The Insurance Regulatory and Development Authority (IRDAI) has proposed to make changes in the motor insurance own damage product. In its exposure draft, the insurance regulator has said that, for new cars upto three years, the sum insured will be the latest on-road vehicle price, manufacturer accessories, as well as road tax/registration.

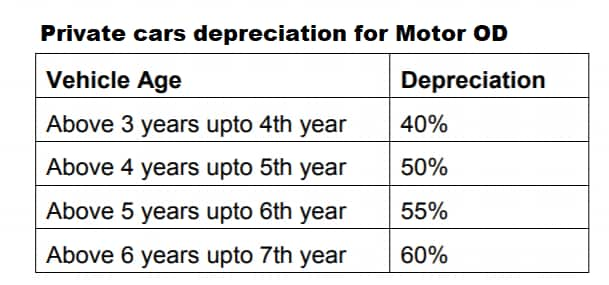

Upto the first three years, no depreciation will be applicable. After that, there will be a depreciation of 40-60 percent, depending on the age of the vehicle from above three years till the seventh year.

This is among the multiple options given in the draft guidelines on how to decide on the motor own damage cover. Own damage cover is taken to protect the vehicle from physical damage. This is an optional cover.

Till now, a complicated formula called insured declared value has been used for deciding on the motor own damage cover. This would look at the price of he vehicle minus the depreciation. The older the vehicle, the lesser the insurance amount a vehicle owner gets in case of total damage of the car/bike.

The level of depreciation has also been lowered in the exposure draft. This means you will get a partially-higher amount of insurance even if the vehicle is older.

At present, the depreciation ranges from 5 percent for vehicles upto six months old to 50 percent for vehicles that are five years old.

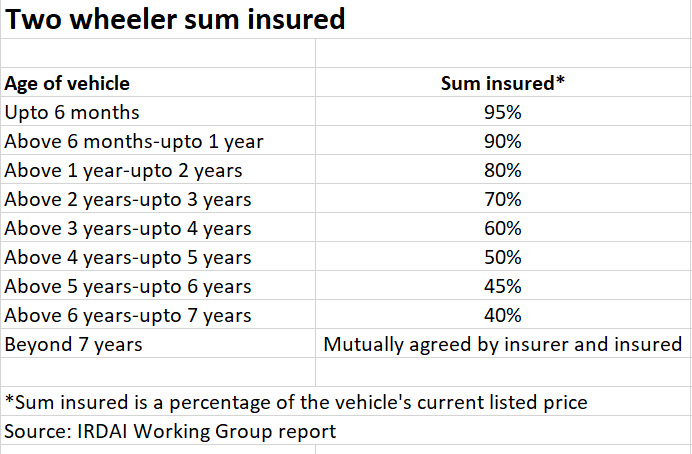

The IRDAI working group said that, beyond the seventh year, the sum-insured will be arrived at a mutually agreed value between the car-owner and insurer. The draft is based on the recommendations of a working group set up to look into motor own damage product structure.

The idea of the working group is to make the process of motor own damage insurance simpler and claims settlement process easier.

When it comes to commercial vehicles, the working group said that the sum-insured will be the current day invoice value plus cost of body building, if any, and all accessories fitted thereon by the manufacturer. This will be adjusted for depreciation at the rate of 10 percent per year till a maximum of 75 percent.

For two-wheelers, the sum-insured will be 95 percent of the vehicle’s listed price till six months of the purchase. This will gradually go down to 90 percent till the bike is one-year-old and, finally, 40 percent once it is seven years old. Beyond the seventh year, the sum-insured will be arrived at a mutually-agreed value between the car owner and insurer.

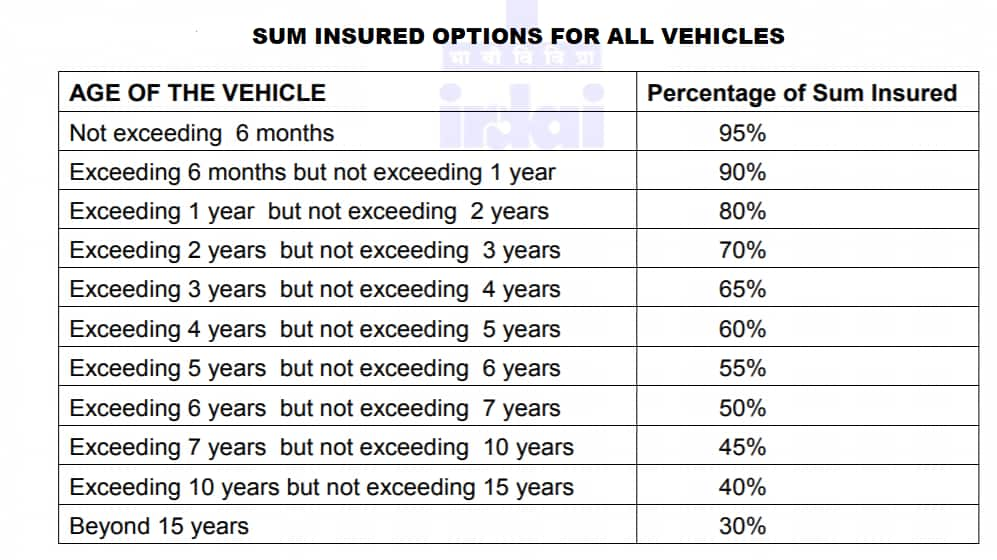

Apart from the above model, another standard model has also been mentioned as an option by the working group. Here, the sum-insured ranges from 95 percent of the car/bike’s current price when it less than six months old to 30 percent when it is 15 years old.

Based on the stakeholder feedback received, IRDAI will frame guidelines on the own damage product pricing post December 16.

The working group has recommended a vehicle age-based depreciation for partial losses to make it completely objective and remove all ambiguity and subjectivity in claim settlement.

Apart from the formula for how to decide on the sum-insured, the working group has also recommended new types of covers. These include pay as you drive and pay how you drive insurance, named driver insurance as well as total loss cover.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!