Domestic institutional investors’ (DII) holdings in BSE 500 firms at the end of the September quarter were the highest in 12 quarters, demonstrating the confidence of retail investors in the Indian market.

Promoter holdings in these firms dropped to their lowest level in three quarters, while foreign institutional investors (FII) increased their holdings marginally from a quarter ago.

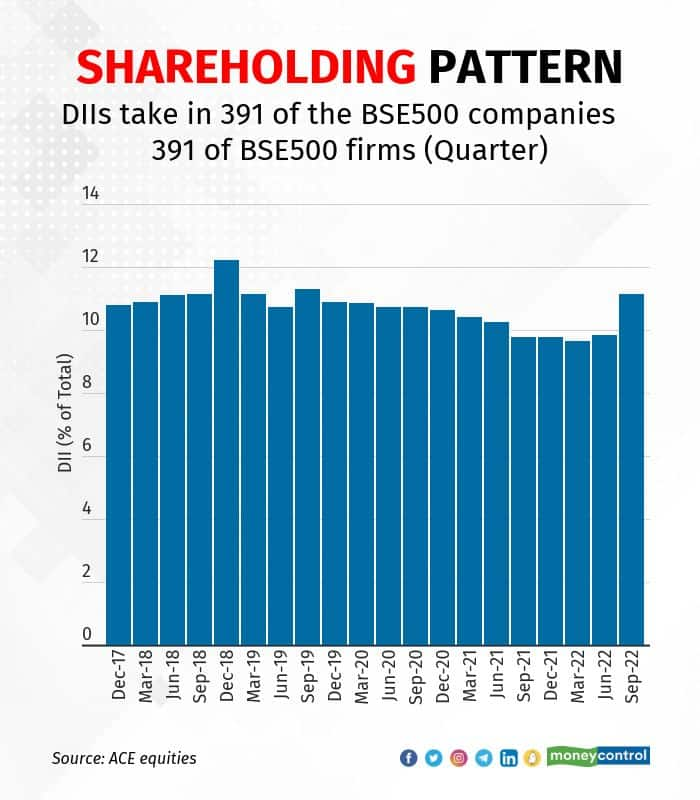

For 391 of the BSE 500 companies that have announced their shareholding pattern and for which comparable data was available for 20 quarters, the data showed that the aggregate DII holdings in these companies stood at 11.14 percent. This is the highest since the quarter ended September 2019.

"Post Covid, we have seen a meaningful shift in allocation from physical to financial assets like mutual funds (MF) and equity," said Prashanth Tapse, research analyst at Mehta Equities.

"We continue to believe that India is better placed than most other countries, evidenced by the multi-fold rise in demat accounts and MF AUM (assets under management) in the last couple of years. With continued and increasing domestic inflows and market opportunities, DIIs have benefited the most from the selling pressure due to the global uncertainty and volatility," Tapse added.

Holdings of promoters were at 57.37 percent, the lowest in three quarters. FII holdings stood at 11.18 percent, a marginal increase from a quarter ago, a Moneycontrol analysis showed.

Insurance companies have grown their share aggressively, with holdings at 5.21 percent, the highest since December 2018. This data captures only the volume increase. The price rise or fall is not considered in this study.

Analysts said the marginal fall in promoter holdings was largely due to the dilution of their shareholding to meet other funding requirements. Rattled by global volatility, analysts think the FIIs have acted in a knee-jerk fashion over the past 12 months. But now, despite aggressive rate hikes by the US Federal Reserve, FIIs are back due to the fear of missing out on the strong India story, they said.

"Among DIIs, insurance companies added to their shareholding aggressively in Q2FY23. This could be due to a combination of attractive valuations post the fall in early July, and the deployment of funds received by them" said Deepak Jasani, Head of Retail Research, HDFC Securities.

DIIs, mainly mutual funds and insurance companies, net bought Rs 17,733 crore of Indian stocks during the quarter. This was the sixth consecutive quarter when they remained net buyers of stocks. According to the Association of Mutual Funds in India, systematic investment plan (SIP) inflows were at over Rs 37,000 crore in the September quarter.

On the other hand, FIIs pumped $5.81 billion into Indian shares in the September quarter, the highest since the quarter ended March 2021. During the quarter, both the Sensex and the Nifty rose 8.3 percent each, while BSE 500 jumped nearly 11 percent.

Of the 391 BSE 500 companies, DIIs raised their stake in 253 companies, and trimmed their stake in 138.

"A clear trend in the Indian capital market for more than two years now is the increasing financialisation of savings. An increasing amount of money is flowing into stocks via direct retail and DII. An interesting feature of the market now is that in the tug-of-war between FIIs and DIIs, the latter has been calling the shots, unlike in the past.

``In CY 2022 till 31st October, FIIs have sold equity worth Rs 1,68,797 crore, while DIIs bought equity worth Rs 2,57,865 crore. This explains the increasing holdings of DIIs. FIIs have lost out in this tug-of-war largely because they have been sellers of banking stocks, which have done very well. The growing heft of DIIs is a trend that is likely to gather momentum," said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.