Anubhav Sahu

Moneycontrol Research

Hindustan Unilever (HUL) reported another strong quarterly result aided by double-digit sales growth across all segments. While rural consumption growth apparently outpaced urban and reached historical levels, key factors that needs to be watched are competitive intensity and crude-led input cost.

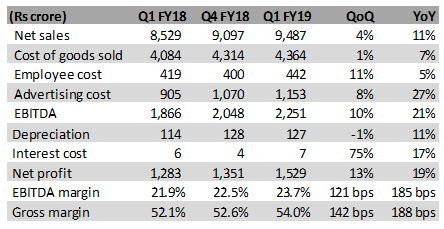

Comparable sales growth of 16% YoY

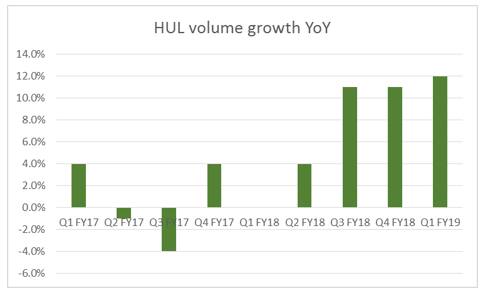

The company posted a like-for-like domestic sales growth of 16 percent year-on-year (YoY) aided by volume growth of 12 percent. Volume growth, however, accrued from a weak base as well. Comparable earnings before interest, tax, depreciation and amortisation (EBITDA) margin improvement of 100 bps YoY was aided by moderate growth in cost of goods sold and savings measures offsetting a surge in advertisement and promotion spending, which is near multi-year highs.

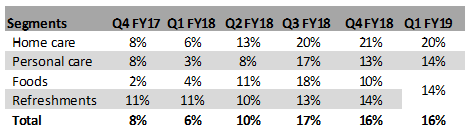

Double digit sales growth for all segments

HUL witnessed double-digit sales growth in 3 segments, similar to the last 2 quarters. In case of the home care segment, growth was aided by performance in fabric wash and household care (Vim). Domex liquid relaunched in the south was a key highlight, while purifiers’ performance remained subdued.

Personal care segment gained from growth in premium categories of hair care (Indulekha) and personal wash. Oral care witnessed its third consecutive quarter of growth, led by Close Up, but the management clearly mentioned there is a long way to go.

In the refreshment segment, growth was driven by all key offerings: tea, desserts and foods. Launch of Lever ayush breakfast range in Tamil Nadu was another interesting highlight.

Outlook positive but near term growth priced in

Its quarterly result continues to reflect upon steady earnings growth as trade and demand conditions are quickly normalising. The management once again sees steady demand improvement across regions, with consumer offtake in rural areas approaching historical levels.

However, competitive intensity and crude oil price led higher input cost remains a key challenge. We reiterate that sustenance of a cost saving programme (6-7 percent of turnover) and ability to maintain traction in premiumisation needs to be watched. Growth in a couple of segments like oral care and popular category of personal wash needs to be closely tracked in light of competitive intensity.

HUL with its high rural exposure (40 percent of sales) and well entrenched distribution network is among the key beneficiaries of a further uptick in consumption and related policy announcements. In the near term, the company is well placed to capitalise on implementation of the e-way bill.

Premium valuation (about 20 percent more than the sector median) factors in limited earnings volatility, innovation profile and strong execution capability amid competitive challenges. The stock has surged about 30 percent in 2018 year-to-date and largely prices in near term growth.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!