Ruchi Agrawal

Moneycontrol Research

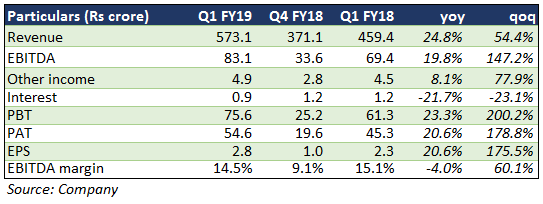

Rallis India (RALL) reported a healthy Q1 FY19 earnings with a significant (24.8 percent) year-on-year (YoY) growth in revenue led by a strong volume growth in the domestic pesticide business. While some of this can be attributed to a low base with Goods & Service Tax-related disruptions last year, overall growth rate is still strong for an agri business. Growth in the seed business remained largely soft at 11.3 percent YoY.

Earnings before interest, tax, depreciation and amortisation (EBITDA) increased 20 percent YoY. However, EBITDA margin contracted 60 basis points due to increase in input costs and low ability to pass on increased cost to customers on subdued crop prices.

The company managed to reduce interest costs by 21 percent YoY. But given the increased tax rate, growth in net profit remained restricted at 20.6 percent.

Result snapshot

Performance in the standalone business remains strong

The standalone business remained the earnings catalyst for the overall business with a 45 percent revenue growth on improved volumes and lower base last year. A substantial (around 64 percent) increase in raw material cost led to restricted profit growth. Employee cost and other expenses saw an 8-10 percent increase YoY.

Costs remain high

For yet another quarter the company saw pressure from rising raw material prices due to strained Chinese supply. Lower pricing power and restrained ability to pass on high costs to end-customers impacted overall margins. The management expects pressure to continue for now, with a slight normalisation in margins towards the end of Q2.

Owing to contraction in Chinese supplies, the management plans to collaborate with peers or backward integrate production of key raw materials with an aim to minimise Chinese dependency and protect future margins. However, the timeline for the same is not clear.

Seed business remains slow

Performance at Metahelix Life Sciences, the seed business of RALL whose portfolio is largely focused on Kharif crops, remained largely slow with 9 percent YoY volume growth. The management said it plans to expand its seeds business internationally going forward. This would help it diversify and reduce risks.

Normal monsoon a positive

The India Meteorological Department and Skymet have both forecasted a normal monsoon, which would benefit the company in the current Kharif season. After a scattered monsoon in Q1, the situation seems to be improving in Q2. Q1 remains largely a seasonally slow quarter for the company as actual Kharif sales pick up in Q2. This along with measures for providing support through minimum support price (MSP) hikes augur well for the company.

New products key triggers for the stock

As per the management, commercialisation of a new molecule for exports along with a foray in pharma custom synthesis & manufacturing (CSM) will drive growth in FY19. The management plans to focus aggressively on its farmer outreach programmes and develop farm products based on the use of artificial intelligence techniques. The company has a decent product line-up which would be its key growth driver going forward.

Outlook

The stock has corrected almost 23 percent in the last 12 months and is trading 34 percent below its 52-week high. After the correction, the stock is trading at FY20e price-to-earnings of 15 times and an enterprise value-to-EBITDA of 10 times. At current prices, valuations looks attractive. However, the company’s external operating environment has been weighing on its performance, the overhang of which would continue in the near term.

The management is looking to foray into a more profitable product mix, which would augur well for margins in the longer term. Commercialisation of new molecules is also something to look out for in the long term.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.