Sharp correction in the Indian stock market and the unabated selling by foreign institutional investors (FIIs) saw the value of their assets under custody (AUC) drop to an 11-month low in the first half of February.

As of mid-February, FIIs' AUC stood at Rs 64.78 lakh crore, the lowest level since March 2024, marking a decline of Rs 13.18 lakh crore from its peak of Rs 77.96 lakh crore in September 2024. Since the beginning of 2025, FIIs have sold shares worth nearly Rs 1.07 lakh crore in Indian equities.

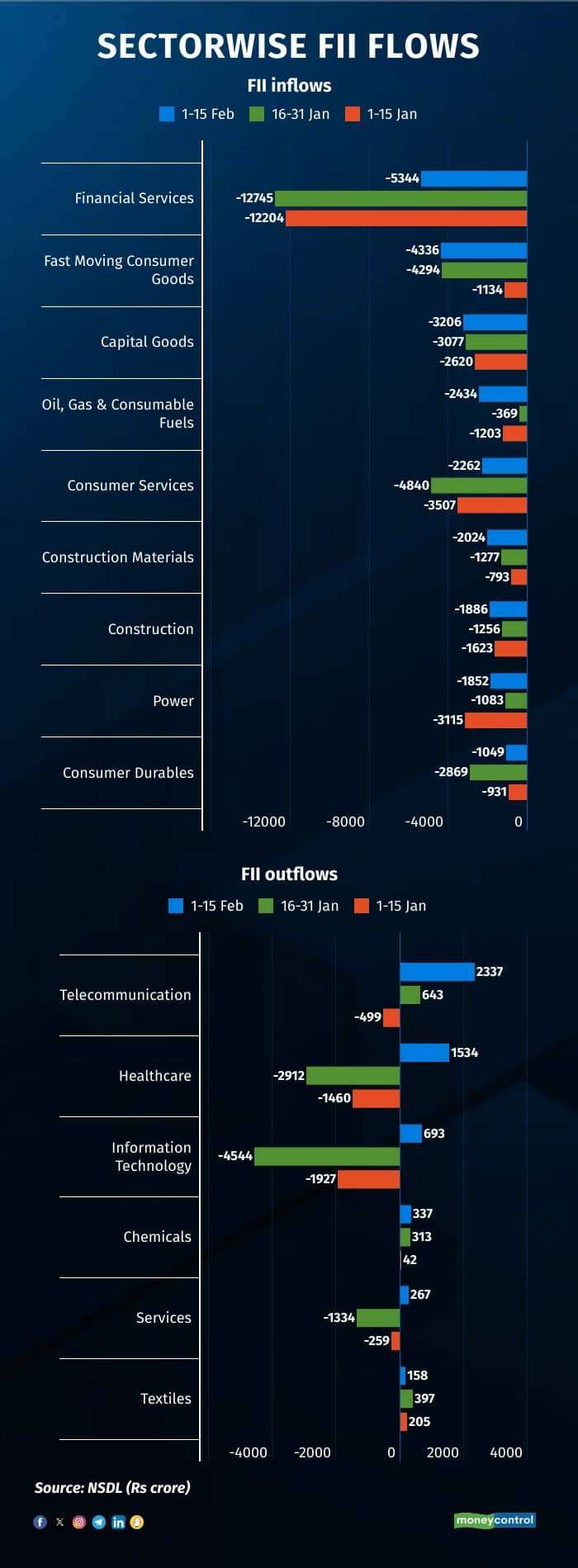

The first two weeks of February saw continued selling pressure in financial services, fast-moving consumer goods (FMCG), and capital goods sectors. In the first half of February, FIIs offloaded Rs 5,344 crore in financial stocks, following a Rs 25,000 crore sell-off in January. In the FMCG sector, they sold Rs 4,336 crore after exiting Rs 5,400 crore in January, while in capital goods, they offloaded Rs 3,200 crore following Rs 5,600 crore in January.

Other sectors also witnessed significant outflows in the first two week of February. FIIs pulled out Rs 2,400 crore from oil & gas, Rs 2,260 crore from consumer services, and Rs 2,024 crore from construction materials. The construction, power, and consumer durables sectors saw sell-offs worth Rs 1,886 crore, Rs 1,852 crore, and Rs 1,050 crore, respectively.

Amid the selling spree, FIIs showed buying interest in select sectors. They invested Rs 2,337 crore in telecommunications, Rs 1,534 crore in healthcare, and Rs 693 crore in IT stocks. This marked a reversal from January when they had sold Rs 4,300 crore in healthcare and Rs 6,400 crore in IT.

Downplaying the outflows by FIIs, finance minister Nirmala Sitharaman recently stated that the selling was driven by profit booking rather than a lack of confidence in the Indian market. She said that the Indian economy continues to generate strong returns, encouraging investors to cash in on their gains.

Speaking at a post-Budget press conference, she reaffirmed that India remains an investor-friendly destination and pointed to recent measures taken to rationalize customs duties.

Interestingly, on February 18, FIIs turned net buyers for the first time after many sessions of selling, purchasing shares worth Rs 4,786 crore amid a huge block deal in Bharti Airtel.

Reacting to the shift in flows, market veteran Samir Arora remarked on social media that the return of FIIs—whether driven by domestic or global factors—indicates that they are not one-way sellers.

While market participants eagerly anticipate a sustained return of FIIs, some global analysts remain cautious. Morgan Stanley in its recent note said India's recent underperformance could reverse in the coming months, but a rebound may not necessarily be led by foreign fund inflows.

It stated that global funds' ownership of Indian equities has fallen to multi-year lows, whereas domestic investments remain strong, supported by rising household allocations to equities. Morgan Stanley further emphasised that liquidity, not flows, is the key driver of stock prices. The global financial services firm asserted that market movements will hinge on confidence in economic growth and macroeconomic stability rather than on foreign institutional flows.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.