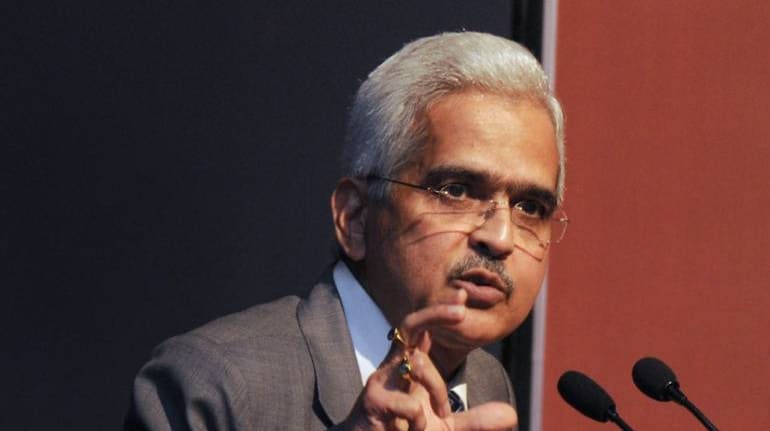

RBI Governor Shaktikanta Das on March 25 said that fintech companies can widen financial inclusion in India by reducing costs and making formal financial services accessible to a large number of people.

"To further deepen digital payments and enhance financial inclusion through fintech, the RBI has also appointed a five member committee under the chairmanship of Nandan Nilekani," Das said.

Das said that recently there has been a focused effort develop a proper national payments infrastructure and technology platforms like Immediate Payments Service, Unified Payments Interface, Bharat Interface for Money, Bharat Bill Pay System or Aadhaar-enabled Payment System.

"This has changed the retail payments scenario of the country. The total volume of retail electronic payments witnessed about nine-fold increase over the last five years," he said.

Das said that seven payment banks have commenced operations and these technology-led banks use fintech, both while onboarding customers as well as while carrying out operations.

Das will also be meeting the heads of payments bank later this week to understand their issues and concerns.

An appropriate regulatory and supervisory framework is necessary to address associated risks with fintech. In order to address that, the RBI's working group on fintech and digital banking has suggested the introduction of a 'regulatory sandbox/innovation hub' to experiment with fintech solutions within a well-defined space so that the consequences of failure can be limited and reasons analysed.

"A 'regulatory sandbox' would benefit fintech companies by way of reduced time to launch innovative products at a lower cost. Going forward, RBI will set up a regulatory sandbox, for which guidelines will be issued in the next two months," Das said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!