY22, out of the Rs 1.75 lakh crore target, only Rs 78,000 crore worth of disinvestment was actually done, marking the third year in a row of the government missing its own disinvestment goal. The realised proceeds just accounted for 44.57 percent of the budgetary estimate during the year.

Between FY15 and FY22, only two years — FY18 and FY19 — saw the revenue from disinvestment exceeding the budgeted receipts. In every other year, it has been less than the target.

During this period, the government was able to earn a total of 4.88 lakh crore as proceeds through disinvestment. However, this accounts for only 58.72 percent of 8.31 lakh crore, which is the total sum of budgetary estimates for each of those years.

Also read: In Graphic Detail | The rise of gross tax revenue and the hiccups in between

FY18 marked the biggest jump in revenue realised from disinvestment till date. The revenue from disinvestment for the year stood at Rs 1 lakh crore, an increase of 109.55 percent from the year before.

Meanwhile, FY19, FY20, and FY21 saw contraction in the growth of revenue through disinvestment. The contraction in growth in FY20 was the biggest, as realised proceeds declined by 46.90 percentage from the year before.

The government’s disinvestment targets being highly ambitious is also to be blamed for its failure to meet these targets. FY21 saw the highest target as the budgetary receipt for disinvestment during the year stood at Rs 2.1 lakh crore. However, the actual revenue from disinvestment during the year was only Rs 37,000 crore, which was just 18.05 percent of the target.

The centre’s target to raise Rs 65,000 crore in FY23 through disinvestment is also unlikely to be met as according to data till November, only Rs 28,000 crore has been earned through the same so far. This accounts for just 44 percent of the target for the fiscal.

Also read: In Graphic Detail | Moving the goalposts — fiscal deficit target and a 20-year delay

Moving forward, it is likely that the centre will set a lower target for disinvestment in FY24 in the upcoming budget as it focuses on closing the proceedings that are already underway. Furthermore, as disinvestment exercises carries the risk of antagonising several sections of the population, they could take the back seat a year ahead of general election, as the NDA switches to the election gear.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!