Indian benchmark indices gained for the second straight session on June 25 amid volatility, and on weekly basis, managed to bounce back with a percent gain.

At close, the Sensex was up 226.04 points, or 0.43 percent at 52925.04, and the Nifty was up 70 points, or 0.44 percent, at 15860.40.

Among sectors, Nifty bank, metal and PSU bank indices added 1-2.5 percent, while BSE midcap index added 1 percent and smallcap index rose 0.4 percent.

"The benchmark is hovering near a record high largely led by a gradual pickup in economic activities, as states start unlocking, the expectation of better earnings and ramp-up of vaccination," said Ajit Mishra, VP - Research, Religare Broking.

"On the flip side, the possibility of the third wave of Covid can impact market sentiments. We remain cautiously optimistic on the markets and suggest aligning the positions accordingly," Mishra added.

Here are 10 key factors that will keep traders busy next week:Coronavirus and VaccinationIndia achieved its highest weekly vaccination figure so far as nearly four crore jabs were administered this week, the latest data on the government’s COWIN platform shows.

About 3.98 crore jabs were given during the week ended June 25, a significant jump from the previous weekly record of 2.47 crore jabs administered between April 3-9.

On the other hand, a single-day rise of 48,698 COVID-19 infections took India's case tally to 3,01,83,143 while the weekly positivity rate declined to 2.97 percent, according to Union Health Ministry data on Saturday.

The death toll climbed to 3,94,493 with 1,183 more people succumbing to the viral disease in a day. The number of active cases has further declined to 5,95,565

The third wave of COVID-19 -- if it occurs -- is unlikely to be as severe as the second wave given the extent of spread of coronavirus infections that has already taken place in the country, according to a study.

ListingDodla Dairy and Krishna Institute of Medical Sciences (KIMS Hospitals) are going to debut on June 28 on the exchanges.

The Rs 2,144-crore KIMS Hospitals public offer witnessed an oversubscription of 3.86 times during June 16-18. The reserved portion of qualified institutional buyers was subscribed 5.26 times, and that of non-institutional investors 1.89 times. The part set aside for retail investors witnessed a subscription of 2.9 times and employees 1.06 times.

Dodla Dairy offer closed for subscription on June 18 after being subscribed 45.62 times. The company raised Rs 520.17 crore through its public issue which comprised a fresh issue of Rs 50 crore and an offer for sale of Rs 470.17 crore by existing selling shareholders.

The other IPO, India Pesticides, is expected to finalise the basis of allotment in the coming week, after successfully closing the public offering. This was the last IPO in the first half of CY21.

The company opened its offer for subscription on June 23 and closed the same on June 25 after being subscribed 15 times aided by all kind of investors.

June Auto salesAuto companies are going to remain in focus, as they are going to declare their monthly sales number for the month of June on July 1.

In May, the companies reported better numbers on the back of robust demand.

"June auto sales numbers would give investors a fair idea around the revival of ground-level sentiment. However, it would be important to remember that markets have already started pricing in a strong rebound in volumes on expectations of pent-up April-May demand because of an accelerated inoculation drive, strong line-up of launches, life-time low auto loan rates and a favourable monsoon," said Nirali Shah,Head of Equity Research, Samco Securities.

