Steady sales in the US, aided by the newly-acquired Mayne portfolio, along with sustained contribution from blockbuster drug Revlimid, is likely to lift Q4 FY24 profit as well as revenue for Dr Reddy's Laboratories.

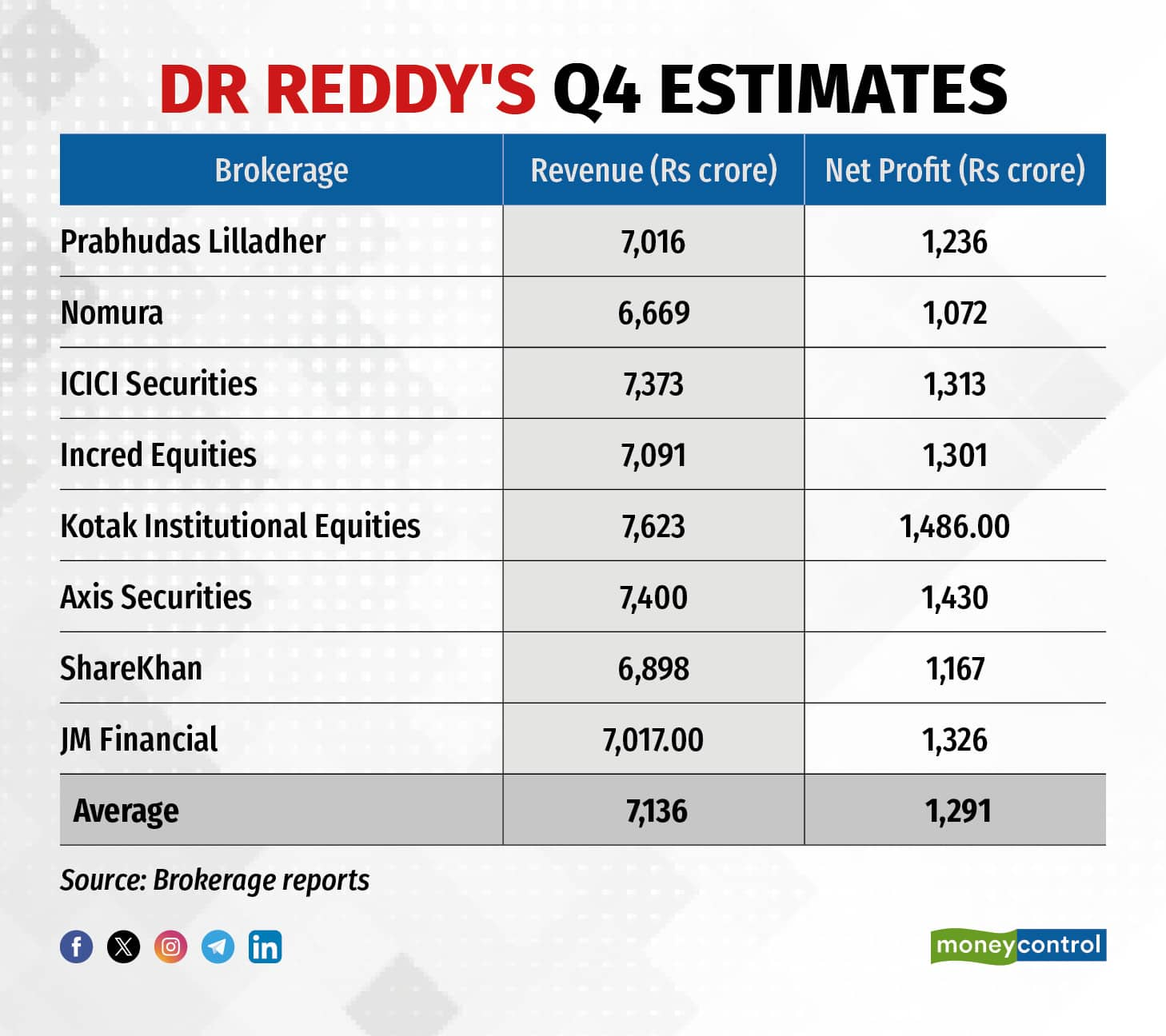

The drugmaker is slated to report its results for the January-March quarter on May 7. According to a poll of eight brokerages collated by Moneycontrol, the drugmaker's net profit is likely to grow around 35 percent on-year to Rs 1,291 crore, up from Rs 959.2 crore reported in the year-ago period.

In addition, the same poll pegged revenue growth for the drugmaker at 13 percent year-on-year to Rs 7,136 crore. The company reported a topline of Rs 6,296.8 crore in the March quarter of the previous fiscal.

US sales remain steady

Easing price erosion along with the ramp-up of Mayne Pharma's recently acquired portfolio is expected to aid the company's US sales in the fourth quarter of FY24.

"Mayne portfolio ramp-up should support incremental growth in base business with its contribution likely to be around $280 million for Dr Reddy's," JM Financial stated in its report. Dr Reddy's announced the acquisition of Australia-based Mayne Pharma in February 2023, with the deal closing in April of the same year.

Above that, blockbuster cancer drug Revlimid will continue to contribute around $100-115 million to Dr Reddy's Q4 revenue, as estimated by most brokerages, aiding not only its bottomline but also its margins. It is also worth noting that Dr Reddy's Labs enjoys the highest contribution from Revlimid among all Indian drugmakers selling the drug, thanks to its first-mover advantage.

In addition, the volume ramp-up of products like Suboxone (opiod drug), Kuvan (blood disorder drug), and Vascepa (cardiovascular drug) will also aid sales in the US market.

Going ahead, Axis Securities believes the company's commentary on the US base business and margin trend will remain key monitorables. The drugmaker is also planning to foray into biosimilars and any update on the same will also remain on investors radar.

Resilient India growth

The company's sales in the domestic market are expected to rise 5 percent on-year, despite facing the brunt of a high base due to the divestment of a few brands. The company sold off nine dermatology brands to Eris Lifesciences in Q1 of FY24.

Despite the absence of contribution from these divested brands, the company's outperformance as compared to the industry in the domestic market is expected to support its growth.

Sharekhan said the drugmaker's growth in the India business will be led by the restructuring of its India team and an increase in medical representatives (MRs).

Sharekhan is also looking forward to Dr Reddy's plans of restructuring its India portfolio and would await any clarity from the management on this front.

Meanwhile, Nomura sees limited margin expansion for the drugmaker, blaming it on a step-up in investments for research and development (R&D) and new initiatives. Dr Reddy's is gradually hiking its R&D investments as it plans to foray into specialty drugs and biosimilars.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!