Ruchi Agrawal

Moneycontrol Research

Hotel companies reported an overall improvement in Q4 FY18 performance, supported by favourable overall demand and supply situation in the hotel industry in India and internal efficiencies. With limited rooms entering the system and rapid uptick in demand, room rates saw an improvement, translating in an improvement in revenue per available room (RevPAR). With expectation of an improvement in occupancies, this uptick is expected to continue in coming quarters. The current market correction offers an opportunity to look at some of the leaders in this space as the sector dynamics have changed for the better.

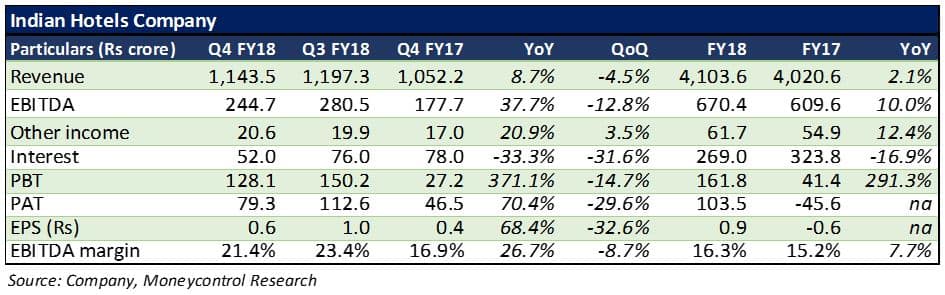

Indian Hotels reported a healthy 8.7 percent year-on-year (YoY) topline growth, led by improved revenues from the domestic operations. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 350 basis points with RevPAR growing 6 percent versus the industry average of around 3.2 percent. The company reduced its debt which led to around 33 percent savings in interest cost. Other income too was higher. Consequently, net profit improved 70 percent YoY.

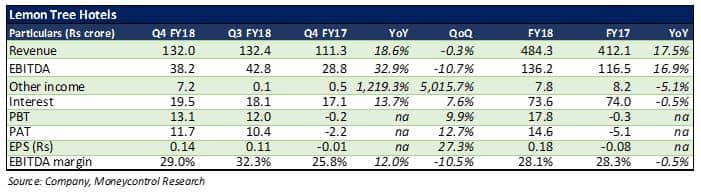

Lemon Tree Hotels, which listed in March, reported its first full year numbers post listing. After consecutive years of losses due to high initial operating expenses, the company has turned profitable on an annual basis. It reported a 19 percent YoY increase in revenue on the back of improved average room rate (ARR) and a 16 percent growth in rooms despite some weakness in occupancy (-2 percentage points YoY). EBITDA margin expanded 320 bps YoY with limited increase in operating costs, leading to a 33 percent expansion in EBITDA. It now has a debt-to-equity ratio of 0.78 times and an interest cover of 1.3 times.

The company reported a strong uptick in revenue and profits with the reopening of one of its main properties in Delhi. EBITDA margin improved 750 bps with reduced employee cost. Despite a reduction in other income and an uptick in interest costs, net profit increased 11 percent YoY in Q4 FY18.

With the reopening of the Delhi property, occupancies and revenues are expected to improve further in coming quarters. Moreover, it has a strong pipeline of rooms which will help drive growth in the longer run. The D/E ratio at 0.2 times is lower than its peers. With an interest cover of 9.8 times, the company has cushion for raising funds for the development of new upcoming properties.

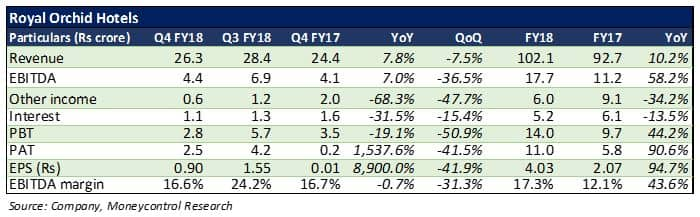

Royal Orchid reported a decent 8 percent YoY uptick in revenue with improvement in both occupancies and ARRs. For FY18, occupancies rose 8 percent while ARR was up 4 percent leading to a RevPar uptick of 16 percent. The company has turned profitable at the consolidated level. Tight cost controls led to a 7 percent uptick in EBITDA. The company reported a substantial increase in net profit for the quarter gone by with annual profit nearly doubling.

The management was able to reduce cost and size of debt. It expects to reduce its debt further in the coming year. Royal Orchid added almost 8 hotels during the year and has plans to add around 15 more properties in FY19. This would lead to an additional 1,000 rooms in the portfolio.

Outlook

Due to the long phase of low occupancies and suppressed room rates on account of strong supply, the industry was under pressure in the past. Q4 saw a healthy performance on account of a seasonally better second half in FY18, recovery in occupancies, improving domestic room rates and RevPARs, rise in domestic leisure spends and favourable demand-supply scenario. We expect the same to continue in coming years.

Around 25 percent of the Indian hotel industry falls under the branded category, unlike 40 percent in major developed economies. Owing to higher disposable incomes and deeper penetration of technology, awareness and reach, there has been a flight of customers from unbranded to the branded segment globally. Most major hotel chains are aiming to capture the branded economy segment. The Indian hotel industry in expected to benefit from the rapid uptick in demand.

Tourism being an important employment generator, it would continue to receive support from the government going forward. This should have a positive rub off on the hotel industry.

The overall demand-supply situation is improving with slowdown in supply and rapid uptick in demand. This is leading to improvement in rates. With an improvement in occupancy growth, we expect revenue and profits to improve in the coming year.

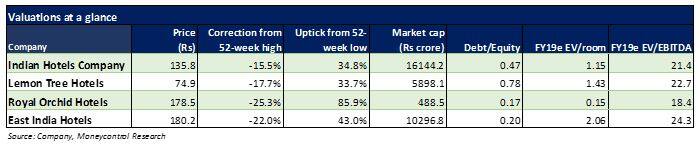

An across the board improvement in margins and profitability, which was witnessed in FY18, is an early signal of changed dynamics in the hotel sector. We have high conviction on Indian Hotels and it remains our top pick. From the midcap space, we like Royal Orchid. While we take note of the improved performance in Lemon Tree and East India Hotels, their valuation makes us cautious. Hence, we would recommend accumulating these stocks on a decline.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!