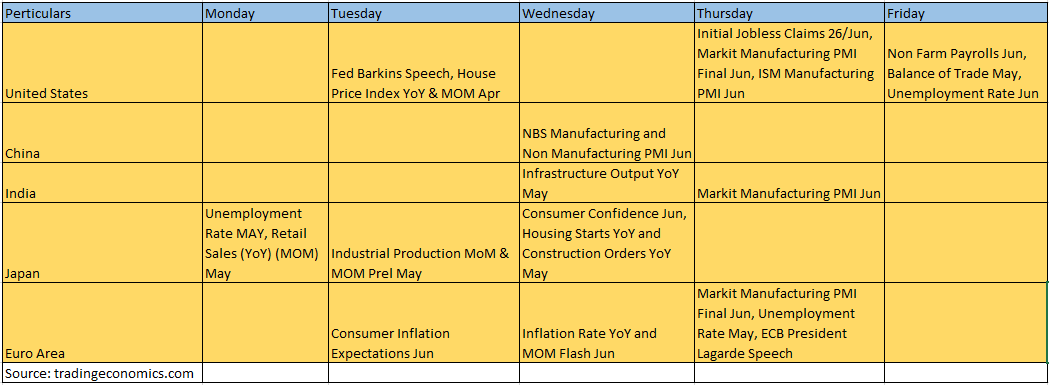

Market Manufacturing PMINikkei Markit Manufacturing PMI numbers will be announced on July 1.

India’s manufacturing activity hit a major speed bump in May after being on the slow road to improvement in April, as the renewed escalation of the (COVID-19) pandemic and subsequent restrictions played spoilsports for factory activity.

According to the monthly IHS Markit India Manufacturing Purchasing Managers’ Index (PMI) survey released on June 1, manufacturing PMI stood at a ten-month low of 50.8 in May, down from 55.5 in the previous month of April.

EarningsIn the last leg of quarterly earnings, more than 1700 BSE listed companies are going to declare their March quarter earnings in the coming week.

SpiceJet, Hindustan Motors, BF Utilities, Archies, Zee Learn, Suzlon Energy, Sunteck Realty, Subros, Sintex Industries, Rail Vikas Nigam, Ruby Mills, Ruchi Soya Industries, NBCC (India), MEP Infrastructure Developers, GMDC, A2Z Infra Engineering, Scooters India, Premier Explosives, NALCO, ISGEC Heavy Engineering, IFCI, Hindustan Aeronautics, Gammon India are among the companies which are going to announced their quarterly earnings in the next week.

FII SellingForeign investors remained net sellers in the cash segment of the Indian equity markets last week.

Foreign institutional investors (FIIs) sold equities worth Rs 2,685.9 crore, while domestic institutional investors (DIIs) bought equities worth Rs 4,729.17 crore last week.

So far in June, FIIs have bought equities worth Rs 3,162.86 and DIIs have bought equities worth Rs 2,436.20 crore.

Technical viewNifty formed bullish candle which resembles Hanging Man kind of pattern formation on the daily charts, while for the week, there was bullish candle formation on the weekly scale.

As the trend in the short term seems to be mixed and indecisive, it looks inevitable for bulls to register a breakout above 15900 on a closing basis to witness a sustainable upmove. In that scenario, a range breakout target of 16300 can be projected as Nifty currently appears to be limiting itself to the 15500 – 15900 kind of consolidation range, said Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.

However, failure to sustain above 15770 in the next session may initially drag down the indices towards 15700 –15670 zone but a close below 15670 shall weaken Nifty further with targets placed near to 15500 levels, he added.

F&O CuesSince it is the beginning of new series, option data is scattered at different strikes.

Maximum Put open interest was seen at 15500 followed by 15000 strike while maximum Call open interest was seen at 16000 followed by 16500 strike.

Option data suggests a wider trading range in between 15500 to 16200 zones while an immediate range in between 15700 to 16000 zones.

"Nifty has to hold above 15800 zones to witness an up move towards 16000 and 16200 zones while on the downside support can be seen at 15700 and 15600 zones," said Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services.

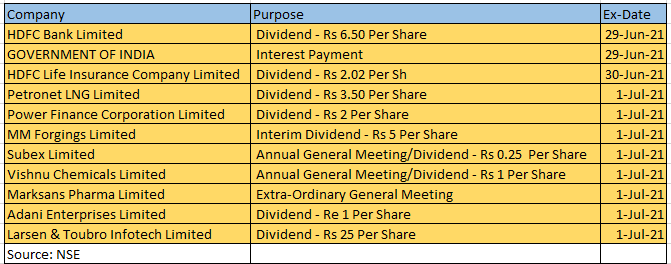

Corporate ActionHere are key corporate actions taking place in the coming week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.